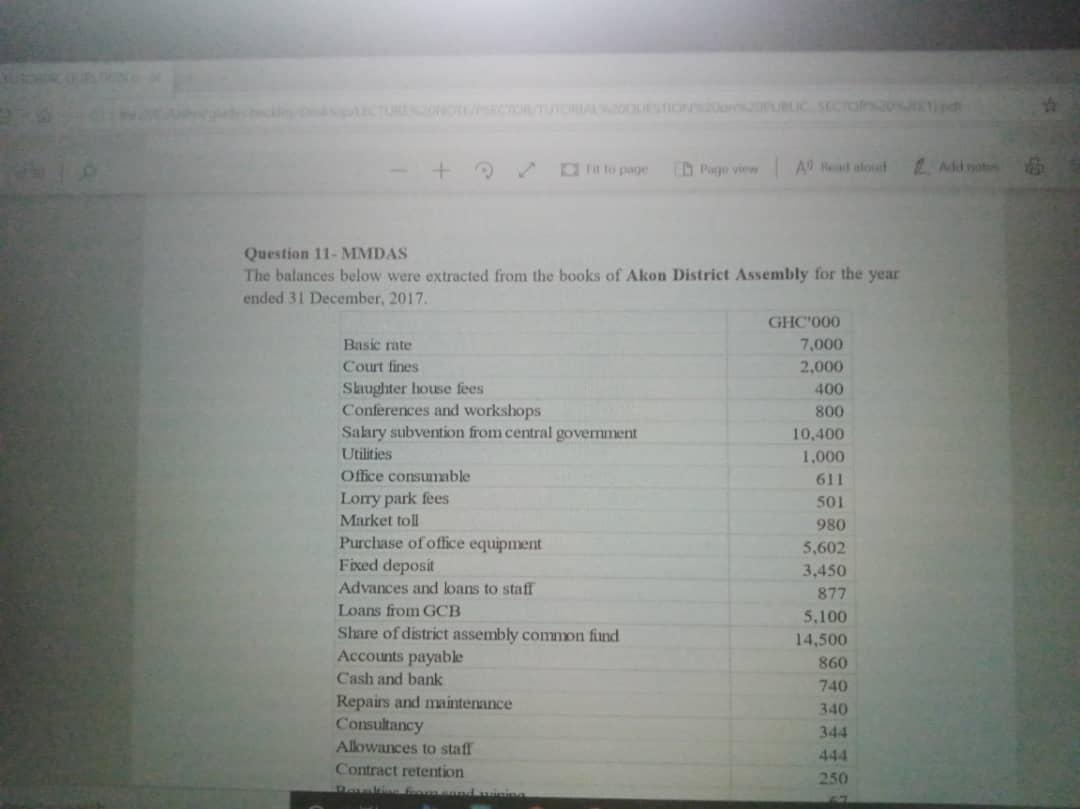

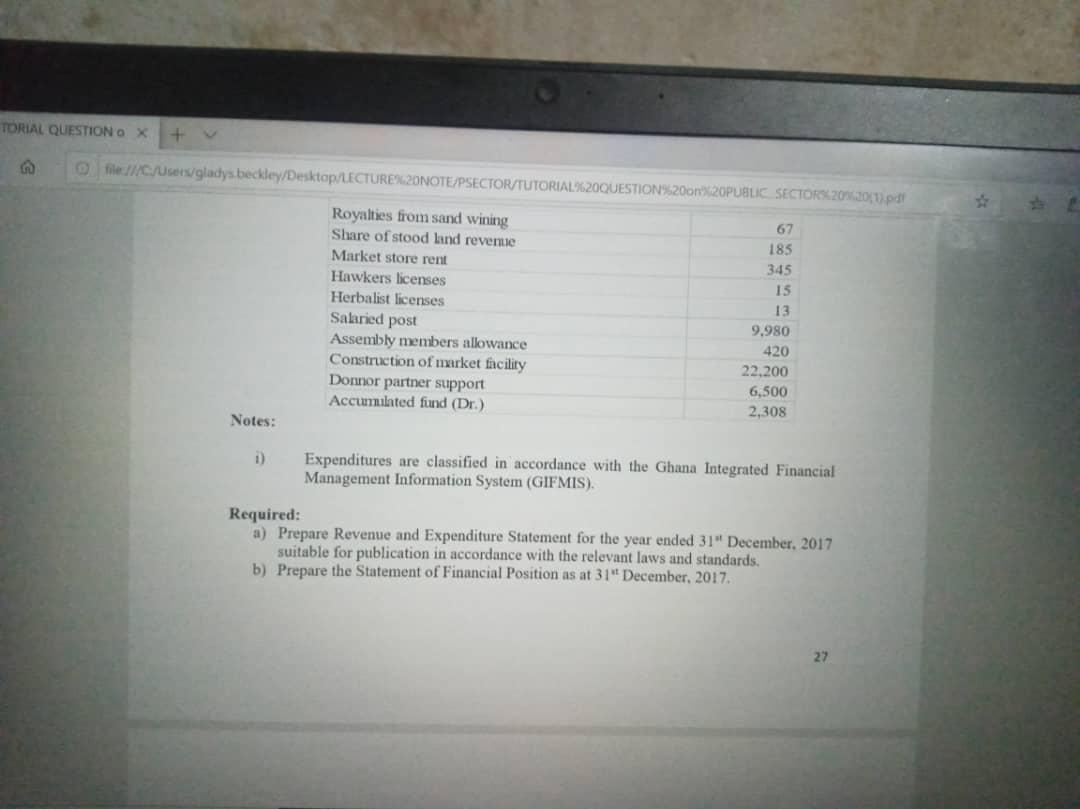

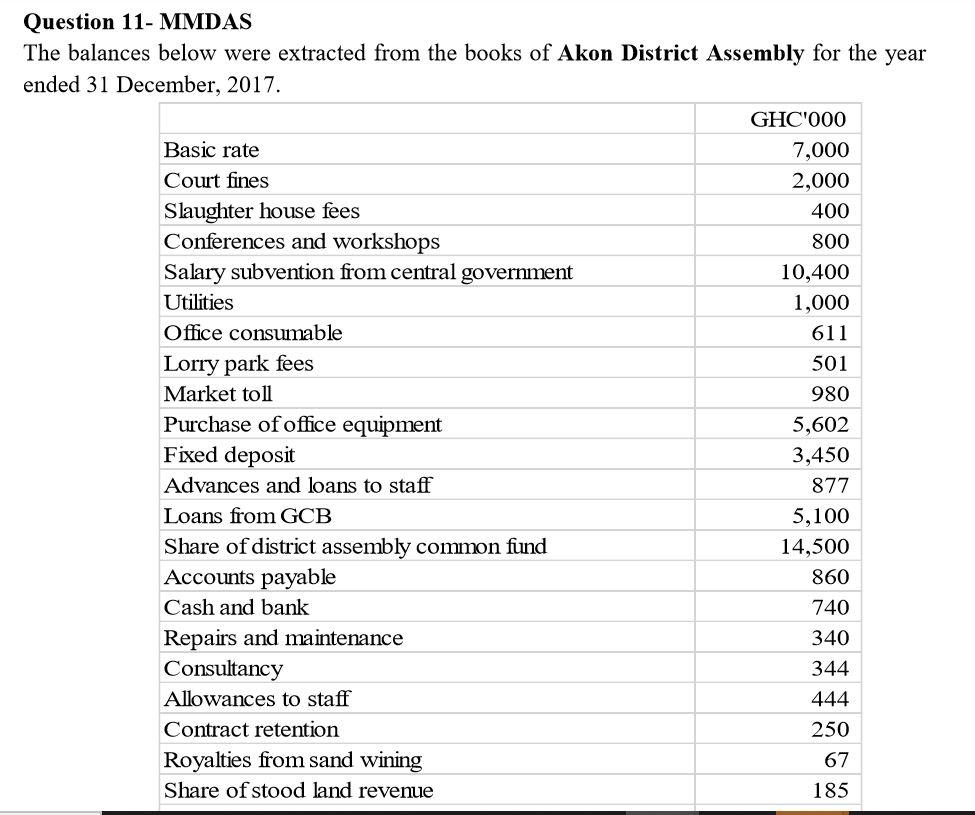

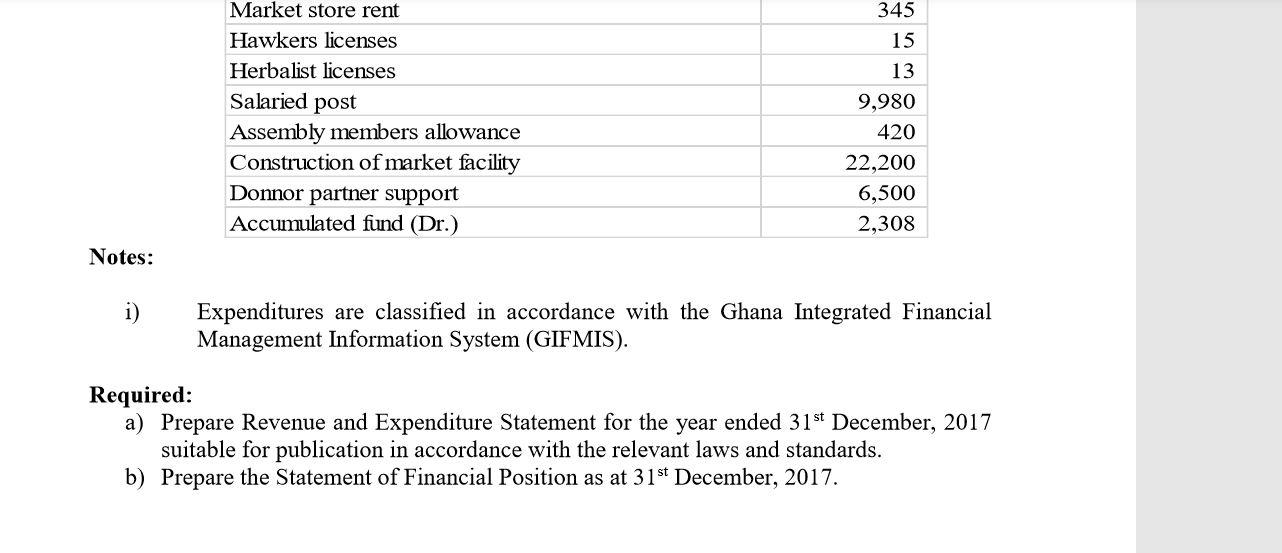

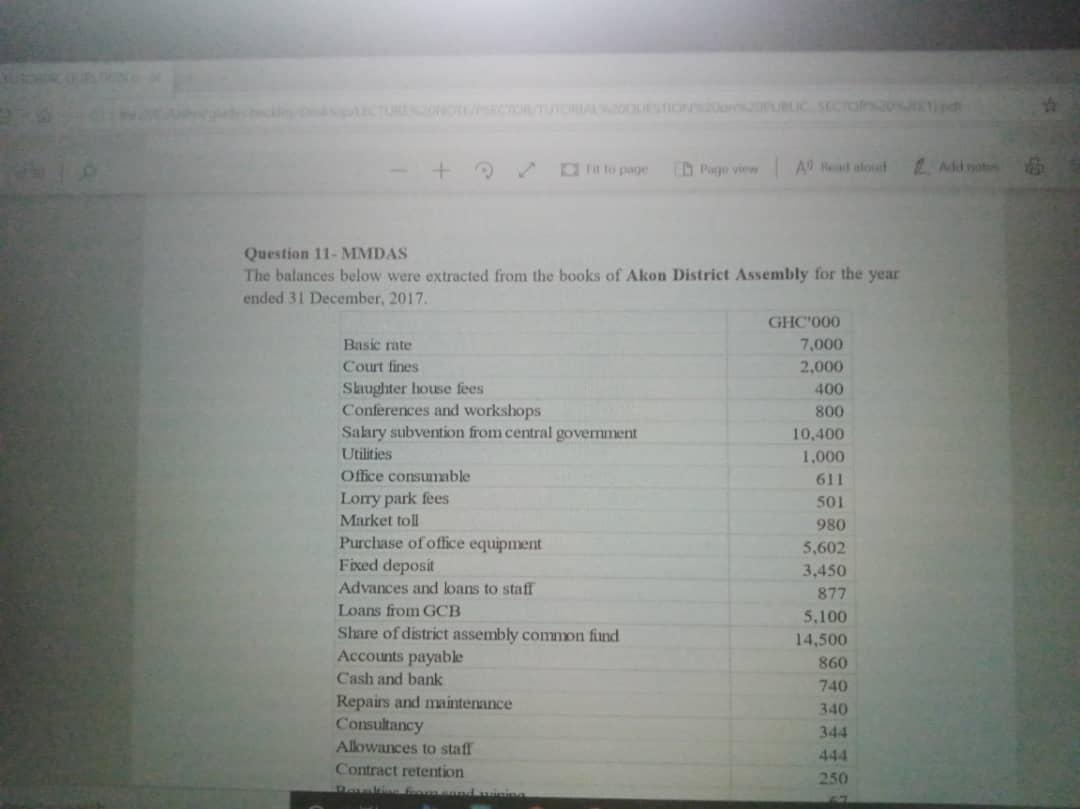

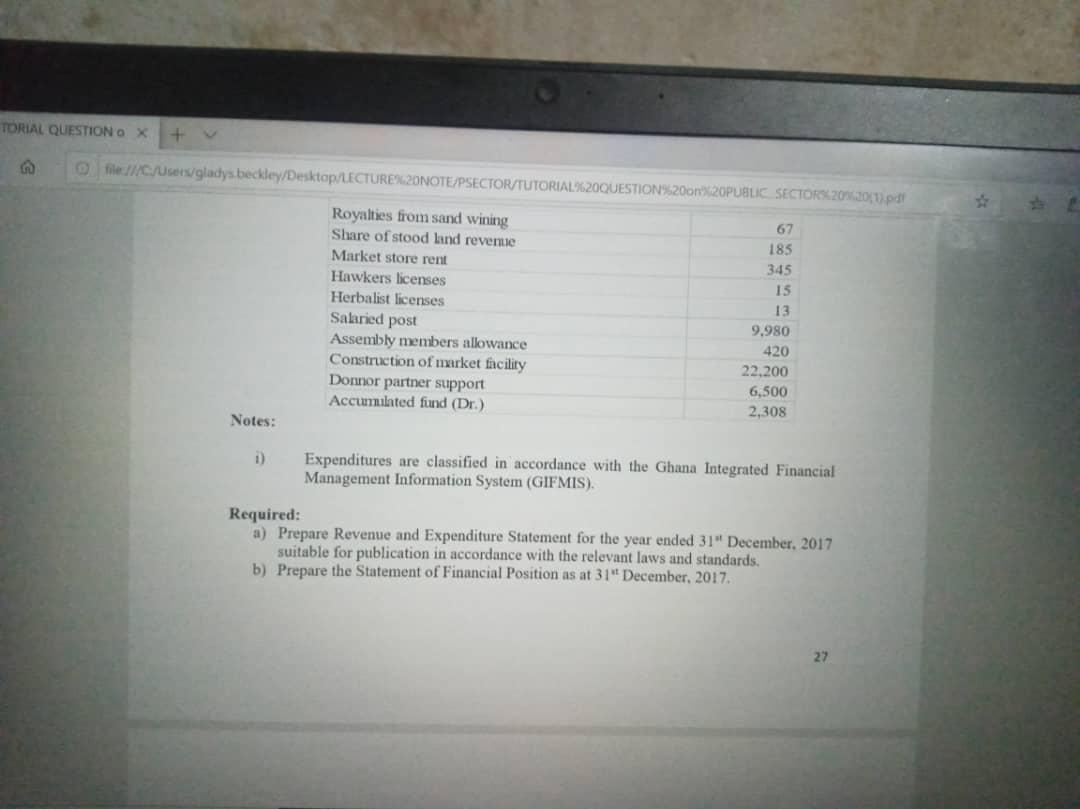

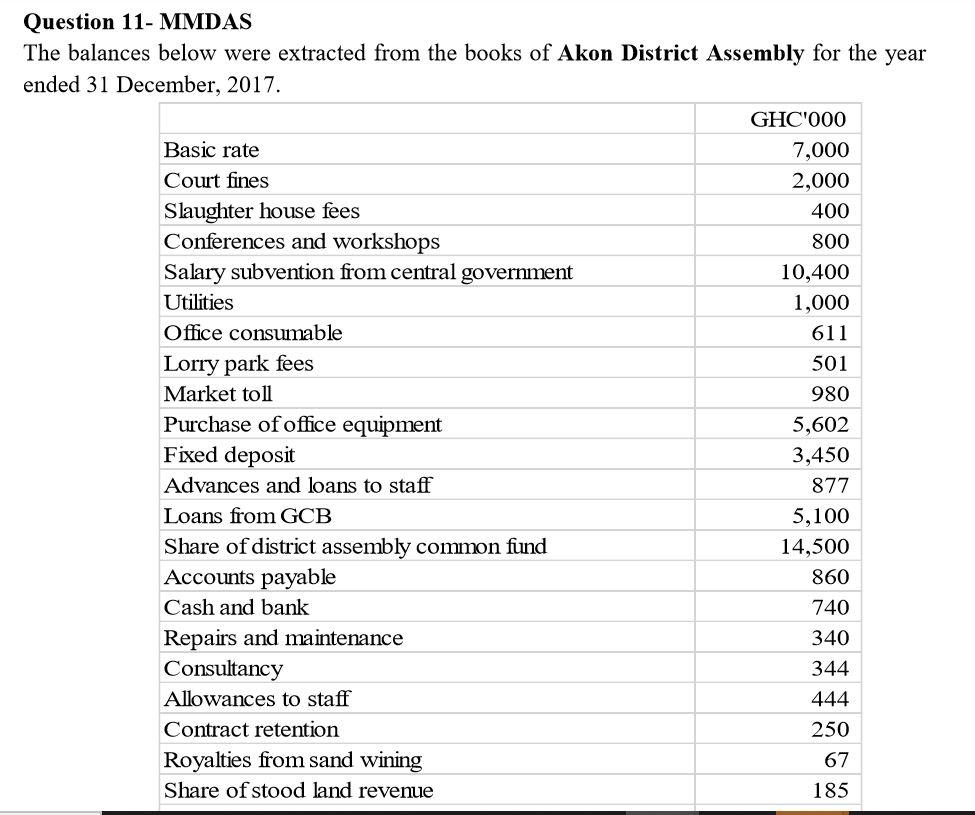

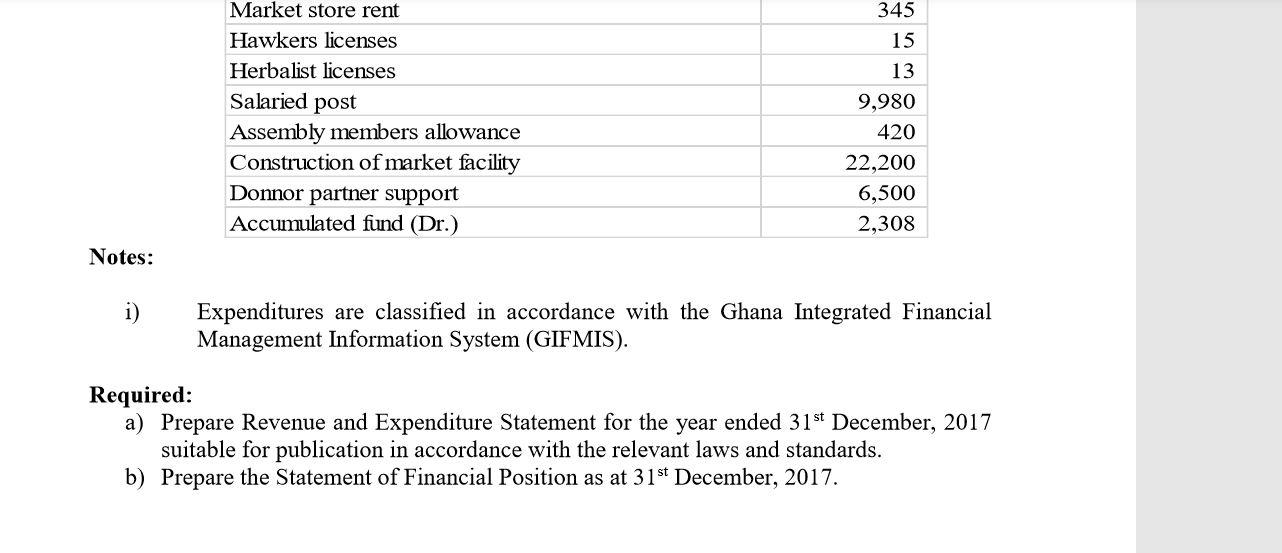

Al Hidalout Question 11- MMDAS The balances below were extracted from the books of Akon District Assembly for the year ended 31 December, 2017 GHC'000 Basic rate 7.000 Court fines 2.000 Slaughter house fees 400 Conferences and workshops 800 Salary subvention from central government 10,400 Utilities 1.000 Office consumable 611 Lorry park fees SOI Market toll 980 Purchase of office equipment 3,602 Fixed deposit 3,450 Advances and loans to staff 877 Loans from GCB 5.100 Share of district assembly common find 14,500 Accounts payable 860 Cash and bank 740 Repairs and maintenance 340 Consultancy 344 Allowances to staff