Question

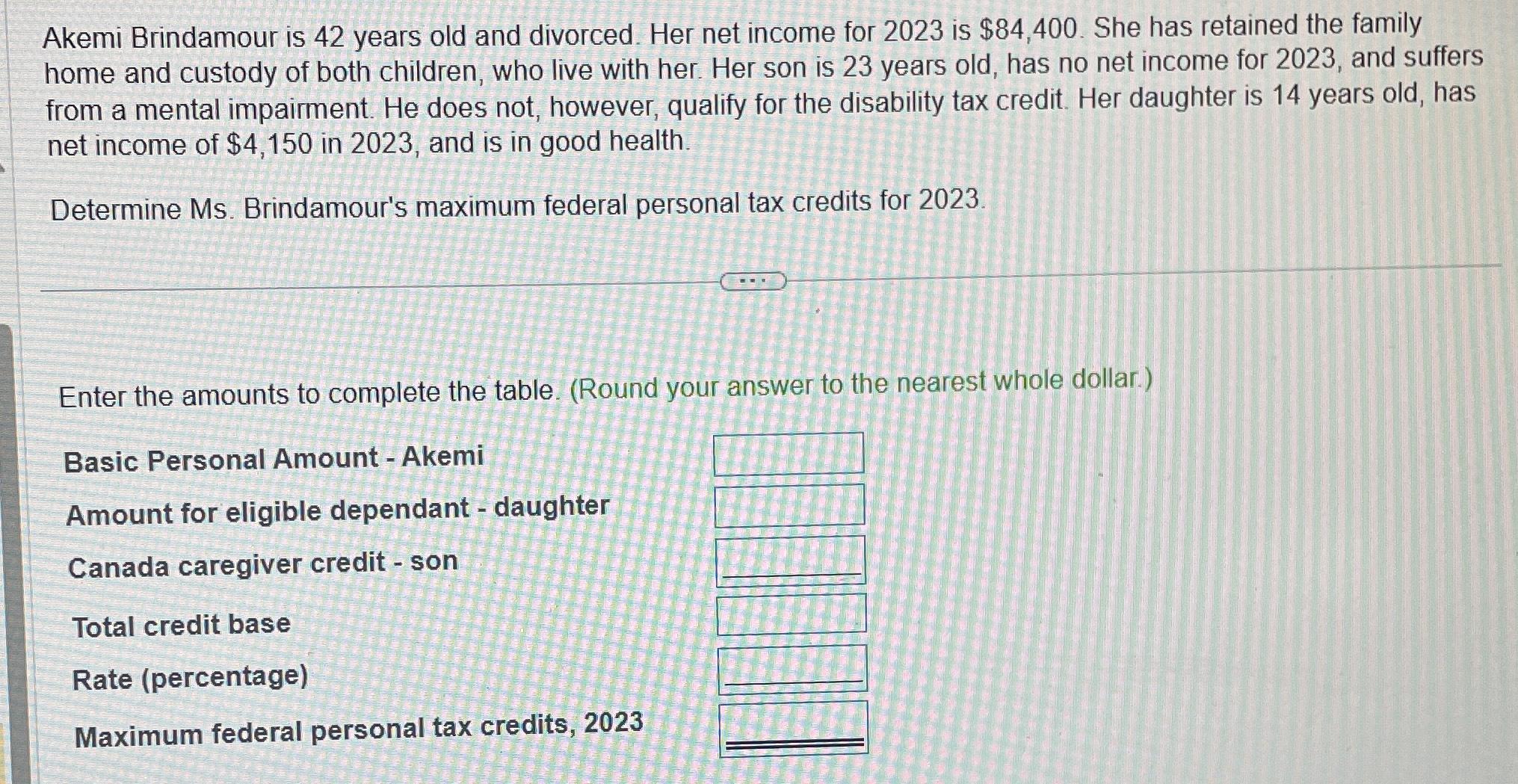

Akemi Brindamour is 42 years old and divorced. Her net income for 2023 is $84,400 . She has retained the family home and custody of

Akemi Brindamour is 42 years old and divorced. Her net income for 2023 is

$84,400. She has retained the family home and custody of both children, who live with her. Her son is 23 years old, has no net income for 2023, and suffers from a mental impairment. He does not, however, qualify for the disability tax credit. Her daughter is 14 years old, has net income of

$4,150 in 2023 , and is in good health.\ Determine Ms. Brindamour's maximum federal personal tax credits for 2023.\ Enter the amounts to complete the table. (Round your answer to the nearest whole dollar.)\ Basic Personal Amount - Akemi\ Amount for eligible dependant - daughter\ Canada caregiver credit - son\ Total credit base\ Rate (percentage)\ Maximum federal personal tax credits, 2023

