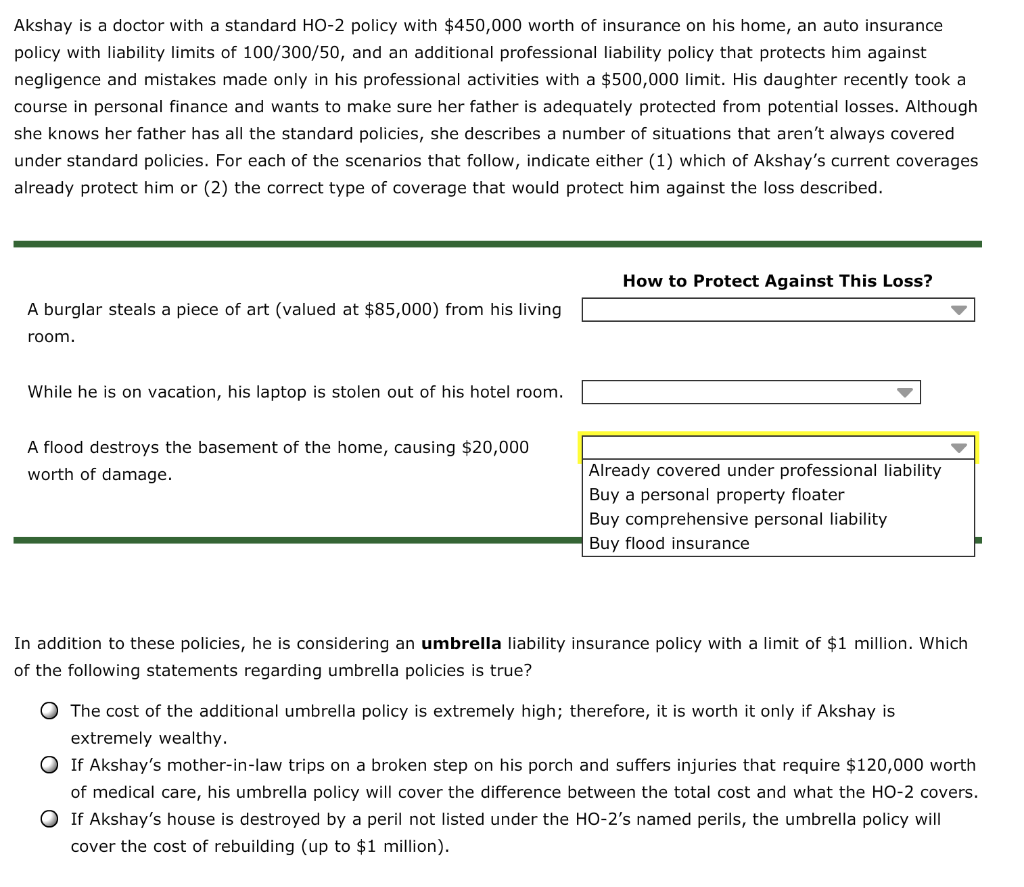

Akshay is a doctor with a standard HO-2 policy with $450,000 worth of insurance on his home, an auto insurance policy with liability limits of 100/300/50, and an additional professional liability policy that protects him against negligence and mistakes made only in his professional activities with a $500,000 limit. His daughter recently took a course in personal finance and wants to make sure her father is adequately protected from potential losses. Although she knows her father has all the standard policies, she describes a number of situations that aren't always covered under standard policies. For each of the scenarios that follow, indicate either (1) which of Akshay's current coverages already protect him or (2) the correct type of coverage that would protect him against the loss described. How to Protect Against This Loss? A burglar steals a piece of art (valued at $85,000) from his living room. While he is on vacation, his laptop is stolen out of his hotel room. A flood destroys the basement of the home, causing $20,000 worth of damage. Already covered under professional liability Buy a personal property floater Buy comprehensive personal liability Buy flood insurance In addition to these policies, he is considering an umbrella liability insurance policy with a limit of $1 million. Which of the following statements regarding umbrella policies is true? O The cost of the additional umbrella policy is extremely high; therefore, it is worth it only if Akshay is extremely wealthy. If Akshay's mother-in-law trips on a broken step on his porch and suffers injuries that require $120,000 worth of medical care, his umbrella policy will cover the difference between the total cost and what the HO-2 covers. If Akshay's house is destroyed by a peril not listed under the HO-2's named perils, the umbrella policy will cover the cost of rebuilding (up to $1 million). Akshay is a doctor with a standard HO-2 policy with $450,000 worth of insurance on his home, an auto insurance policy with liability limits of 100/300/50, and an additional professional liability policy that protects him against negligence and mistakes made only in his professional activities with a $500,000 limit. His daughter recently took a course in personal finance and wants to make sure her father is adequately protected from potential losses. Although she knows her father has all the standard policies, she describes a number of situations that aren't always covered under standard policies. For each of the scenarios that follow, indicate either (1) which of Akshay's current coverages already protect him or (2) the correct type of coverage that would protect him against the loss described. How to Protect Against This Loss? A burglar steals a piece of art (valued at $85,000) from his living room. While he is on vacation, his laptop is stolen out of his hotel room. A flood destroys the basement of the home, causing $20,000 worth of damage. Already covered under professional liability Buy a personal property floater Buy comprehensive personal liability Buy flood insurance In addition to these policies, he is considering an umbrella liability insurance policy with a limit of $1 million. Which of the following statements regarding umbrella policies is true? O The cost of the additional umbrella policy is extremely high; therefore, it is worth it only if Akshay is extremely wealthy. If Akshay's mother-in-law trips on a broken step on his porch and suffers injuries that require $120,000 worth of medical care, his umbrella policy will cover the difference between the total cost and what the HO-2 covers. If Akshay's house is destroyed by a peril not listed under the HO-2's named perils, the umbrella policy will cover the cost of rebuilding (up to $1 million)