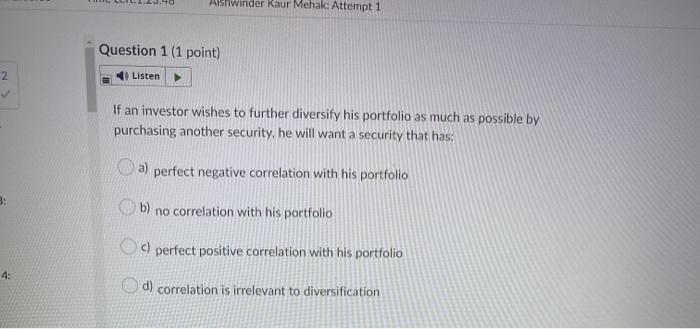

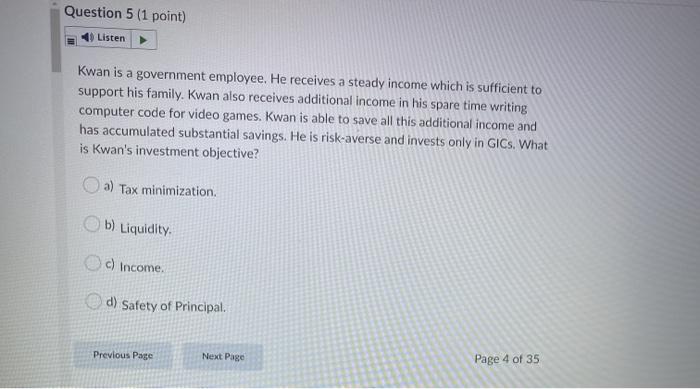

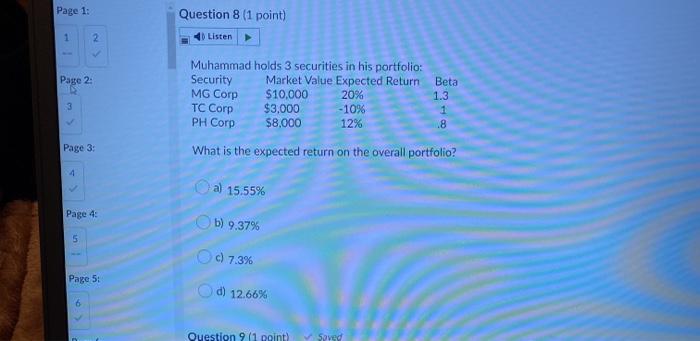

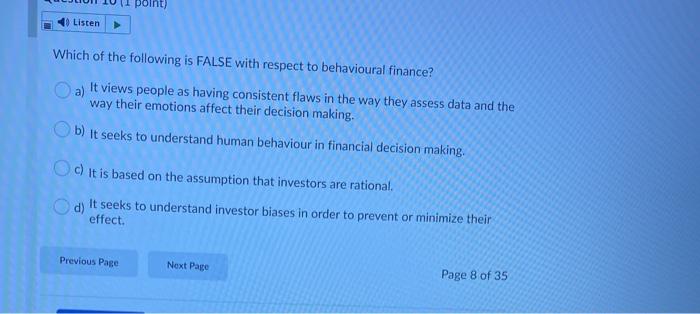

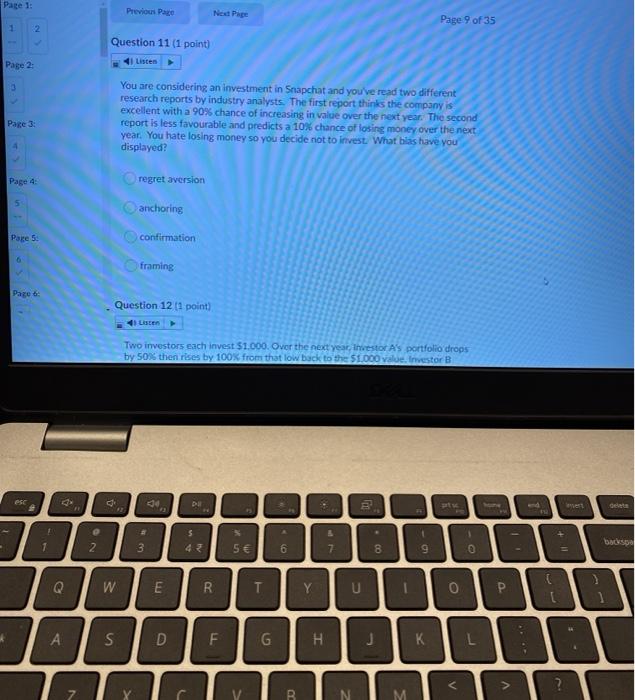

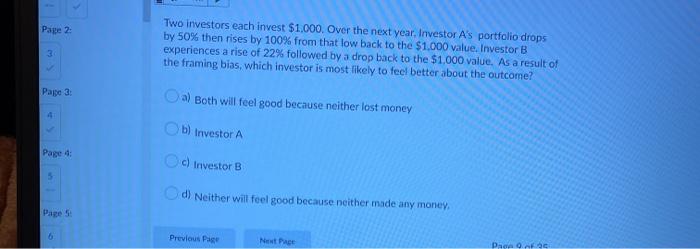

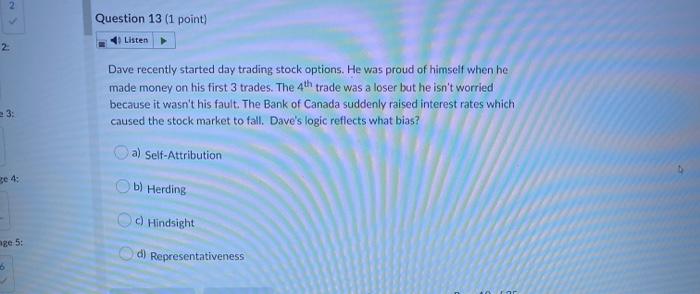

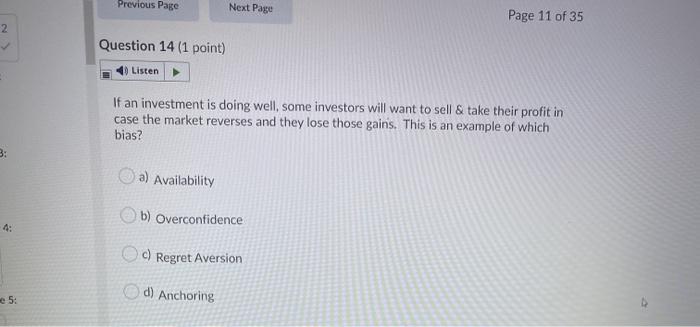

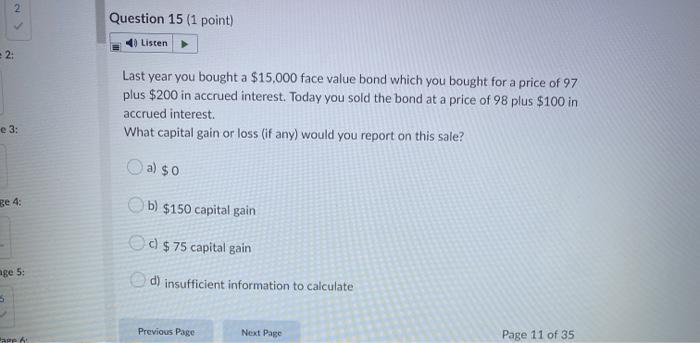

Aishwinder Kaur Mehak: Attempt 1 Question 1 (1 point) 2 Listen If an investor wishes to further diversify his portfolio as much as possible by purchasing another security, he will want a security that has: a) perfect negative correlation with his portfolio b) no correlation with his portfolio perfect positive correlation with his portfolio 4: d) correlation is irrelevant to diversification Question 5 (1 point) Listen Kwan is a government employee. He receives a steady income which is sufficient to support his family. Kwan also receives additional income in his spare time writing computer code for video games. Kwan is able to save all this additional income and has accumulated substantial savings. He is risk-averse and invests only in GICs. What is Kwan's investment objective? a) Tax minimization b) Liquidity c) Income d) Safety of Principal Previous Page Next Page Page 4 of 35 Page 1: Question 8 (1 point) 1 2 Listen Page 2 Muhammad holds 3 securities in his portfolio: Security Market Value Expected Return MG Corp $10,000 20% TC Corp $3,000 - 10% PH Corp $8,000 12% 3 Beta 1.3 1 .8 Page 3: What is the expected return on the overall portfolio? a) 15.55% Page 4 b) 9.37% 5 c) 7.3% Page 5: d) 12.66% 6 Question 9 (1 point) Soved Page 1: Previous Pace Ned Page Page 9 of 35 2 Question 11 (1 point) Listen Page 2 You are considering an investment in Snapchat and you've read two different research reports by industry analysts. The first report thinks the company is excellent with