Question

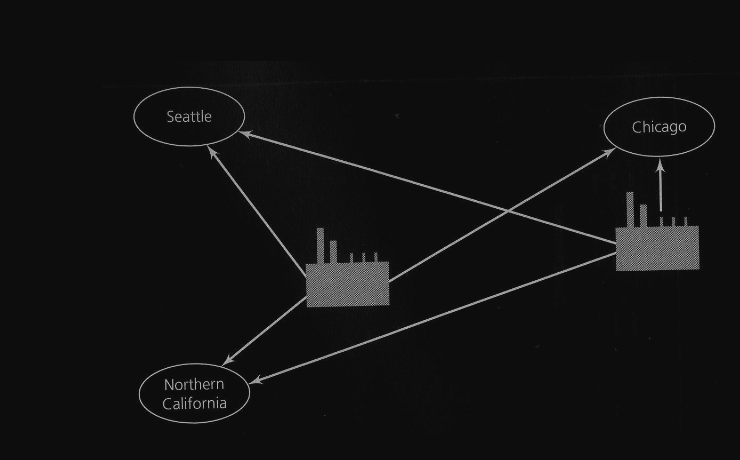

Ajax presently has a production facility in Chicago where its principal market share is located. Business is growing, and 2 new markets are emerging in

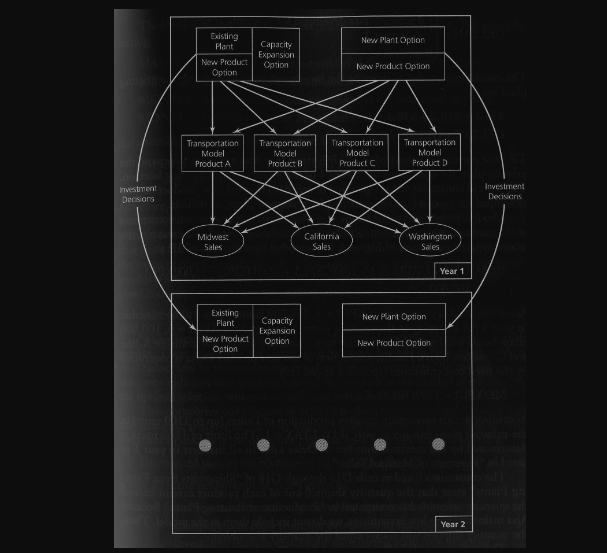

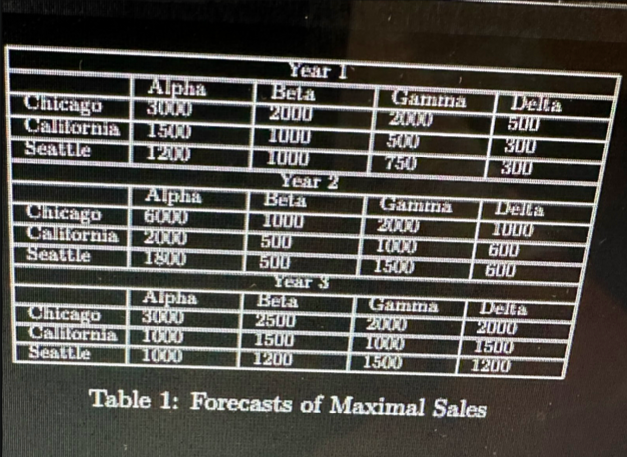

Ajax presently has a production facility in Chicago where its principal market share is located. Business is growing, and 2 new markets are emerging in California and Seattle. Ajax is planning for the coming 3 years. You have been hired by Ajax as a consultant to investigate the following strategic decisions. Should Ajax open a new production facility in Sunnyvale, California, and if so, in what year (1, 2, or 3)? Should Ajax invest in a major expansion of its Chicago facility, and if so, in what year? Should Ajax invest in developing a new product, Delta laptops, and if so, should it assign it to the plant at Chicago, or to the potential plant at Sunnyvale? What quantity of each product to produce at each plant in each time period? Which plant should serve each market for each product in each time period?

Some assumptions: Capacity of Chicago plant is expanded in either first, second, or third year, if at all. New product, Delta, may be developed for assembly in year 1 at the existing plant only, the new plant only, or neither. Unit revenue: $1,350, $1,650, $3,000, and $2,500 for Alpha, Beta, Gamma, and Delta, respectively.

Some assumptions: Capacity of Chicago plant is expanded in either first, second, or third year, if at all. New product, Delta, may be developed for assembly in year 1 at the existing plant only, the new plant only, or neither. Unit revenue: $1,350, $1,650, $3,000, and $2,500 for Alpha, Beta, Gamma, and Delta, respectively.

(Please list the constraints for this optimization problem. Please the suggested notation at the bottom.)

Chicago plant (existing facility):

A line test: Alphas and Betas; 1 hour for any Alpha or Beta tested. Capacity w/o expansion: 6,000 hrs. Capacity after expansion: 8,000 hrs.

C-line test: Gammas and Deltas; 1 hour for any Gamma or Delta tested. Capacity w/o expansion: 2,400 hrs. Capacity after expansion: 3,200 hrs.

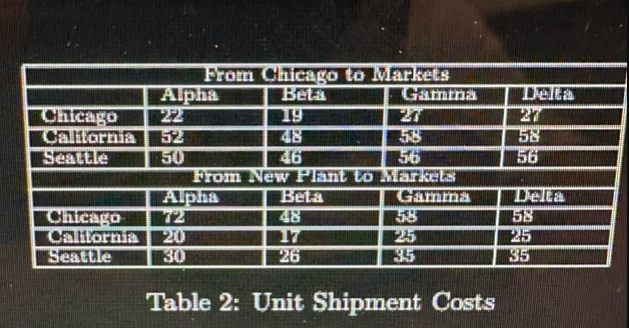

Assembly line: 10 hrs for 1 Alpha, 15 hrs for 1 Beta, 20 hrs for 1 Gamma, 22 hrs for 1 Delta. Capacity w/o expansion: 100,000 hrs. Capacity after expansion: 133,000 hrs. Unit cost: $1,000, $1,175, $2,250, and $2,100 for Alpha, Beta, Gamma, and Delta, respectively. Expansion cost in any year: $834,000. Fixed cost for developing Delta at the Chicago plant: $775,000. New plant: A-line test: Alphas and Betas; 1 hour for any Alpha or Beta tested. Capacity expansion: 5,000 hrs. C-line test: Gammas and Deltas; 1 hour for any Gamma or Delta tested. Capacity expansion: 2,000 hrs. Assembly line: 9 hrs for 1 Alpha, 14 hrs for 1 Beta, 18 hrs for 1 Gamma, 20 hrs for 1 Delta. Capacity expansion: 80,000 hrs. Unit cost: $925, $1,100, $2,125, and $1,900 for Alpha, Beta, Gamma, and Delta, respectively. Opening plant in any year: $2,225,000. Fixed cost for developing Delta at new plant: $775,000.

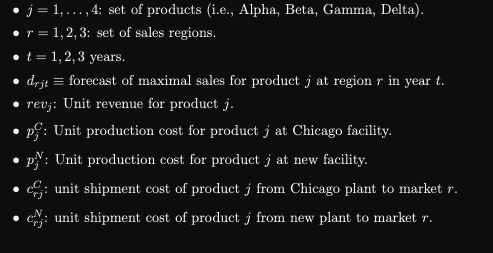

NOTATIONS:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started