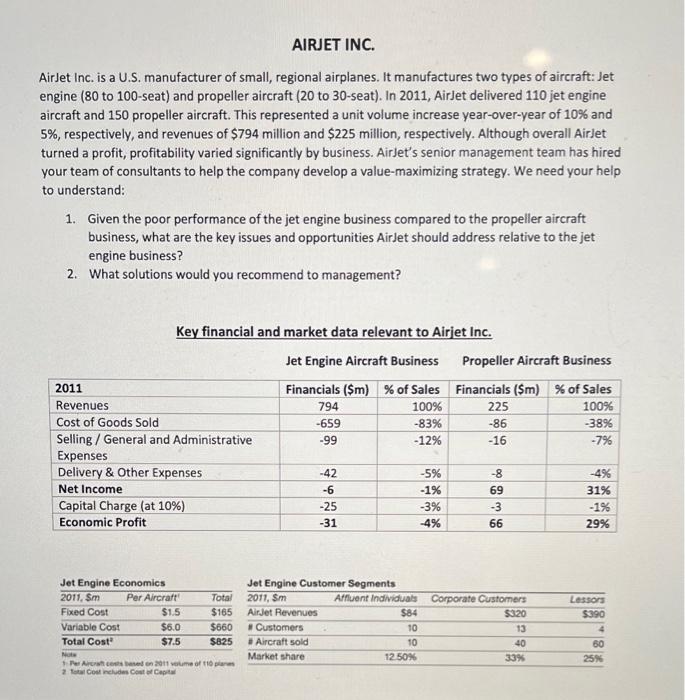

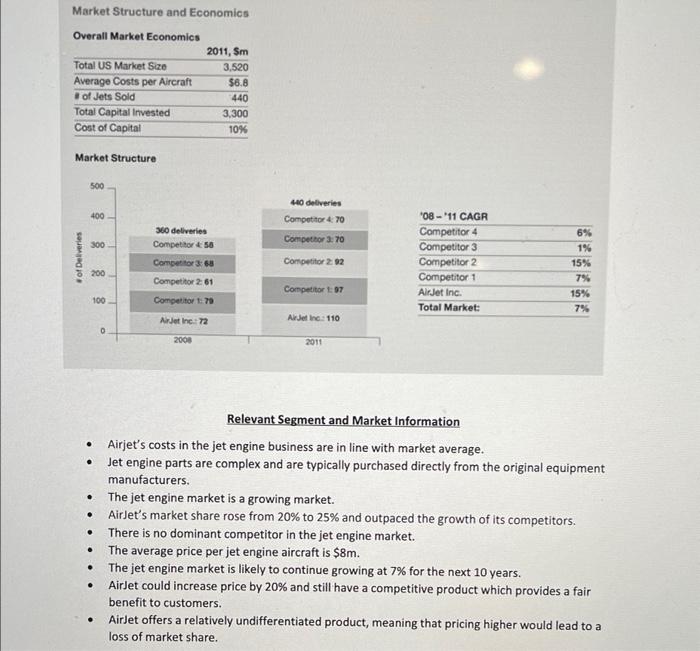

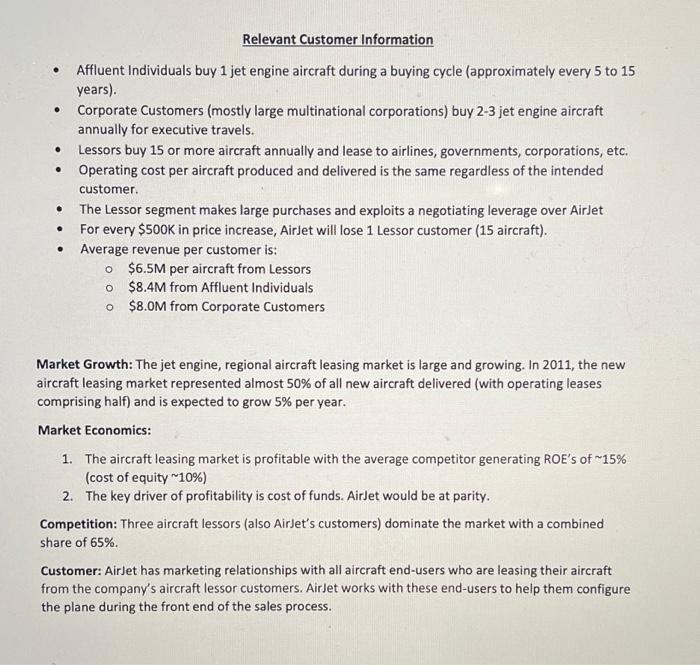

AIRJET INC. AirJet Inc. is a U.S. manufacturer of small, regional airplanes. It manufactures two types of aircraft: Jet engine (80 to 100-seat) and propeller aircraft (20 to 30-seat). In 2011, AirJet delivered 110 jet engine aircraft and 150 propeller aircraft. This represented a unit volume increase year-over-year of 10% and 5%, respectively, and revenues of $794 million and $225 million, respectively. Although overall Airdet turned a profit, profitability varied significantly by business. AirJet's senior management team has hired your team of consultants to help the company develop a value-maximizing strategy. We need your help to understand: 1. Given the poor performance of the jet engine business compared to the propeller aircraft business, what are the key issues and opportunities AirJet should address relative to the jet engine business? 2. What solutions would you recommend to management? Key financial and market data relevant to Airjet Inc. Jet Engine Aircraft Business Propeller Aircraft Business Financials ($m) % of Sales Financials ($m) % of Sales 794 100% 225 100% -659 -83% -86 -3896 -99 -12% -16 -7% 2011 Revenues Cost of Goods Sold Selling / General and Administrative Expenses Delivery & Other Expenses Net Income Capital Charge (at 10%) Economic Profit -42 -6 -25 -31 -5% -1% -3% -4% -8 69 -3 66 -4% 31% - 1% 29% Jet Engine Customer Segments 2011, Sm Affluent individuals Corporate Customers AirJet Revenues $84 $320 * Customers 10 13 Aircraft sold 10 40 Market share 12 50% Jet Engine Economics 2011, Sm Per Aircraft Total Fixed Cost $1.5 $165 Variable Cost $6.0 $660 Total Cost $7.5 $825 M Per Arred on 2011 um of 10 2 toalost includes Cool Capit Lessors $390 60 25% 33% Market Structure and Economics Overall Market Economics 2011, Sm Total US Market Size 3.520 Average Costs per Aircraft $6.8 #of Jets Sold 440 Total Capital Invested 3,300 Cost of Capital 10% Market Structure 500 400 40 deliveries Competitor & 70 Competitor 3: 70 360 deliveries Competitors 300 # of Deliveries Competitor 360 Competitor 2 02 '08-'11 CAGR Competitor 4 Competitor 3 Competitor 2 Competitor 1 AlrJet Inc. Total Market: 200 6% 1% 15% 7% 15% 7% Competitor 261 Competitor t07 100 Competitor : 70 AlJet Inc.: 72 0 ArJet 100: 110 2011 2000 . . . Relevant Segment and Market Information Airjet's costs in the jet engine business are in line with market average. Jet engine parts are complex and are typically purchased directly from the original equipment manufacturers. The jet engine market is a growing market. AirJet's market share rose from 20% to 25% and outpaced the growth of its competitors. There is no dominant competitor in the jet engine market. The average price per jet engine aircraft is $8m. The jet engine market is likely to continue growing at 7% for the next 10 years. AirJet could increase price by 20% and still have a competitive product which provides a fair benefit to customers. AirJet offers a relatively undifferentiated product, meaning that pricing higher would lead to a loss of