Question

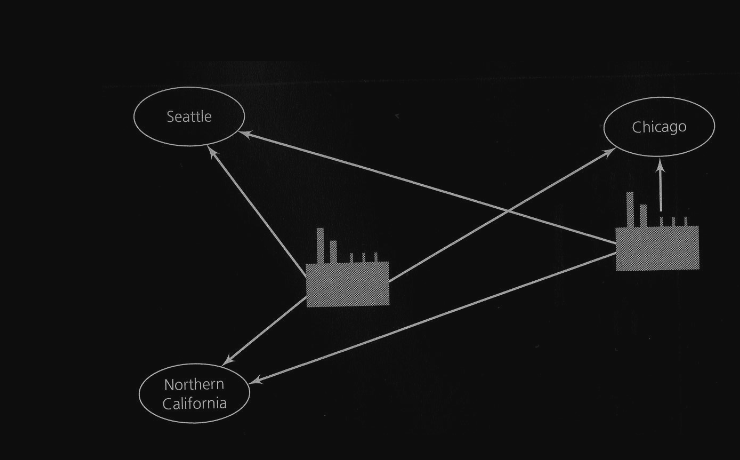

Ajax presently has a production facility in Chicago where its principal market share is located. Business is growing, and 2 new markets are emerging in

Ajax presently has a production facility in Chicago where its principal market share is located. Business is growing, and 2 new markets are emerging in California and Seattle. Ajax is planning for the coming 3 years. You have been hired by Ajax as a consultant to investigate the following strategic decisions.

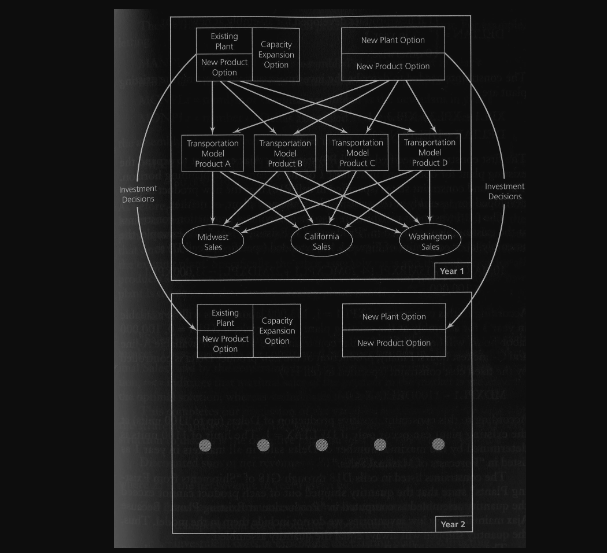

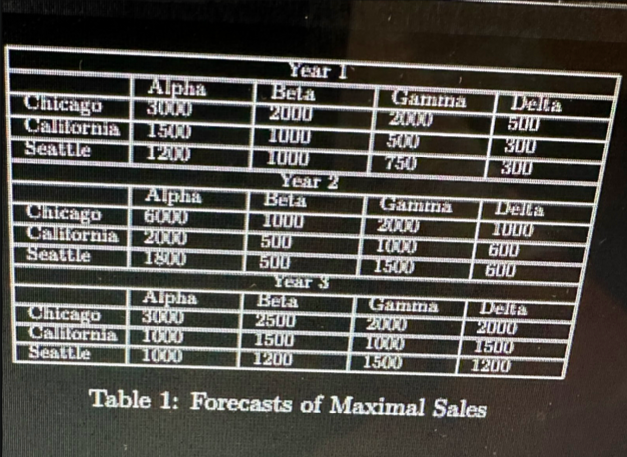

Some assumptions: Capacity of Chicago plant is expanded in either first, second, or third year, if at all. New product, Delta, may be developed for assembly in year 1 at the existing plant only, the new plant only, or neither. Unit revenue: $1,350, $1,650, $3,000, and $2,500 for Alpha, Beta, Gamma, and Delta, respectively.

Some assumptions: Capacity of Chicago plant is expanded in either first, second, or third year, if at all. New product, Delta, may be developed for assembly in year 1 at the existing plant only, the new plant only, or neither. Unit revenue: $1,350, $1,650, $3,000, and $2,500 for Alpha, Beta, Gamma, and Delta, respectively.

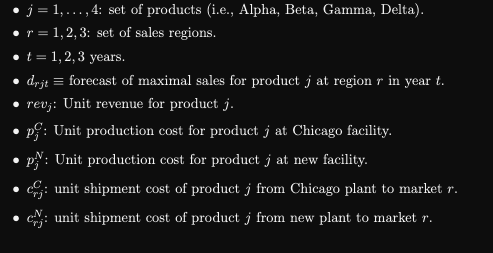

(Please list the constraints for this optimization problem.Please the suggested notation at the bottom )

Chicago plant (existing facility):

A line test: Alphas and Betas; 1 hour for any Alpha or Beta tested. Capacity w/o expansion: 6,000 hrs. Capacity after expansion: 8,000 hrs.

C-line test: Gammas and Deltas; 1 hour for any Gamma or Delta tested. Capacity w/o expansion: 2,400 hrs. Capacity after expansion: 3,200 hrs.

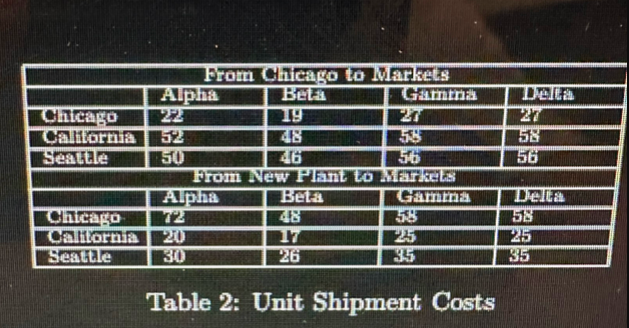

Assembly line: 10 hrs for 1 Alpha, 15 hrs for 1 Beta, 20 hrs for 1 Gamma, 22 hrs for 1 Delta. Capacity w/o expansion: 100,000 hrs. Capacity after expansion: 133,000 hrs. Unit cost: $1,000, $1,175, $2,250, and $2,100 for Alpha, Beta, Gamma, and Delta, respectively. Expansion cost in any year: $834,000. Fixed cost for developing Delta at the Chicago plant: $775,000.

New plant: A-line test: Alphas and Betas; 1 hour for any Alpha or Beta tested. Capacity expansion: 5,000 hrs. C-line test: Gammas and Deltas; 1 hour for any Gamma or Delta tested. Capacity expansion: 2,000 hrs. Assembly line: 9 hrs for 1 Alpha, 14 hrs for 1 Beta, 18 hrs for 1 Gamma, 20 hrs for 1 Delta. Capacity expansion: 80,000 hrs. Unit cost: $925, $1,100, $2,125, and $1,900 for Alpha, Beta, Gamma, and Delta, respectively. Opening plant in any year: $2,225,000. Fixed cost for developing Delta at the new plant: $775,000.

NOTATIONS:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started