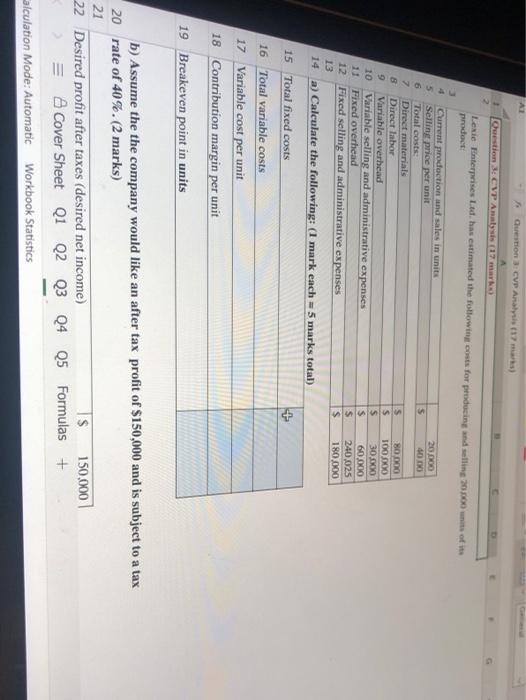

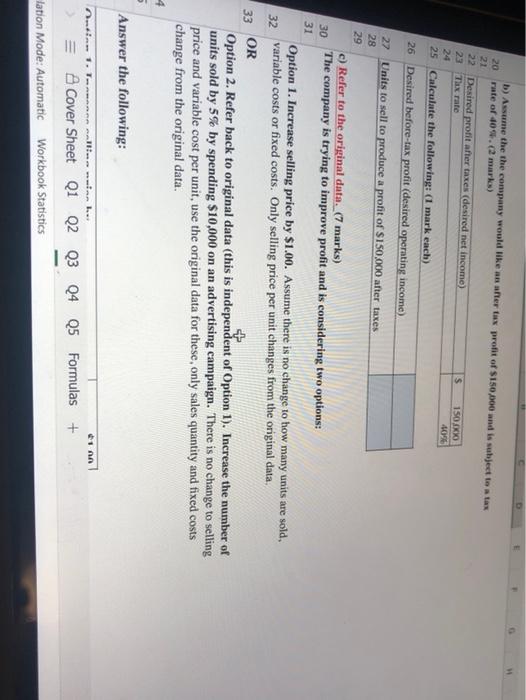

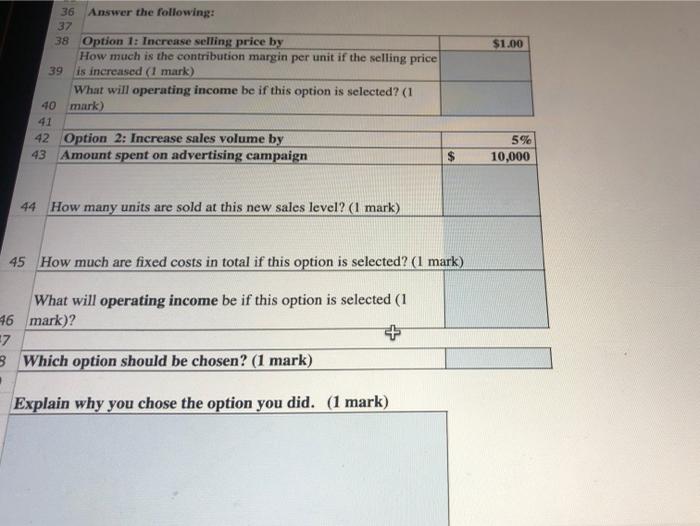

AL Question : CVP Analysis (17) Question : CVP Analysis (17) 2 Lexie Enterprises Ltd. has estimated the following costs for producing and in 2000 product S 20 000 1000 4 Current production and sales in units Selling price per unit 6 Total costs 7 Direct materials 8 Direct labor 9 Variable overhead 10 Variable selling and administrative expenses 11 Fixed overhead 12 Fixed selling and administrative expenses 13 14 a) Calculate the following: (I mark each = 5 marks total) S $ $ $ $ $ 80.000 100.000 30.000 60,000 240,025 180.000 15 Total fixed costs + 16 Total variable costs 17 Variable cost per unit 18 Contribution margin per unit 19 Breakeven point in units b) Assume the the company would like an after tax profit of $150,000 and is subject to a tax 20 rate of 40%. (2 marks) 21 22 Desired profit after taxes (desired net income) IS 150.000 Cover Sheet Q1 Q2 Q3 04 05 Formulas + alculation Mode: Automatic Workbook Statistics b) Assume the the company would like an after tax profit of $150,000 and is subject to tax 20 rate of 405. (2 marks) 21 22 Desired profit after taxes (desired net income) s 150.00 23 Thex rate 4096 24 25 Calculate the following: (1 mark each) 26 Desired before-tax profit (desired operating income) 27 Units to sell to produce a profit of $150,000 after taxes 28 29 c) Refer to the original data. (7 marks) 30 The company is trying to improve profit and is considering two options: 31 Option 1. Increase selling price by $1.00. Assume there is no change to how many units are sold, 32 variable costs or fixed costs. Only selling price per unit changes from the original data. 33 OR Option 2. Refer back to original data (this is independent of Option 1). Increase the number of units sold by 5% by spending $10,000 on an advertising campaign. There is no change to selling price and variable cost per unit, use the original data for these, only sales quantity and fixed costs change from the original data. 4 5 Answer the following: II. H Minh l 1 = Cover Sheet Q1 Q2 Q3 Q4 Q5 Formulas + lation Mode: Automatic Workbook Statistics $1.00 36 Answer the following: 37 38 Option 1: Increase selling price by How much is the contribution margin per unit if the selling price 39 is increased 1 mark) What will operating income be if this option is selected? (1 40 mark) 41 42 Option 2: Increase sales volume by 43 Amount spent on advertising campaign 5% 10,000 44 How many units are sold at this new sales level? (1 mark) 45 How much are fixed costs in total if this option is selected? (1 mark) What will operating income be if this option is selected (1 46 mark)? 7 3 Which option should be chosen? (1 mark) Explain why you chose the option you did. (1 mark)