Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors live at 12340 Cocoshell Road, Coral Gables, FL

Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors live at 12340 Cocoshell Road, Coral Gables, FL 33134. Captain Gaytor is a charter fishing boat captain but took 6 months off from his job in 2018 to train and study for his Masters Captain’s License.

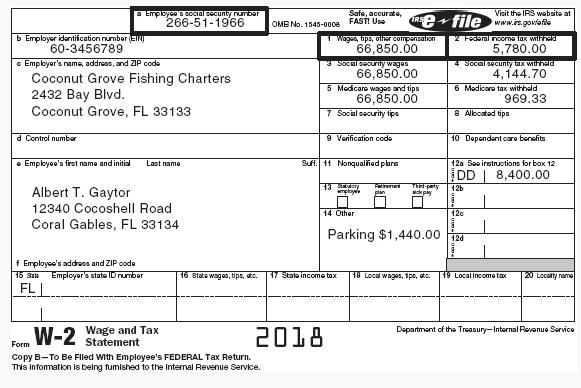

In 2018, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc.:

| Name | Social Security Number | Date of Birth |

| Albert T. Gaytor | 266-51-1966 | 09/22/1969 |

| Allison A. Gaytor | 266-34-1967 | 07/01/1970 |

| Crocker Gaytor | 261-55-1212 | 12/21/2001 |

The Gaytors have a 17-year-old son, Crocker, who is a full-time freshman at Brickell State University.

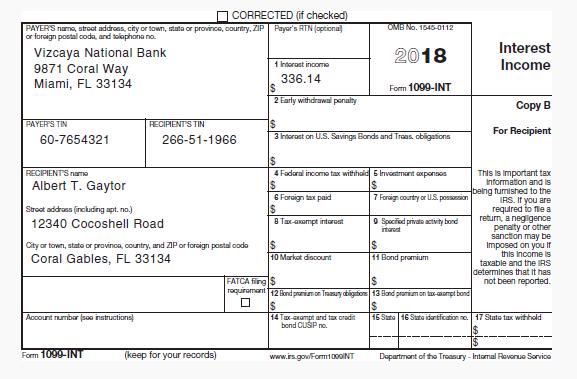

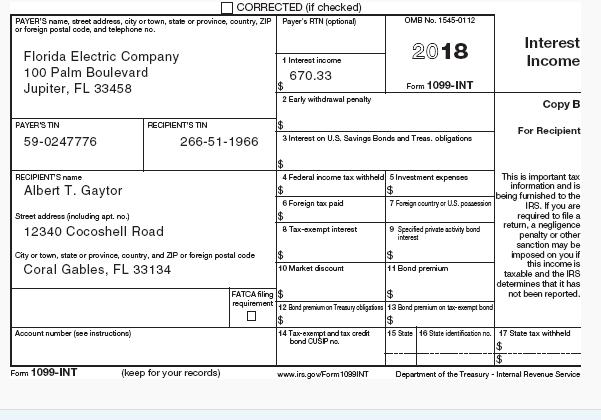

Albert and Allison have a savings account and received the following Form 1099-INT for 2018:

The Gaytors also received interest of $745 from bonds issued by the Miami-Dade County Airport Authority (Form 1099 not shown).

In February, Allison received $50,000 in life insurance proceeds from the death of her friend, Sharon.

In July, Albert’s Uncle Ivan died and left him real estate (undeveloped land) worth $72,000.

Five years ago, Albert and Allison divorced. Albert married Iris, but the marriage did not work out and they divorced a year later. Under the 2014 divorce decree, Albert pays Iris $11,500 per year in alimony. All payments were on time in 2018 and Iris’ Social Security number is 667-34-9224. Three years ago, Albert and Allison were remarried.

Coconut Fishing Charters, Inc. pays Albert’s captain’s license fees and membership dues to the Charter Fisherman’s Association. During 2018, Coconut Fishing paid $1,300 for such dues and fees for Albert.

