Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Air Inc. is a global airline, based in Canada. In 2020, Air Inc. made significant adjustment to its network and operations due to the

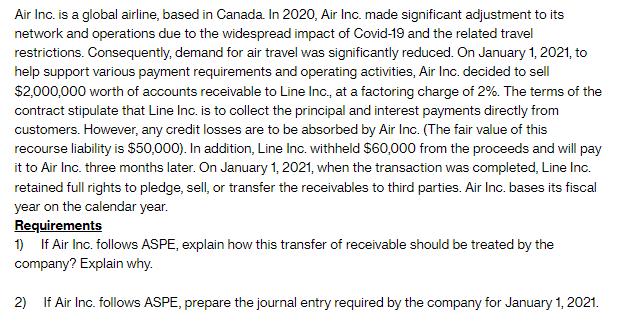

Air Inc. is a global airline, based in Canada. In 2020, Air Inc. made significant adjustment to its network and operations due to the widespread impact of Covid-19 and the related travel restrictions. Consequently, demand for air travel was significantly reduced. On January 1, 2021, to help support various payment requirements and operating activities, Air Inc. decided to sell $2,000,000 worth of accounts receivable to Line Inc., at a factoring charge of 2%. The terms of the contract stipulate that Line Inc. is to collect the principal and interest payments directly from customers. However, any credit losses are to be absorbed by Air Inc. (The fair value of this recourse liability is $50,000). In addition, Line Inc. withheld $60,000 from the proceeds and will pay it to Air Inc. three months later. On January 1, 2021, when the transaction was completed, Line Inc. retained full rights to pledge, sell, or transfer the receivables to third parties. Air Inc. bases its fiscal year on the calendar year. Requirements 1) If Air Inc. follows ASPE, explain how this transfer of receivable should be treated by the company? Explain why. 2) If Air Inc. follows ASPE, prepare the journal entry required by the company for January 1, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Under the Accounting Standards for Private Enterprises ASPE in Canada the transfer of receivables by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started