Answered step by step

Verified Expert Solution

Question

1 Approved Answer

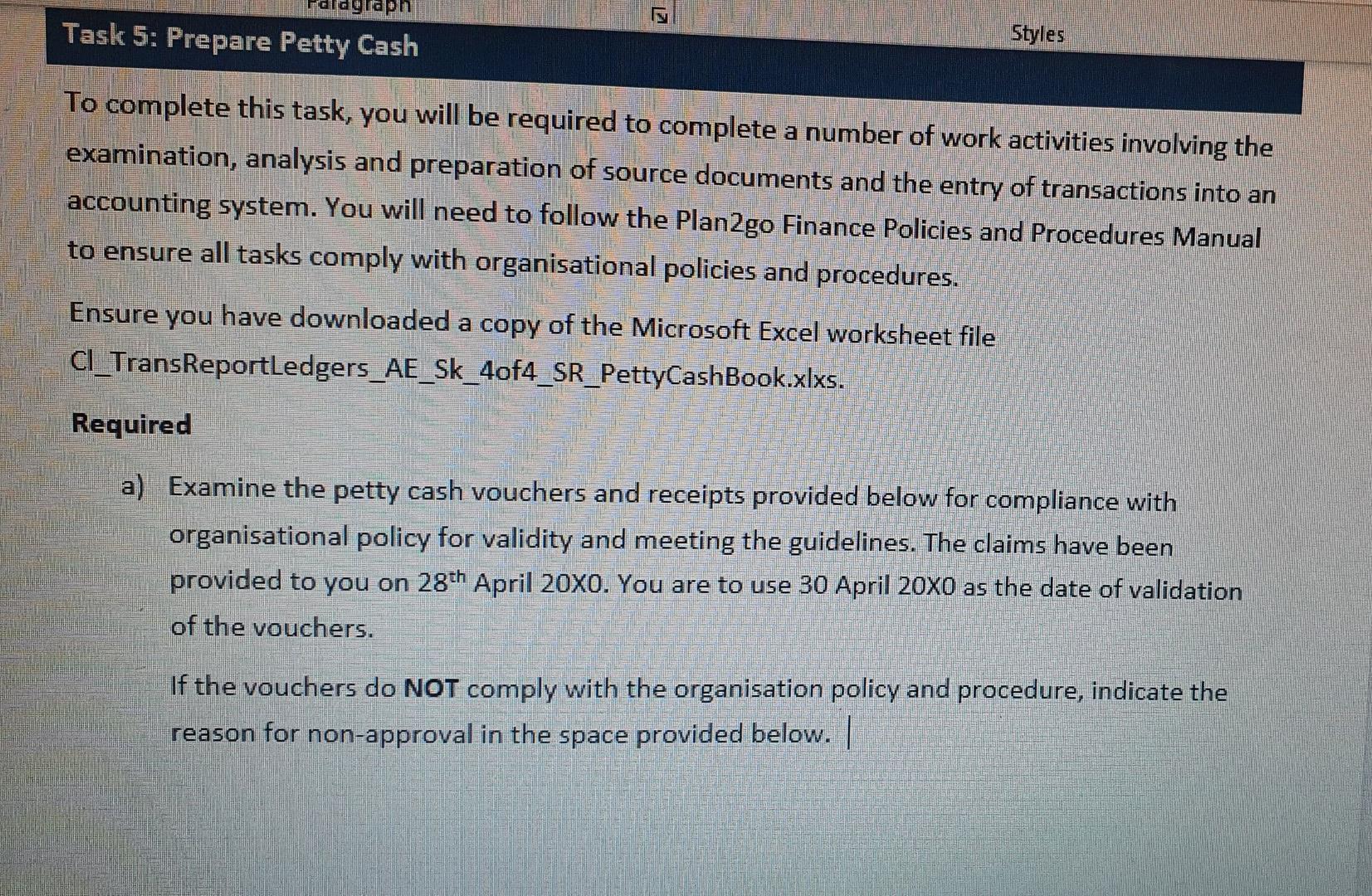

alaglaph Task 5: Prepare Petty Cash Styles To complete this task, you will be required to complete a number of work activities involving the examination,

