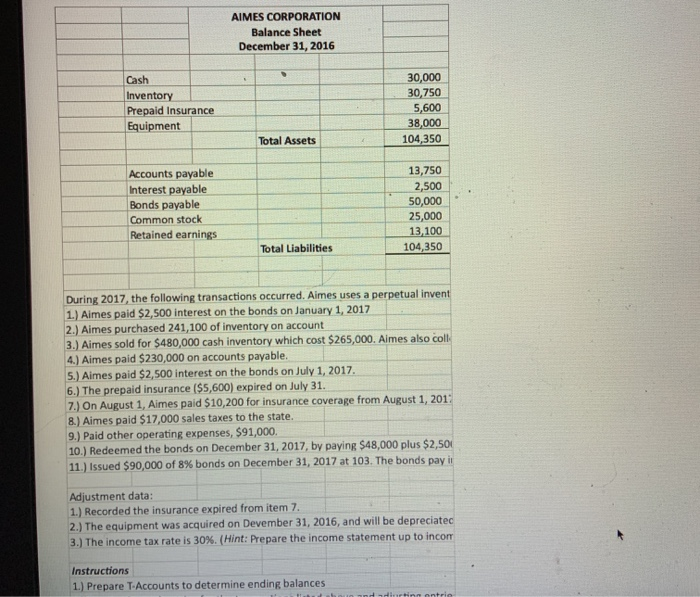

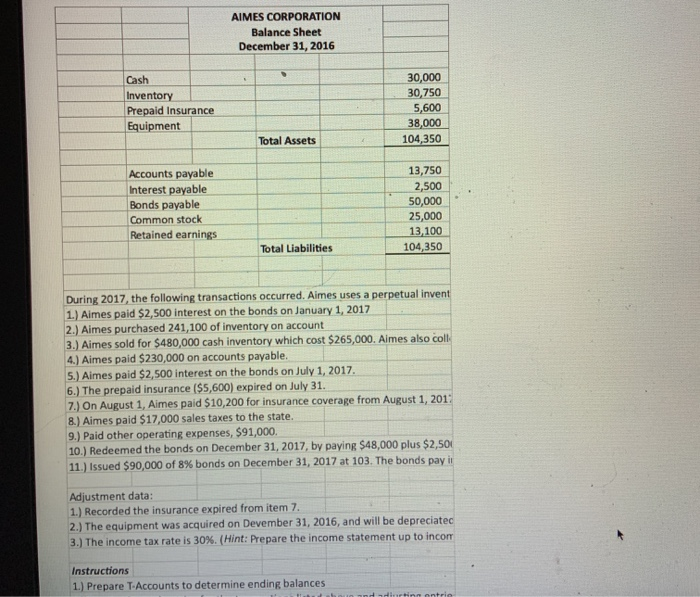

AIMES CORPORATION Balance Sheet December 31, 2016 Cash Inventory Prepaid Insurance Equipment 30,000 30,750 5,600 38,000 104,350 Total Assets Accounts payable Interest payable Bonds payable Common stock Retained earnings 13,750 2,500 50,000 25,000 13,100 104,350 Total Liabilities During 2017, the following transactions occurred. Aimes uses a perpetual invent 1.) Aimes paid $2,500 interest on the bonds on January 1, 2017 2.) Almes purchased 241,100 of inventory on account 3.) Aimes sold for $480,000 cash inventory which cost $265,000. Aimes also coll 4.) Aimes paid $230,000 on accounts payable. 5.) Aimes paid $2,500 interest on the bonds on July 1, 2017. 6.) The prepaid insurance ($5,600) expired on July 31. 7.) On August 1, Aimes paid $10,200 for insurance coverage from August 1, 2013 8.) Aimes paid $17,000 sales taxes to the state. 9.) Paid other operating expenses, $91,000. 10.) Redeemed the bonds on December 31, 2017, by paying $48,000 plus $2,500 11.) Issued $90,000 of 8% bonds on December 31, 2017 at 103. The bonds pay it Adjustment data: 1.) Recorded the insurance expired from item 7. 2.) The equipment was acquired on Devember 31, 2016, and will be depreciatec 3.) The income tax rate is 30%. (Hint: Prepare the income statement up to incorr Instructions 1.) Prepare T-Accounts to determine ending balances AIMES CORPORATION Balance Sheet December 31, 2016 Cash Inventory Prepaid Insurance Equipment 30,000 30,750 5,600 38,000 104,350 Total Assets Accounts payable Interest payable Bonds payable Common stock Retained earnings 13,750 2,500 50,000 25,000 13,100 104,350 Total Liabilities During 2017, the following transactions occurred. Aimes uses a perpetual invent 1.) Aimes paid $2,500 interest on the bonds on January 1, 2017 2.) Almes purchased 241,100 of inventory on account 3.) Aimes sold for $480,000 cash inventory which cost $265,000. Aimes also coll 4.) Aimes paid $230,000 on accounts payable. 5.) Aimes paid $2,500 interest on the bonds on July 1, 2017. 6.) The prepaid insurance ($5,600) expired on July 31. 7.) On August 1, Aimes paid $10,200 for insurance coverage from August 1, 2013 8.) Aimes paid $17,000 sales taxes to the state. 9.) Paid other operating expenses, $91,000. 10.) Redeemed the bonds on December 31, 2017, by paying $48,000 plus $2,500 11.) Issued $90,000 of 8% bonds on December 31, 2017 at 103. The bonds pay it Adjustment data: 1.) Recorded the insurance expired from item 7. 2.) The equipment was acquired on Devember 31, 2016, and will be depreciatec 3.) The income tax rate is 30%. (Hint: Prepare the income statement up to incorr Instructions 1.) Prepare T-Accounts to determine ending balances