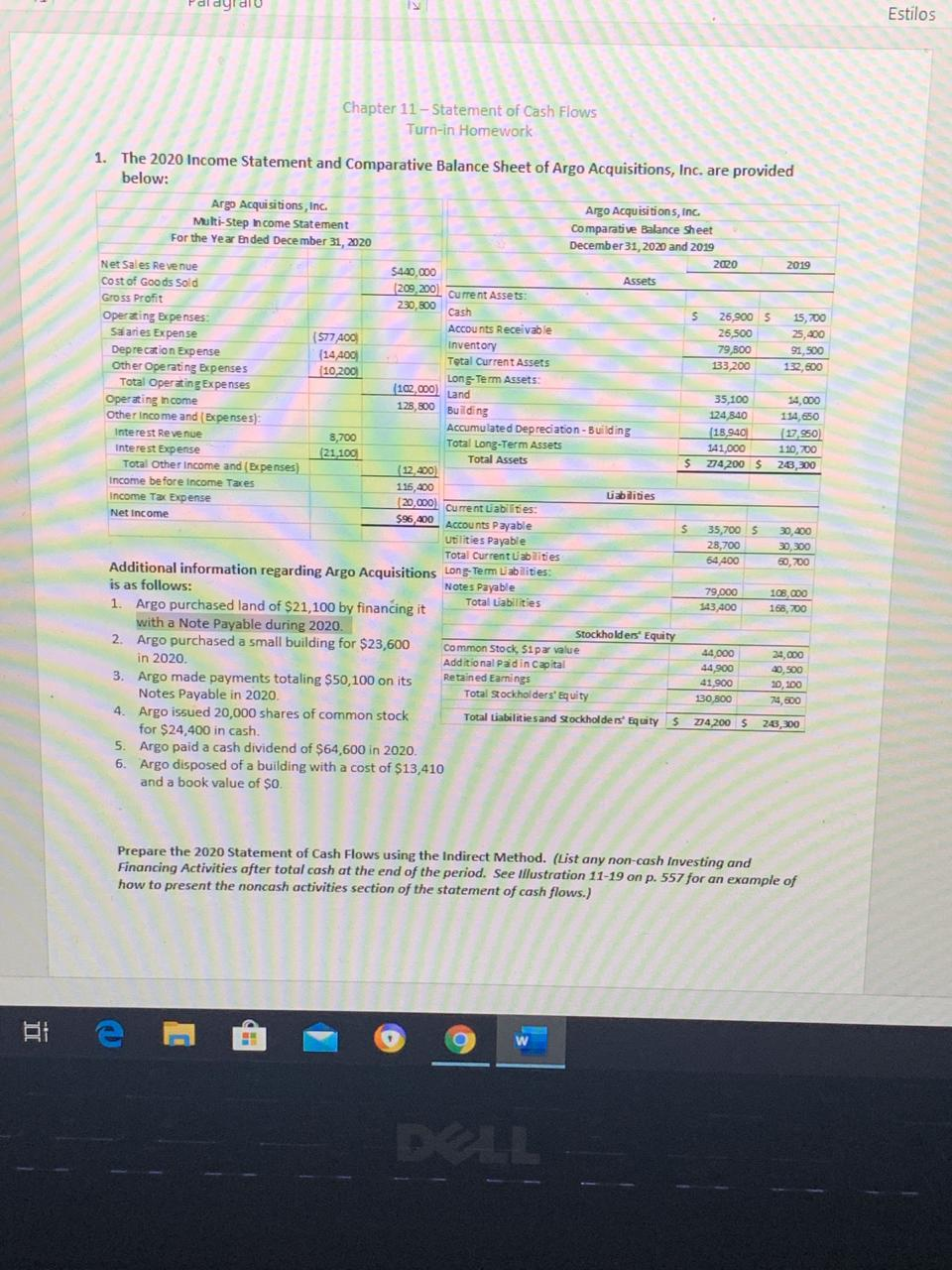

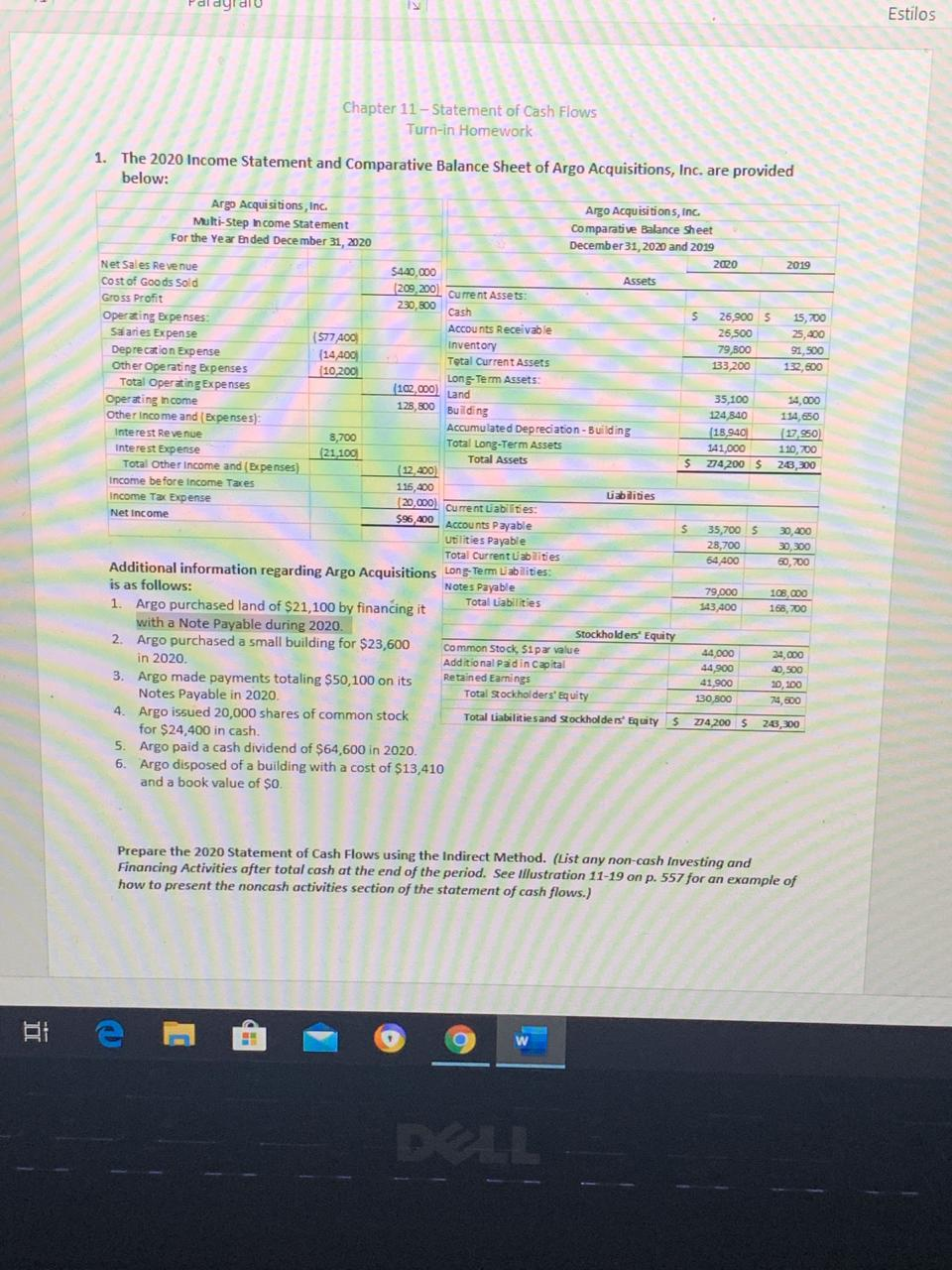

alaydi Estilos Chapter 11 - Statement of Cash Flows Turn-in Homework (102,000 Land 1. The 2020 Income Statement and Comparative Balance Sheet of Argo Acquisitions, Inc. are provided below: Argo Acquisitions, Inc. Argo Acquisitions, Inc. Multi-Step Income Statement Comparative Balance Sheet For the Year Ended December 31, 2020 December 31, 2020 and 2019 2020 2019 Net Sales Revenue $440,000 Assets cost of Goods Sold 209,200 Current Assets: Gross Profit 230,800 Cash 26,900 5 15,700 Operating Bxpenses Accounts Receivable 25,500 25,400 Saanes Expense (577 400 Inventory 79,800 91,500 Deprecation Expense (14,400 Total Current Assets 33,200 132,600 Other Operating Expenses (10,200 Long Term Assets Total Operating Expenses 35,100 $4,000 Operating income 125,800 Building 124 840 114,650 Other Income and expenses) Accumulated Depreciation - Building 18,940 2 7,950) Interest Revenue 8,700 Total Long-Term Assets 141,000 110,700 Interest Expense 21.100 Total Assets $ 274200 $ 28,300 Total Other Income and (Bxpenses) 12,400) Income before Income Taces 116,400 Labdities Income Tax Expense (20.000). Current abilities: Net Income $96,400 Accounts Payable 35,700 5 Utilities Payable 28,700 30.000 Total Current abilities 54 400 50,700 Additional information regarding Argo Acquisitions 79.000 Notes Payable is as follows: 108,000 Total abilitie 143,400 168,700 1. Argo purchased land of $21,100 by financing it with a Note Payable during 2020. Stockholders' Equity 2. Argo purchased a small building for $23,600 Common Stock Sipar value 44,000 24,000 in 2020. Additional Padin Capital 44,900 40, 500 Retained Earnings 41,900 3. Argo made payments totaling $50,100 on its 30,100 Notes Payable in 2020. Total Stockholders' Equity 130.800 74,600 4. Argo issued 20,000 shares of common stock Total Liabilities and Stockholders' Equity 5 274 2005 28,300 for $24,400 in cash. 5. Argo paid a cash dividend of $64,600 in 2020. 6. Argo disposed of a building with a cost of $13,410 and a book value of $0. 30.000 Prepare the 2020 Statement of Cash Flows using the Indirect Method. (List any non-cash Investing and Financing Activities after total cash at the end of the period. See Illustration 11-19 on p. 557 for an example of how to present the noncash activities section of the statement of cash flows.) i e