Question

Ajit lives in Ontario, and operates a consulting business that produces a taxable income of $230,000 per year. The business is currently a proprietorship, so

Ajit lives in Ontario, and operates a consulting business that produces a taxable income of $230,000 per year. The business is currently a proprietorship, so the taxable income is treated as personal income for Ajit, from a tax perspective. Ajit files taxes singly and can claim $12,069 as a federal personal exemption and $10,582 as a provincial personal exemption against his personal income. (Note that these are updated values on those listed in Table 12-2 in the textbook).

Ajit is considering incorporating his business. If he does, he will pay himself a salary of $80,000 a year from the corporation. The corporation will then pay corporate taxes on the remaining $150,000.

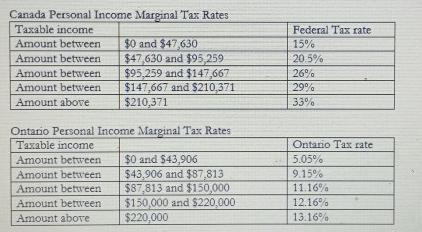

Marginal 2019 federal and Ontario personal income tax rates are listed in the tables below. (Note that the federal rates are updated values on those listed in Table 12-1 in the textbook).

In 2019, the federal corporate tax rate is 15%, and the Ontario corporate tax rate is 11.5%. (These values have not changed since 2015, so they match the information in Table 12-3.) 2

a. How much federal income tax does Ajit pay now? How much provincial income tax?

b. How much federal and how much provincial tax would he pay if he incorporated his business, both personally and through his corporation?

c Should he incorporate will his taxes go down)?

Canada Personal Income Marginal Tax Rates Taxable income Federal Tax rate $0 and $47,630 $47,630 and $95,259 $95,259 and $147,667 $147,667 and $210,371 $210,371 Amount between 15% Amount between 20.5% Amount between 26% Amount between 29% Amount above 33% Ontario Personal Income Marginal Tax Rates Taxable income Amount between Ontario Tax rate $O and $43,906 $43,906 and $87,813 $87,813 and $150,000 $150,000 and $220,000 $220,000 5.05% Amount between 9.15% Amount between 11.16% Amount between 12.16% Amount above 13.16%

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer to a Calculation of Federal Income Tax Now Particulars Amount in 12069 Exemption 0 to 47630 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started