Contract retention 250 TORIAL QUESTION OX file:///C:/Users/gladys bekley/Desktop/LECTURE%20NOTE/PSECTOR/TUTORIAL%20QUESTION%2001%20PUBLIC SECTORS 2020pdf 67 185 345 Royalties from sand wining Share of stood land revenue Market store rent Hawkers licenses Herbalist licenses Salaried post Assembly members allowance Construction of market facility Donnor partner support Accumulated fund (Dr.) 15 13 9,980 420 22.200 6,500 2,308 Notes: Expenditures are classified accordance with the Ghana Integrated Financial Management Information System (GIFMIS). Required: a) Prepare Revenue and Expenditure Statement for the year ended 31 December, 2017 suitable for publication in accordance with the relevant laws and standards. b) Prepare the Statement of Financial Position as at 31 December, 2017 22 Question 11- MMDAS The balances below were extracted from the books of Akon District Assembly for the year ended 31 December, 2017. GHC'000 Basic rate 7,000 Court fines 2,000 Slaughter house fees 400 Conferences and workshops 800 Salary subvention from central government 10,400 Utilities 1,000 Office consumable 611 Lorry park fees 501 Market toll 980 Purchase of office equipment 5,602 Fixed deposit 3,450 Advances and loans to staff 877 Loans from GCB 5,100 Share of district assembly common fund 14,500 Accounts payable 860 Cash and bank 740 Repairs and maintenance 340 Consultancy 344 Allowances to staff 444 Contract retention 250 Royalties from sand wining 67 Share of stood land revenue 185 Market store rent Hawkers licenses Herbalist licenses Salaried post Assembly members allowance Construction of market facility Donnor partner support Accumulated fund (Dr.) 345 15 13 9,980 420 22,200 6,500 2,308 Notes: i) Expenditures are classified in accordance with the Ghana Integrated Financial Management Information System (GIFMIS). Required: a) Prepare Revenue and Expenditure Statement for the year ended 