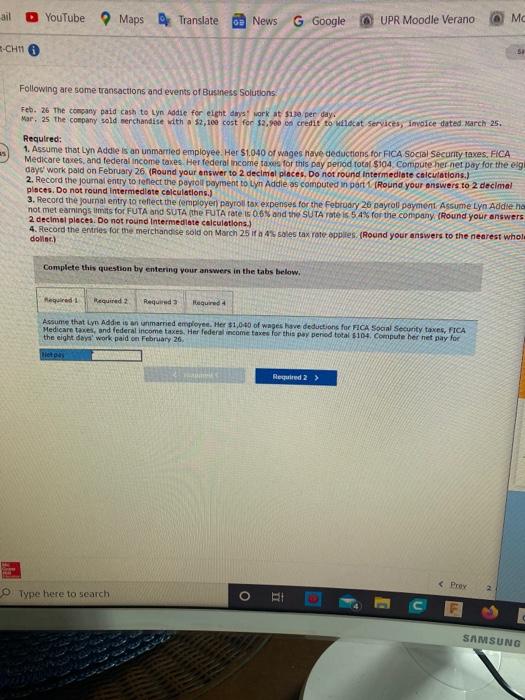

ail YouTube Maps Translate OD News G Google @ UPR Moodle Verano @ Mc -CH 32 Following are some transactions and events of Business Solutions Feb. 26 The company paid cash to Lyn Addie for eight days work at $130 per day Mar. 25 the company sold merchandise with a $2,100 cost for $3.900 on credit to wildcat services, Invoice dated March 25. Required: 1. Assume that Lyn Adde is an unmarried employee. Her $1.040 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total 5104 Compute her net pay for the eig days' work paid on February 26 (Round your answer to 2 decimal places. Do not round Intermediate calculations.) 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1 (Round your answers to 2 decimal places. Do not round Intermediate calculations.) 3. Record the journal entry to reflect the employer payroll tax expenses for the February 26 payroll payment Assume Lyn Addieho not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company (Round your answers 2 decimal places. Do not round Intermediate calculations.) 4. Record the entries for the merchandise sold on March 25 if a 4% soles tax rate appies (Round your answers to the nearest whol dollar) Complete this question by entering your answers in the tabs below. Required Required2 Required Required Assume that lyn Addie is an unmarried employee. Her $1,000 of wages have deductions for FICA Social Secunty taxes, FICA Medicare taxes and federal income taxes. Her federal income taxes for this pay period total $104. Compute het net pay for the eight days work paid on February 26, Tietoa Required 2 > & Poor Type here to search O SAMSUNG ail YouTube Maps Translate OD News G Google @ UPR Moodle Verano @ Mc -CH 32 Following are some transactions and events of Business Solutions Feb. 26 The company paid cash to Lyn Addie for eight days work at $130 per day Mar. 25 the company sold merchandise with a $2,100 cost for $3.900 on credit to wildcat services, Invoice dated March 25. Required: 1. Assume that Lyn Adde is an unmarried employee. Her $1.040 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total 5104 Compute her net pay for the eig days' work paid on February 26 (Round your answer to 2 decimal places. Do not round Intermediate calculations.) 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1 (Round your answers to 2 decimal places. Do not round Intermediate calculations.) 3. Record the journal entry to reflect the employer payroll tax expenses for the February 26 payroll payment Assume Lyn Addieho not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company (Round your answers 2 decimal places. Do not round Intermediate calculations.) 4. Record the entries for the merchandise sold on March 25 if a 4% soles tax rate appies (Round your answers to the nearest whol dollar) Complete this question by entering your answers in the tabs below. Required Required2 Required Required Assume that lyn Addie is an unmarried employee. Her $1,000 of wages have deductions for FICA Social Secunty taxes, FICA Medicare taxes and federal income taxes. Her federal income taxes for this pay period total $104. Compute het net pay for the eight days work paid on February 26, Tietoa Required 2 > & Poor Type here to search O SAMSUNG