Answered step by step

Verified Expert Solution

Question

1 Approved Answer

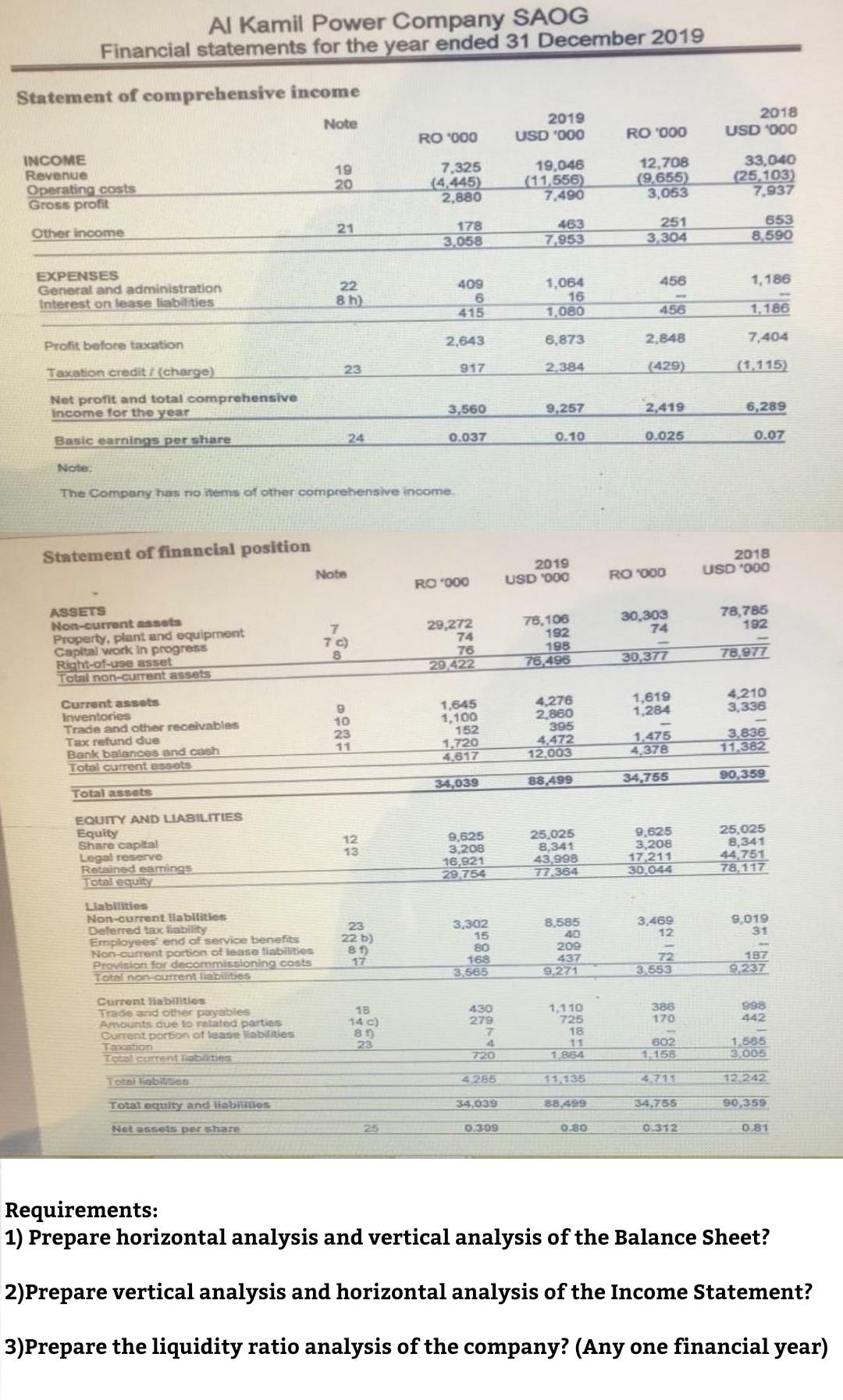

Al Kamil Power Company SAOG Financial statements for the year ended 31 December 2019 Statement of comprehensive income 2019 RO 000 Note 2018 USD 000

Al Kamil Power Company SAOG Financial statements for the year ended 31 December 2019 Statement of comprehensive income 2019 RO 000 Note 2018 USD 000 ROOOO USD 000 INCOME Revenue Operating costs Gross profit 19 20 7,325 4.445) 2,880 19.046 (11 556 7.490 12,708 (9.655) 3,053 33,040 (25,103) 7,937 Other income 21 178 3.058 463 7.953 251 3.304 653 8.590 456 1,186 EXPENSES General and administration Interest on lease liabilities 22 8h) 409 6 415 1,064 16 1.080 456 1,186 2.643 6.873 2.848 Profit before taxation 7,404 23 917 2.384 (429) (1.115) Taxation credit ? (charge) Net profit and total comprehensive Income for the year 3,560 9,257 2,419 6,289 Basic earnings per share 24 0.037 0.10 0.025 0.07 Note The Company has no items of other comprehensive income Statement of financial position Nota 2019 USD '000 2018 USD "000 R000 RO000 30,303 74 78,785 192 7 ASSETS Non-current assets Property, plant and equipment Capital work in progress Right-of-use esset Total non-current assets 70 29,272 74 76 29,422 78,105 192 198 76.496 30.377 78,97 1,619 1.284 4,210 3,336 Current assots Inventories Trade and other receivables Tax refund due Bank balances and cash Total current assets 10 23 11 1,645 1,100 152 1.720 4.276 2.860 395 4.472 12.003 1.475 4,378 3.836 11.382 4.617 34,039 88,499 34.755 90,359 Total assets EQUITY AND LIABILITIES Equity Share capital Legal reserve Retained earings Total equity 12 13 9.625 3.208 16,921 29.754 25,025 8.341 43,998 77.364 9.625 3,208 17.211 30.044 25,025 8.341 44.751 78.117 23 8.585 3.469 12 9,019 31 Liabilities Non-current liabilities Deferred tax liability Employees' end of service benefits Non-current portion of lease fiabilities Provision for decommissioning costs Total non-current liabites 225) 81) 3.302 15 BO 168 3.565 17 209 437 9.2711 72 3.553 187 9.237 388 170 Current liabilities Trade and other payables Amounts due to related parties Current portion of lease liabilities Taction Tous comentaries 998 442 18 14 C) 85 23 1.110 725 18 430 279 7 4 720 1.585 802 1.158 1.854 3 005 Total lobis 4285 4.715 12 242 Total equity and Tables 34,039 88.499 34,755 90,359 Net assets per share 25 0.309 0.80 0.312 0.81 Requirements: 1) Prepare horizontal analysis and vertical analysis of the Balance Sheet? 2)Prepare vertical analysis and horizontal analysis of the Income Statement? 3)Prepare the liquidity ratio analysis of the company? (Any one financial year)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started