Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Albatross Airlines is evaluating the acquisition of new airplane. Its price is $40,000 and it will be in CCA class 9 (25%). Purchase of the

Albatross Airlines is evaluating the acquisition of new airplane. Its price is $40,000 and it will be in CCA class 9 (25%). Purchase of the new plane would involve the purchase of $2,000 in part for $2,000. Before tax revenues will increase by $20,000 per year with a matching increase in expenses for $5,000 per year. The plan will be used by 3 years and then be sold for $25,000. The firm's tax rate is 40% and its cost of capital is 14%. Find NPV

The parts are purchase at the start (PV) of the project; then sold for cash at the end if the project (FV)

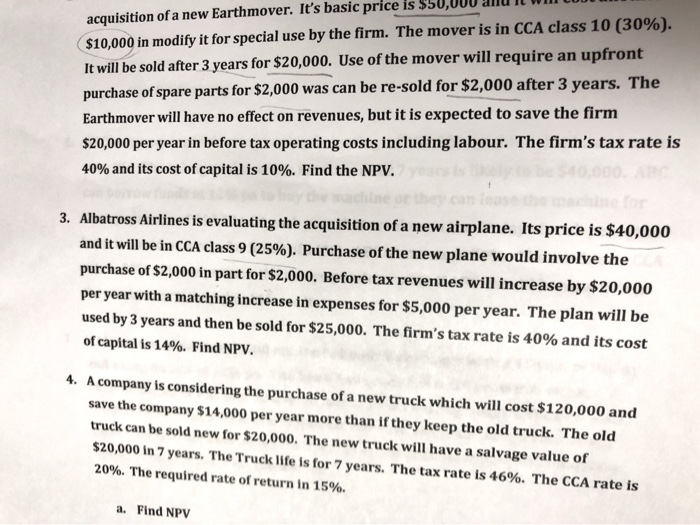

acquisition of a new Earthmover. It's basic price is $50,000 DNU IL WII $10,000 in modify it for special use by the firm. The mover is in CCA class 10 (30%). It will be sold after 3 years for $20,000. Use of the mover will require an upfront purchase of spare parts for $2,000 was can be re-sold for $2,000 after 3 years. The Earthmover will have no effect on revenues, but it is expected to save the firm $20,000 per year in before tax operating costs including labour. The firm's tax rate is 40% and its cost of capital is 10%. Find the NPV. 3. Albatross Airlines is evaluating the acquisition of a new airplane. Its price is $40,000 and it will be in CCA class 9 (25%). Purchase of the new plane would involve the purchase of $2,000 in part for $2,000. Before tax revenues will increase by $20,000 per year with a matching increase in expenses for $5,000 per year. The plan will be used by 3 years and then be sold for $25,000. The firm's tax rate is 40% and its cost of capital is 14%. Find NPV. 4. A company is considering the purchase of a new truck which will cost $120,000 and save the company $14,000 per year more than if they keep the old truck. The old truck can be sold new for $20,000. The new truck will have a salvage value of $20,000 in 7 years. The Truck life is for 7 years. The tax rate is 46%. The CCA rate is 20%. The required rate of return in 15%. a. Find NPV Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started