Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aisha needs a new car at once. She finds a nice model and haggles the price down to $27,500, but she has no money

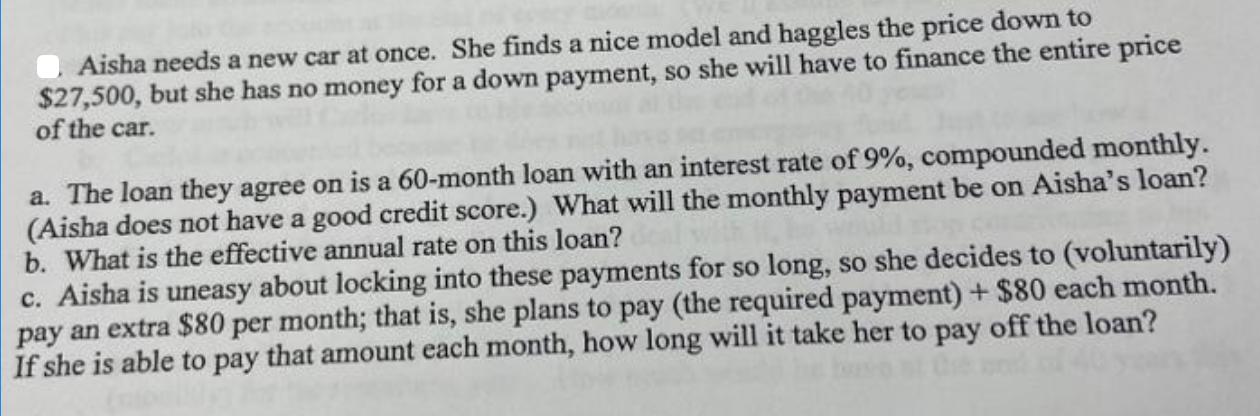

Aisha needs a new car at once. She finds a nice model and haggles the price down to $27,500, but she has no money for a down payment, so she will have to finance the entire price of the car. a. The loan they agree on is a 60-month loan with an interest rate of 9%, compounded monthly. (Aisha does not have a good credit score.) What will the monthly payment be on Aisha's loan? b. What is the effective annual rate on this loan? c. Aisha is uneasy about locking into these payments for so long, so she decides to (voluntarily) pay an extra $80 per month; that is, she plans to pay (the required payment) + $80 each month. If she is able to pay that amount each month, how long will it take her to pay off the loan?

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the monthly payment on Aishas loan we can use the formula for the monthly payment of a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started