Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carlos has established himself in his new job, and he's only 26 years old. Currently he is paid $62,000 (after taxes) each year. He

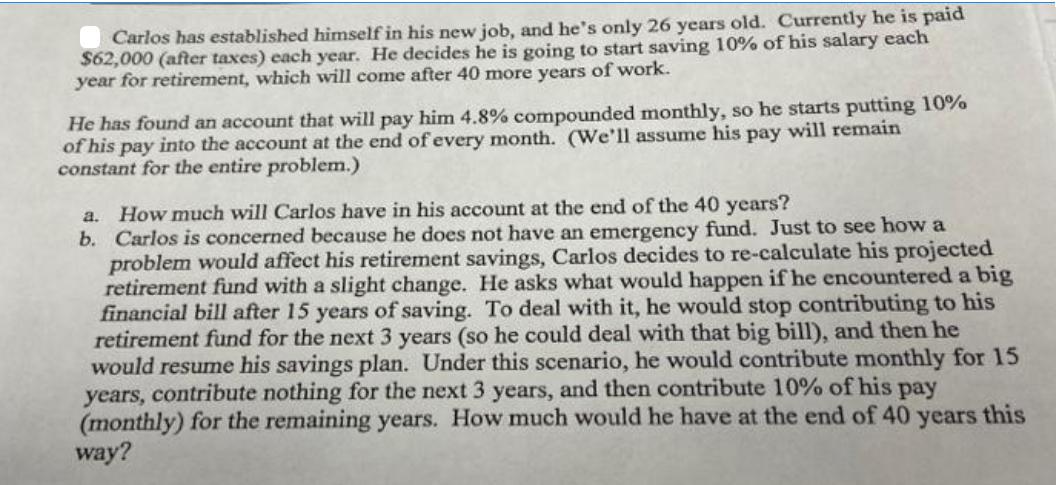

Carlos has established himself in his new job, and he's only 26 years old. Currently he is paid $62,000 (after taxes) each year. He decides he is going to start saving 10% of his salary each year for retirement, which will come after 40 more years of work. He has found an account that will pay him 4.8% compounded monthly, so he starts putting 10% of his pay into the account at the end of every month. (We'll assume his pay will remain constant for the entire problem.) a. How much will Carlos have in his account at the end of the 40 years? b. Carlos is concerned because he does not have an emergency fund. Just to see how a problem would affect his retirement savings, Carlos decides to re-calculate his projected retirement fund with a slight change. He asks what would happen if he encountered a big financial bill after 15 years of saving. To deal with it, he would stop contributing to his retirement fund for the next 3 years (so he could deal with that big bill), and then he would resume his savings plan. Under this scenario, he would contribute monthly for 15 years, contribute nothing for the next 3 years, and then contribute 10% of his pay (monthly) for the remaining years. How much would he have at the end of 40 way? years this

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Lets go through the calculations step by step a Without any interruptions in saving Step 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started