31st December, 2017 suitable for publication in accordance with the relevant laws and standards. b) Prepare the Statement of Financial Position as at 31st December, 2017. Al Hidalout Question 11- MMDAS The balances below were extracted from the books of Akon District Assembly for the year ended 31 December, 2017 GHC'000 Basic rate 7.000 Court fines 2.000 Slaughter house fees 400 Conferences and workshops 800 Salary subvention from central government 10,400 Utilities 1.000 Office consumable 611 Lorry park fees SOI Market toll 980 Purchase of office equipment 3,602 Fixed deposit 3,450 Advances and loans to staff 877 Loans from GCB 5.100 Share of district assembly common find 14,500 Accounts payable 860 Cash and bank 740 Repairs and maintenance 340 Consultancy 344 Allowances to staff Contract retention 250 TORIAL QUESTION OX file:///C:/Users/gladys bekley/Desktop/LECTURE%20NOTE/PSECTOR/TUTORIAL%20QUESTION%2001%20PUBLIC SECTORS 2020pdf 67 185 345 Royalties from sand wining Share of stood land revenue Market store rent Hawkers licenses Herbalist licenses Salaried post Assembly members allowance Construction of market facility Donnor partner support Accumulated fund (Dr.) 15 13 9,980 420 22.200 6,500 2,308 Notes: Expenditures are classified accordance with the Ghana Integrated Financial Management Information System (GIFMIS). Required: a) Prepare Revenue and Expenditure Statement for the year ended 31 December, 2017 suitable for publication in accordance with the relevant laws and standards. b) Prepare the Statement of Financial Position as at 31 December, 2017 22 Question 11- MMDAS The balances below were extracted from the books of Akon District Assembly for the year ended 31 December, 2017. GHC'000 Basic rate 7,000 Court fines 2,000 Slaughter house fees 400 Conferences and workshops 800 Salary subvention from central government 10,400 Utilities 1,000 Office consumable 611 Lorry park fees 501 Market toll 980 Purchase of office equipment 5,602 Fixed deposit 3,450 Advances and loans to staff 877 Loans from GCB 5,100 Share of district assembly common fund 14,500 Accounts payable 860 Cash and bank 740 Repairs and maintenance 340 Consultancy 344 Allowances to staff 444 Contract retention 250 Royalties from sand wining 67 Share of stood land revenue 185 Market store rent Hawkers licenses Herbalist licenses Salaried post Assembly members allowance Construction of market facility Donnor partner support Accumulated fund (Dr.) 345 15 13 9,980 420 22,200 6,500 2,308 Notes: i) Expenditures are classified in accordance with the Ghana Integrated Financial Management Information System (GIFMIS). Required: a) Prepare Revenue and Expenditure Statement for the year ended 31st December, 2017 suitable for publication in accordance with the relevant laws and standards. b) Prepare the Statement of Financial Position as at 31st December, 2017