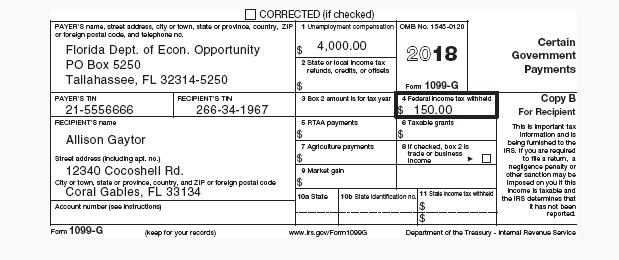

Allison was laid off from her job on January 2, 2018. She received a Form 1099-G for unemployment benefits:

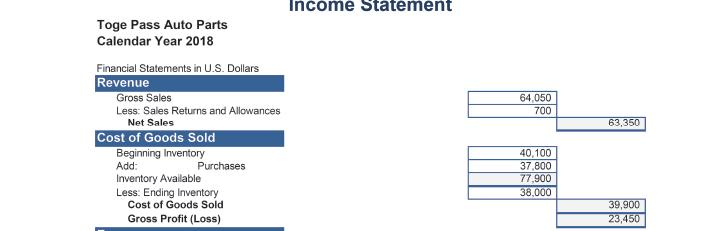

On September 1, Allison opened a retail store that specializes in sports car accessories. The name of the store is “Toge Pass.” The store is located at 617 Crandon Boulevard, Key Biscayne, FL 33149. The store uses the cash method of accounting for everything except inventory which is kept on an accrual basis. The store’s EIN is 98-7321654. Allison purchased inventory in August and thus started her business on September 1 with $40,100 of inventory. The Toge Pass accountant provided the following financial information:

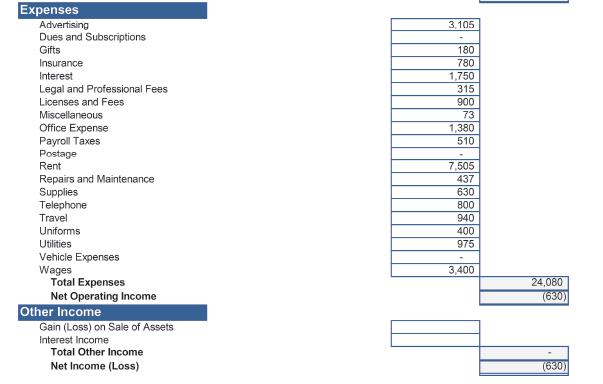

A review of the expense account detail reveals the following:

The travel expense includes the costs Allison incurred to attend a seminar on sports car accessories. She spent $300 on airfare, $400 on lodging, $90 on a rental car, and $150 on meals. Allison has proper receipts for these amounts.

The gift account details show that Allison gave a $30 gift to each of her six best suppliers.

The supplies expense account detail reflects the purchase of 250 pens with the “Toge Pass” logo inscribed on each pen. Allison gave the pens away to suppliers, customers, and other business contacts before the end of the year.

Uniforms expense reflects the cost to purchase polo shirts Allison provided for each employee (but not herself). The shirts have the Toge Pass logo printed on the front and back and are the required apparel while working but otherwise are just like any other polo shirts.

The license and fee account includes a $900 fine Toge Pass paid to the state of Washington for environmental damage resulting from an oil spill.

Allison drove her 2010 Ford Explorer 1,701 miles for business related to Toge Pass. The Explorer was driven a total of 11,450 miles for the year. Included in the total 11,450 miles is 5,000 miles spent commuting to the store. Allison has the required substantiation for this business mileage. She uses the standard mileage method.

In late 2018, Albert started to mount and stuff some of his trophy fish to display in his “man cave” at the Gaytor’s home. Some of his friends liked Albert’s taxidermy work and asked him to prepare a couple of trophy fish for them as well. Although he doubts he will ever sell any more stuffed fish, he was paid $150 and had no expenses related to this activity in 2018.