market share. . . . . Relevant Customer Information . . . Affluent Individuals buy 1 jet engine aircraft during a buying cycle (approximately every 5 to 15 years). Corporate Customers (mostly large multinational corporations) buy 2-3 jet engine aircraft annually for executive travels. Lessors buy 15 or more aircraft annually and lease to airlines, governments, corporations, etc. Operating cost per aircraft produced and delivered is the same regardless of the intended customer The Lessor segment makes large purchases and exploits a negotiating leverage over Air det For every $500K in price increase, AirJet will lose 1 Lessor customer (15 aircraft). Average revenue per customer is: o $6.5M per aircraft from Lessors $8.4M from Affluent individuals o $8.0M from Corporate Customers . . O Market Growth: The jet engine, regional aircraft leasing market is large and growing. In 2011, the new aircraft leasing market represented almost 50% of all new aircraft delivered (with operating leases comprising half) and is expected to grow 5% per year. Market Economics: 1. The aircraft leasing market is profitable with the average competitor generating ROE's of -15% (cost of equity 10%) 2. The key driver of profitability is cost of funds. AirJet would be at parity. Competition: Three aircraft lessors (also AirJet's customers) dominate the market with a combined share of 65%. Customer: AirJet has marketing relationships with all aircraft end-users who are leasing their aircraft from the company's aircraft lessor customers. AirJet works with these end-users to help them configure the plane during the front end of the sales process. AIRJET INC. AirJet Inc. is a U.S. manufacturer of small, regional airplanes. It manufactures two types of aircraft: Jet engine (80 to 100-seat) and propeller aircraft (20 to 30-seat). In 2011, AirJet delivered 110 jet engine aircraft and 150 propeller aircraft. This represented a unit volume increase year-over-year of 10% and 5%, respectively, and revenues of $794 million and $225 million, respectively. Although overall Airdet turned a profit, profitability varied significantly by business. AirJet's senior management team has hired your team of consultants to help the company develop a value-maximizing strategy. We need your help to understand: 1. Given the poor performance of the jet engine business compared to the propeller aircraft business, what are the key issues and opportunities AirJet should address relative to the jet engine business? 2. What solutions would you recommend to management? Key financial and market data relevant to Airjet Inc. Jet Engine Aircraft Business Propeller Aircraft Business Financials ($m) % of Sales Financials ($m) % of Sales 794 100% 225 100% -659 -83% -86 -3896 -99 -12% -16 -7% 2011 Revenues Cost of Goods Sold Selling / General and Administrative Expenses Delivery & Other Expenses Net Income Capital Charge (at 10%) Economic Profit -42 -6 -25 -31 -5% -1% -3% -4% -8 69 -3 66 -4% 31% - 1% 29% Jet Engine Customer Segments 2011, Sm Affluent individuals Corporate Customers AirJet Revenues $84 $320 * Customers 10 13 Aircraft sold 10 40 Market share 12 50% Jet