Answered step by step

Verified Expert Solution

Question

1 Approved Answer

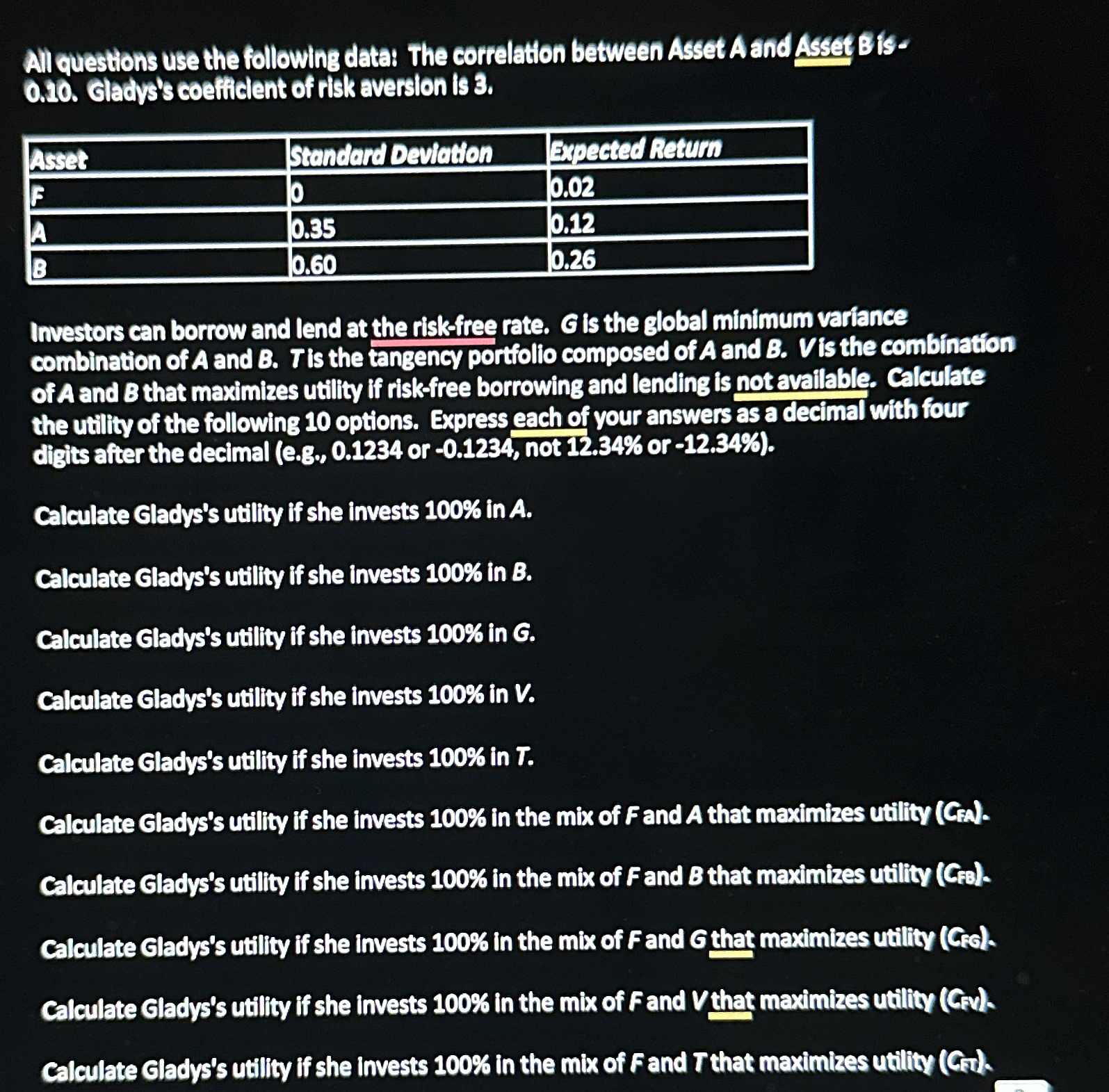

Al questions use the following data: The correlation between Asset A and Asset B is - 0 . 1 0 . Glady's coefitilent of risk

Al questions use the following data: The correlation between Asset A and Asset B is

Glady's coefitilent of risk aversion is

Investors can borrow and lend at the riskfree rate. is the global minimum variance

combination of A and Tis the tangency portfolio composed of A and Vis the combination

of A and that maximizes utility if risksree borrowing and lending is not available. Calculate

the utility of the following options. Express each of your answers as a decimal with four

digits after the decimal eg or not or

Calculate Gladys's utility if she invests in A

Calculate Gladys's utility if she invests in B

Calculate Gladys's utility if she invests in

Calculate Gladys's utility if she invests in

Calculate Gladys's utility if she invests in

Calculate Gladys's utility if she invests in the mix of and A that maximizes utility

Calculate Gladys's utility if she invests in the mix of and that maximizes utility Grs

Calculate Cladys's utility if she invests in the mix of and that maximizes utility Grs

Calculate Gladys's utility if she invests in the mix of F and V that maximizes utility Grv

Calculate Glady's utility if she invests in the mix of and that maximizes utility Gan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started