Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a)Journal entries to record the above revaluations (narrations are not required). (b) Extract Statement of Profit or Loss and Other Comprehensive Income for the year

(a)Journal entries to record the above revaluations (narrations are not required).

(b) Extract Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2018, 2020 and 2021.

(c) Extract Statement of Financial Position as at 30 June 2021.

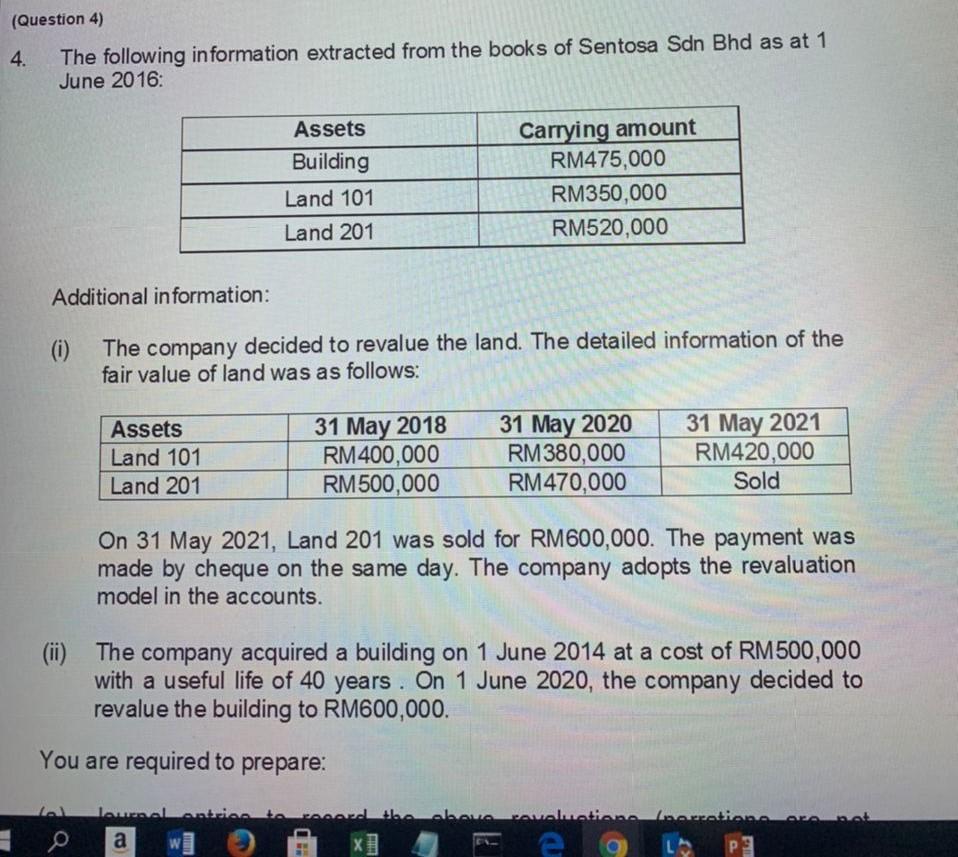

(Question 4) 4. The following information extracted from the books of Sentosa Sdn Bhd as at 1 June 2016: Assets Building Land 101 Land 201 Carrying amount RM475,000 RM350,000 RM520,000 Additional information: (0) The company decided to revalue the land. The detailed information of the fair value of land was as follows: Assets Land 101 Land 201 31 May 2018 RM 400,000 RM500,000 31 May 2020 RM380,000 RM470,000 31 May 2021 RM420,000 Sold On 31 May 2021, Land 201 was sold for RM600,000. The payment was made by cheque on the same day. The company adopts the revaluation model in the accounts. (ii) The company acquired a building on 1 June 2014 at a cost of RM500,000 with a useful life of 40 years . On 1 June 2020, the company decided to revalue the building to RM600,000. You are required to prepare: Journal entries a w o x . Ft L p3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started