Alan is considering investing in Word.Com Bhd. He is fully aware that the firm would cease its operation in the next five years. This

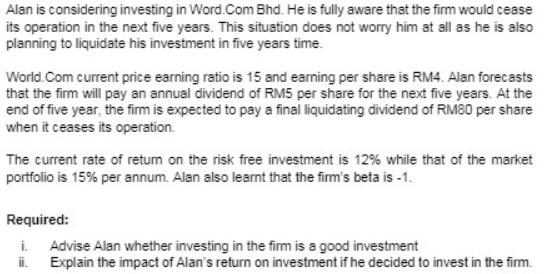

Alan is considering investing in Word.Com Bhd. He is fully aware that the firm would cease its operation in the next five years. This situation does not worry him at all as he is also planning to liquidate his investment in five years time. World.Com current price earning ratio is 15 and earning per share is RM4. Alan forecasts that the firm will pay an annual dividend of RM5 per share for the next five years. At the end of five year, the firm is expected to pay a final liquidating dividend of RM80 per share when it ceases its operation. The current rate of return on the risk free investment is 12% while that of the market portfolio is 15% per annum. Alan also learnt that the firm's beta is -1. Required: i. ii. Advise Alan whether investing in the firm is a good investment Explain the impact of Alan's return on investment if he decided to invest in the firm.

Step by Step Solution

3.25 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION i Advising Alan whether investing in WordCom Bhd is a good investment To advise Alan whether investing in WordCom Bhd is a good investment we need to evaluate the investment based on its pote...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started