Engine Economics 2011, Sm Per Aircraft Total Fixed Cost $1.5 $165 Variable Cost $6.0 $660 Total Cost $7.5 $825 M Per Arred on 2011 um of 10 2 toalost includes Cool Capit Lessors $390 60 25% 33% Market Structure and Economics Overall Market Economics 2011, Sm Total US Market Size 3.520 Average Costs per Aircraft $6.8 #of Jets Sold 440 Total Capital Invested 3,300 Cost of Capital 10% Market Structure 500 400 40 deliveries Competitor & 70 Competitor 3: 70 360 deliveries Competitors 300 # of Deliveries Competitor 360 Competitor 2 02 '08-'11 CAGR Competitor 4 Competitor 3 Competitor 2 Competitor 1 AlrJet Inc. Total Market: 200 6% 1% 15% 7% 15% 7% Competitor 261 Competitor t07 100 Competitor : 70 AlJet Inc.: 72 0 ArJet 100: 110 2011 2000 . . . Relevant Segment and Market Information Airjet's costs in the jet engine business are in line with market average. Jet engine parts are complex and are typically purchased directly from the original equipment manufacturers. The jet engine market is a growing market. AirJet's market share rose from 20% to 25% and outpaced the growth of its competitors. There is no dominant competitor in the jet engine market. The average price per jet engine aircraft is $8m. The jet engine market is likely to continue growing at 7% for the next 10 years. AirJet could increase price by 20% and still have a competitive product which provides a fair benefit to customers. AirJet offers a relatively undifferentiated product, meaning that pricing higher would lead to a loss of market share. . . . . Relevant Customer Information . . . Affluent Individuals buy 1 jet engine aircraft during a buying cycle (approximately every 5 to 15 years). Corporate Customers (mostly large multinational corporations) buy 2-3 jet engine aircraft annually for executive travels. Lessors buy 15 or more aircraft annually and lease to airlines, governments, corporations, etc. Operating cost per aircraft produced and delivered is the same regardless of the intended customer The Lessor segment makes large purchases and exploits a negotiating leverage over Air det For every $500K in price increase, AirJet will lose 1 Lessor customer (15 aircraft). Average revenue per customer is: o $6.5M per aircraft from Lessors $8.4M from Affluent individuals o $8.0M from Corporate Customers . . O Market Growth: The jet engine, regional aircraft leasing market is large and growing. In 2011, the new aircraft leasing market represented almost 50% of all new aircraft delivered (with operating leases comprising half) and is expected to grow 5% per year. Market Economics: 1. The aircraft leasing market is profitable with the average competitor generating ROE's of -15% (cost of equity 10%) 2. The key driver of profitability is cost of funds. AirJet would be at parity. Competition: Three aircraft lessors (also AirJet's customers) dominate the market with a combined share of 65%. Customer: AirJet has marketing relationships with all aircraft end-users who are leasing their aircraft from the company's aircraft lessor customers. AirJet works with these end-users to help them configure the plane during the front end of the sales process