Answered step by step

Verified Expert Solution

Question

1 Approved Answer

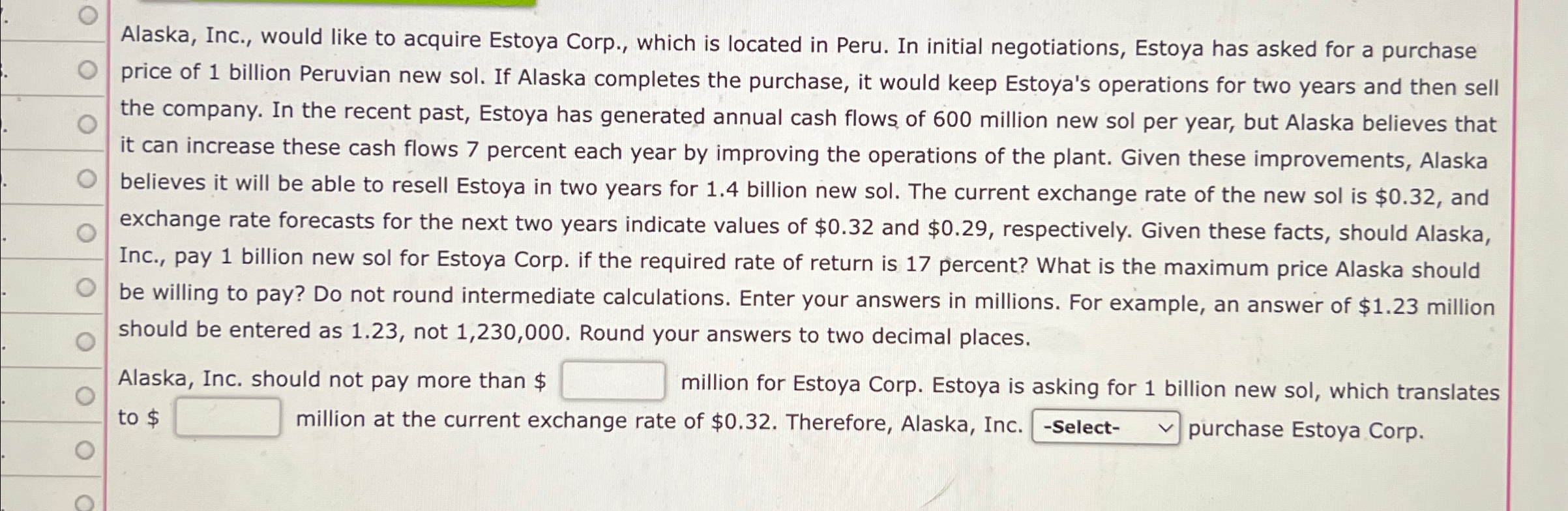

Alaska, Inc., would like to acquire Estoya Corp., which is located in Peru. In initial negotiations, Estoya has asked for a purchase price of 1

Alaska, Inc., would like to acquire Estoya Corp., which is located in Peru. In initial negotiations, Estoya has asked for a purchase price of billion Peruvian new sol. If Alaska completes the purchase, it would keep Estoya's operations for two years and then sell the company. In the recent past, Estoya has generated annual cash flows of million new sol per year, but Alaska believes that it can increase these cash flows percent each year by improving the operations of the plant. Given these improvements, Alaska believes it will be able to resell Estoya in two years for billion new sol. The current exchange rate of the new sol is $ and exchange rate forecasts for the next two years indicate values of $ and $ respectively. Given these facts, should Alaska, Inc., pay billion new sol for Estoya Corp. if the required rate of return is percent? What is the maximum price Alaska should be willing to pay? Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $ million should be entered as not Round your answers to two decimal places.

Alaska, Inc. should not pay more than $ million for Estoya Corp. Estoya is asking for billion new sol, which translates to $ million at the current exchange rate of $ Therefore, Alaska, Inc. purchase Estoya Corp.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started