The Gaytors own a rental beach house in Hawaii. The beach house was rented for the full year during 2018 and was not used by the Gaytors during the year. The Gaytors were active participants in the management of the rental house. Pertinent information about the rental house is as follows:

| Address: 1237 Pineapple St., Lihue, HI 96766 | |

| Gross rental income | $20,000 |

| Mortgage interest | 7,850 |

| Real estate taxes | 2,250 |

| Utilities | 2,100 |

| Maintenance | 2,400 |

The house is fully depreciated so there is no depreciation expense.

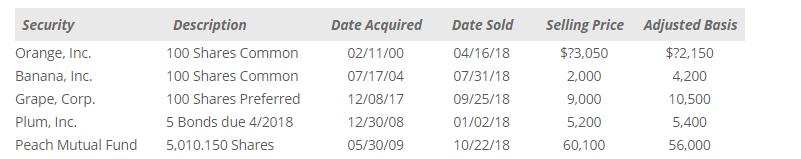

Albert sold the following securities during the year and received a Form 1099-B that showed the following information:

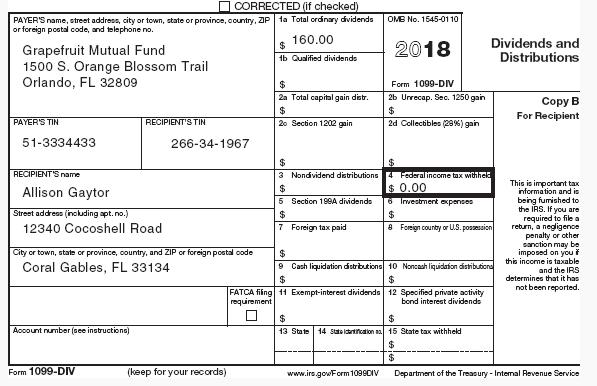

The selling price given is net of sales commissions and the basis was reported to the IRS for all sales. In addition to the above amounts, the Grapefruit mutual fund distributed a long-term capital gain of $450 on December 30, 2018.

On January 12, 2018, Albert and Allison sold their personal residence for $715,150 and purchased a new house for $725,000. This was their personal residence before and after the divorce (they have lived in it together for three years since remarrying). The old house cost $120,000 back in January of 2006 and they added on a new bedroom and bathroom a few years ago for a cost of $20,000. They also built a pool for a cost of $60,000. They moved into the new house on January 19, 2018.

Complete the Gaynor’s 2018 tax return, including the following:

Form 1040

a Employco'S SOCial secunty rumbar 266-51-1966 Safe, accurate, FASTI Use Vitit the IR wabsite at RSP+ file www.s.goviafle OMB No. 1545-000e b Employer idontifcation number (EIN 60-3456789 wagea, bps, olher compansaen 66,850.00 2 Federal ncome lax wilIR 5,780.00 o Employer's nama, addreas, and ZP code Coconut Grove Fishing Charters 2432 Bay Blvd. Coconut Grove, FL 33133 35O urily wages 66,850.00 4 SOcial socunty lax wihad 4,144.70 6 Modicare tax withhald 969.33 5 Medicare wages and tips 66,850.00 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dopendent care benefits Employoe's firet name andinitial Suff. 11 Nonqualied plara 12a Soo instruotions for box 12 Last name DD | 8,400.00 Thed-party Albert T. Gaytor 126 mpkye plan 12340 Cocoshell Road 14 Other 120 Coral Gables, FL 33134 Parking $1,440.00 i2a f Employee's addross and ZIP code 15 Sak Employer's state ID number 16 State wagas, tips, atc. 17 State income tax 18 Local wages, Ips, atc. 19 LocalIncome tax 20 Localty name FL| W-2 Wage and Tax Statement Department of the Treasury-Internal Pevenue Service 2018 Form Copy B-To Be Fled With Employee's FEDERAL Tax Return. This Information is being fumished to the Internal Revenue Service.

Step by Step Solution

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To complete the Gaytors 2018 tax return I will guide you through the main components of the Form 1040 based on the provided information This will incl...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started