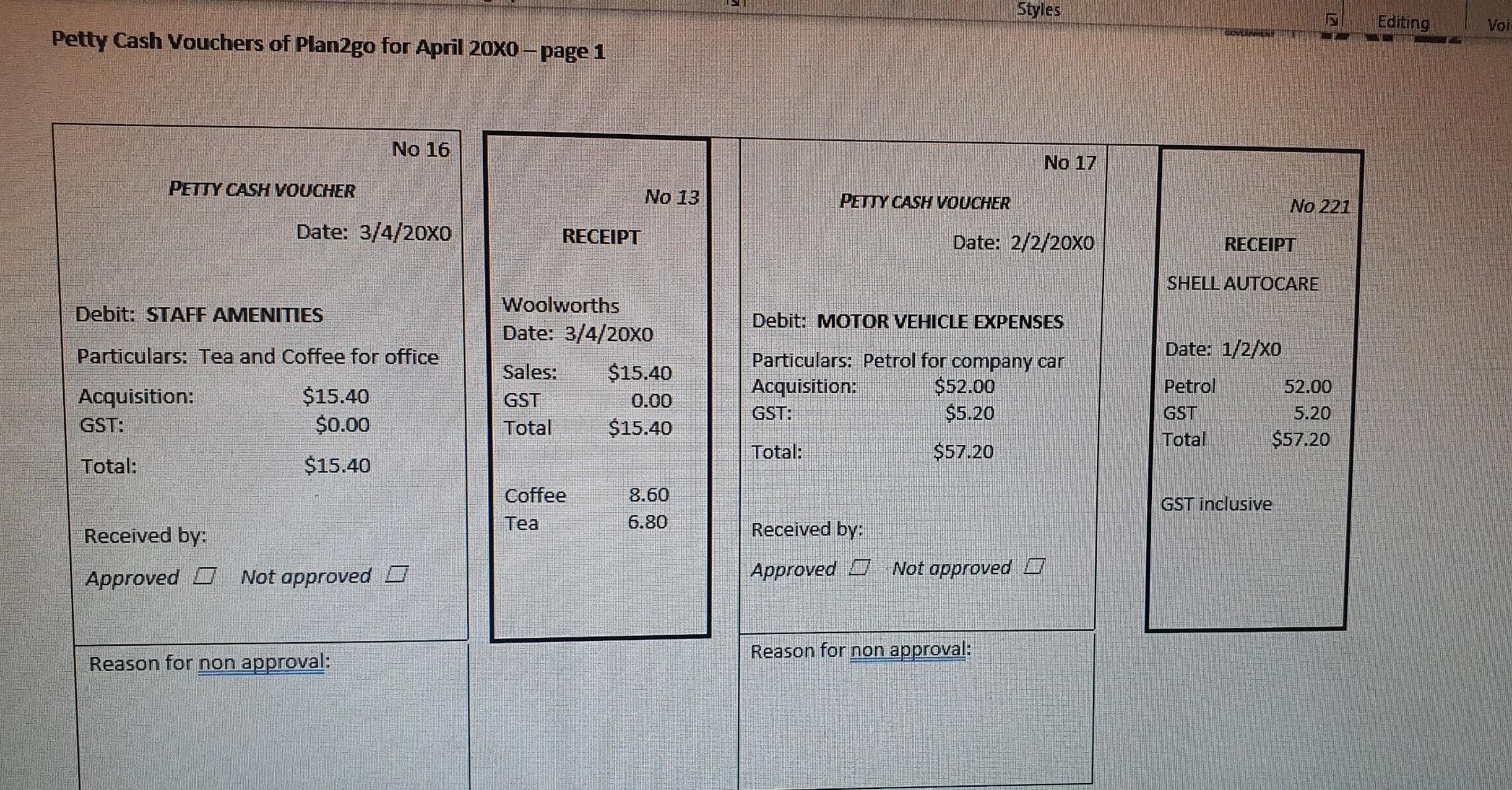

alaglaph Task 5: Prepare Petty Cash Styles To complete this task, you will be required to complete a number of work activities involving the examination, analysis and preparation of source documents and the entry of transactions into an accounting system. You will need to follow the Plan2go Finance Policies and Procedures Manual to ensure all tasks comply with organisational policies and procedures. Ensure you have downloaded a copy of the Microsoft Excel worksheet file cl_TransReportLedgers_AE_Sk_40f4_SR_PettyCashBook.xlxs. Required a) Examine the petty cash vouchers and receipts provided below for compliance with organisational policy for validity and meeting the guidelines. The claims have been provided to you on 28th April 20x0. You are to use 30 April 20X0 as the date of validation of the vouchers. If the vouchers do NOT comply with the organisation policy and procedure, indicate the reason for non-approval in the space provided below. | Styles Editing Voi COMING Petty Cash Vouchers of Plan2go for April 20x0 - page 1 No 16 No 17 PETTY CASH VOUCHER No 13 PETY CASH VOUCHER No 221 Date: 3/4/20x0 RECEIPT Date: 2/2/20x0 RECEIPT SHELL AUTOCARE Debit: STAFF AMENITIES Debit: MOTOR VEHICLE EXPENSES Particulars: Tea and Coffee for office Date: 1/2/x0 Woolworths Date: 3/4/20x0 Sales: $15.40 GST 0.00 Total $15.40 Particulars: Petrol for company car Acquisition: $52.00 GST: $5.20 Acquisition: GST: $15.40 $0.00 Petrol GST Total 52.00 5.20 $57.20 Total: $57.20 Total: $15.40 Coffee Tea 8.60 6.80 GST inclusive Received by: Received by: Approved Not approved 0 Approved 0 Not approved 0 Reason for non approval: Reason for non approval

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started