a 90% chance of increasing in value over the next year. The second report is less favourable and predicts a 10% chance of losing money over the next year. You hate losing money so you decide not to invest. What blas have you displayed? Page 3 4 Page 4 regret aversion anchoring 5 Page 5 confirmation 6 framing Page 6 Question 12 [1 point) Listen Two investors each invest $1.000. Over the next year, Investor A's portfolio drops by 50% then rises by 100from that low back to the $1.000 value. Investor B esc 2 D To est F S 5 2 3 A 6 be 1 2 5 7 8 9 0 Q W E R . Y U S S F G G H J L 7 V R M Page 2 Two investors each invest $1.000. Over the next year. Investor A's portfolio drops by 50% then rises by 100% from that low back to the $1.000 value. Investor B experiences a rise of 22% followed by a drop back to the $1,000 value. As a result of the framing bias, which investor is most likely to feel better about the outcome? 3 Page 3 a) Both will feel good because neither lost money b) Investor A Page 4 c) Investor B 5 d) Neither will feel good because neither made any money, Page 5 6 Previous Page NetPage Dame Previous Page Next Page Page 11 of 35 Question 14 (1 point) Listen If an investment is doing well, some investors will want to sell & take their profit in case the market reverses and they lose those gains. This is an example of which bias? a) Availability b) Overconfidence 4: c) Regret Aversion d) Anchoring 5: 2 > Question 15 (1 point) 4. Listen 2: Last year you bought a $15,000 face value bond which you bought for a price of 97 plus $200 in accrued interest. Today you sold the bond at a price of 98 plus $100 in accrued interest What capital gain or loss (if any) would you report on this sale? e 3: a) $0 ge 4: b) $150 capital gain d) $ 75 capital gain age 5: d) insufficient information to calculate 5 Previous Page Next Page app 6 Page 11 of 35