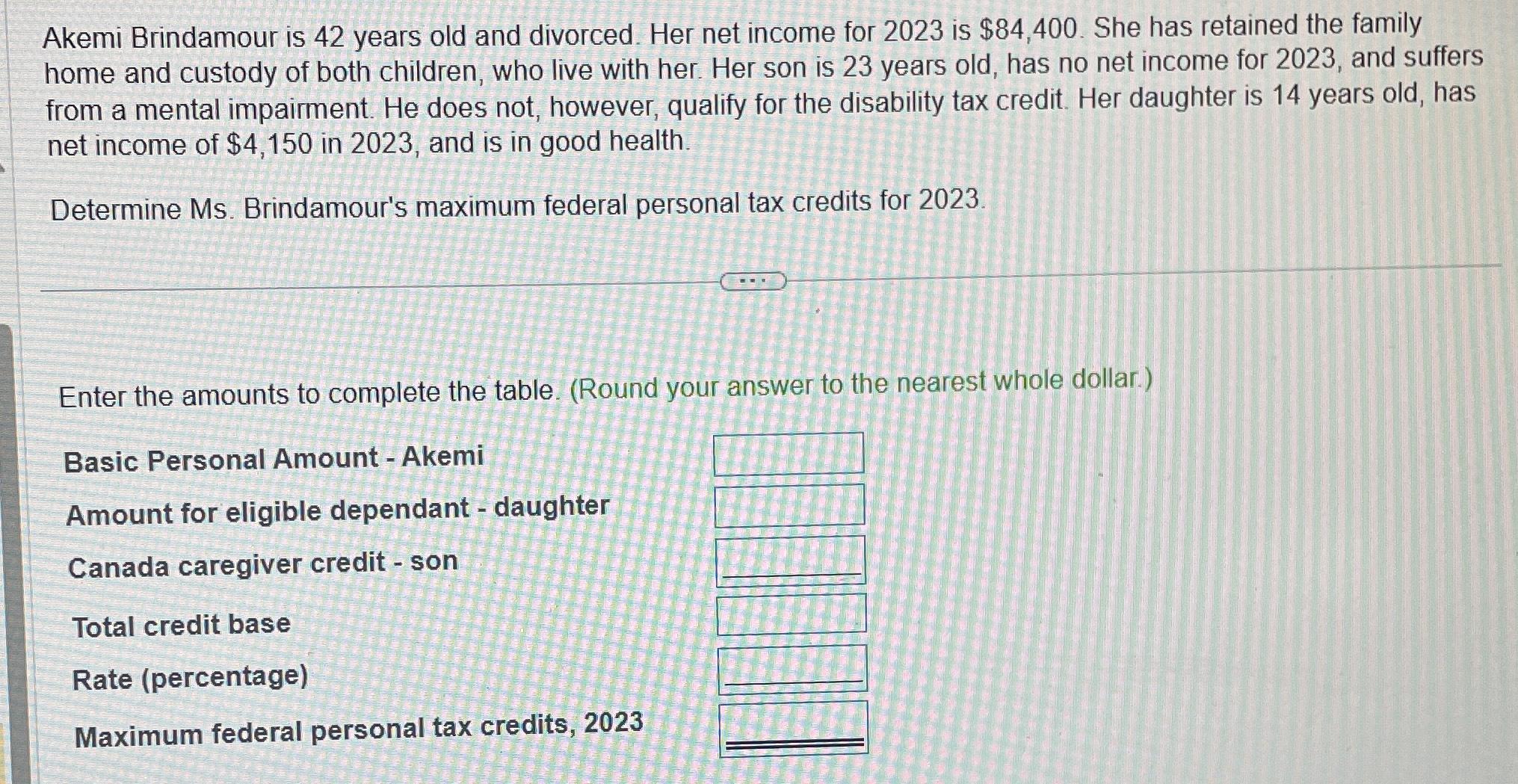

Akemi Brindamour is 42 years old and divorced. Her net income for 2023 is

$84,400. She has retained the family home and custody of both children, who live with her. Her son is 23 years old, has no net income for 2023, and suffers from a mental impairment. He does not, however, qualify for the disability tax credit. Her daughter is 14 years old, has net income of

$4,150in 2023 , and is in good health.\ Determine Ms. Brindamour's maximum federal personal tax credits for 2023.\ Enter the amounts to complete the table. (Round your answer to the nearest whole dollar.)\ Basic Personal Amount - Akemi\ Amount for eligible dependant - daughter\ Canada caregiver credit - son\ Total credit base\ Rate (percentage)\ Maximum federal personal tax credits, 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started