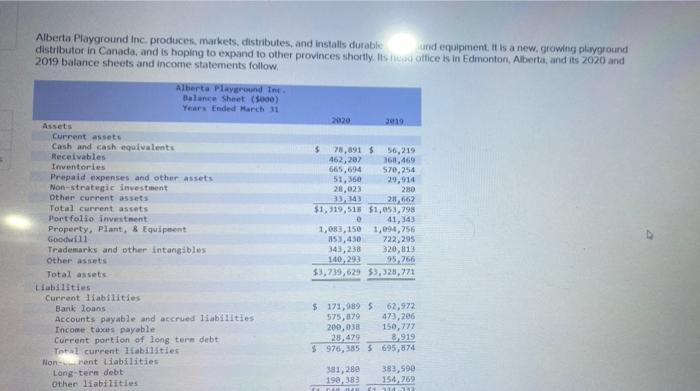

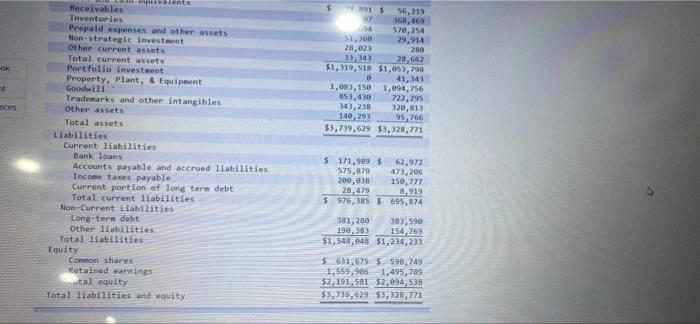

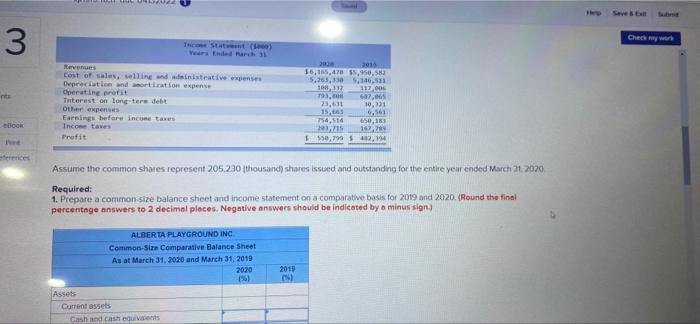

Alberto Playground Inc. produces, markets, distributes, and installs durable und equipment. It is a new growing playground distributor in Canada, and is hoping to expand to other provinces shortly. Its office is in Edmonton, Alberta, and its 2020 and 2019 balance sheets and income statements follow, Alberta Playground The Balance Sheet (5000) Years Ended March 1 2019 Assets Current assets Cash and cash equivalents Receivables Inventories Prepaid expenses and other assets Non-strategic investment Other current assets Total current assets Portfolio investment Property, plant, & Equipment Goodwill Trademarks and other intangibles Other assets Total assets Liabilities Current liabilities Bank loans Accounts payable and accrued liabilities Income taxes payable Current portion of long ters debt Total current liabilities Non rent liabilities Long-tern debt Other liabilities $ 78,0915 56,219 462,20% 3611,469 665,694 570,254 51,360 29,914 28,023 230 33, 143 28,662 $1,319,513 $1,053,798 0 41,43 1,083,150 1,094,756 53,430 722295 343,238 320,813 140,292 95.266 $3,739,629 53,328,771 $ 171,9895 62,972 575, 079 423,286 200,033 150,777 28,479 8.919 $976,3855695,874 381,280 190,38 383,590 154,269 f ook 15 56,219 3611,469 570,254 51.360 29,914 28,023 280 33,30 20,662 $1,319,518 $1,053,798 41, 43 1,083,150 1,094,756 353,430 722,295 343,238 320,813 140, 291 95, 266 $3,739,629 13,328,771 nces Avalents Heceivables Inventories Prepaid expenses and other assets Non-strategic investment Other current assets Total current assets Portfolio investment Property. Plant, & Equipment Goodwill Trademarks and other intangibles Other assets Total assets Liabilities Current liabilities Bank loans Accounts payable and accrued liablities Income taxes payable Current portion of long term debt Total current liabilities Non-Current Liabilities Long-ter debt Other liabilities Total liabilities Equity Common shares Retained warnings tal equity Total liabilities and wity $ 171,989 $ 62,972 575,879 473,206 200,038 150,777 28,479 3.919 $ 976,385 5695,874 381,280 383,590 190, 383 156,269 51,548,8 51,236,233 $631,625 $598,749 1,559,906 1.495,789 52, 191,580 52.094,538 53,739,629 53,328,771 RA 3 Check my w Start Revenues Cost of sales vind dinistrative expenses Depreciation and mortization expense Operating profit Tinterest on lont tere detit Other expenses Earnings before income taxes Income taves Profit 16,115,478,950.580 5.26, 120.533 108,113 113.00 793, 6a7,00 23,611 10,11 15,3 4,561 75,514 IS 167,789 $50,7995482,194 BOOK 650, Assume the common shares represent 205.220 thousand shares issued and outstanding for the entire year ended March 21, 2020 Required: 1. Prepare a common size balance sheet and income statement on a comparative basis for 2019 and 2020. (Round the final percentage answers to 2 decimal places. Negative answers should be indicated by a minus sign ALBERTA PLAYGROUND INC Common Size Comparative Balance Sheet As at March 31, 2020 and March 31, 2019 2020 2010 Assets Current assets Cash and cash equivalent 3 Assume the common shares represent 205,230 thousand shares issued an outstanding for the entire year ended Match 31, 2020 Required: 1. Prepare a common size balance sheet and income statement on a comparative basis for 2019 and 2020. (Round the final percentage answers to 2 decimal places. Negative answers should be indicated by a minus sign) 10 points Book ALBERTA PLAYGROUND INC Common-Sure Comparative Balance Sheet As at March 31, 2020 and March 31, 2015 2020 Bences 2019 (761 Assets Current assets Cash and cash equivalents Receivables Invetones Prepaid expenses and other assets Non-strategic investment Other current assets Total current assets Portfolio investment Poplant and equipment Goodwill Trademarks and other intangibles CH 3 10 point Po Prud expomes and others Non-strategic investment Other costs Tot currents Porto investment Property, plant and equipment Good Trademarks and other angles Other assets Total assets Lies Current les Bank loans Accounts payable and accredibilities mes payable Current portion of long to detit Total current Long term be Others Toallabates Equity Common shar domings Total Chi 3 current lang Others Toutes Equy Common has 30 To Towandel ALBERTA PLAYGROUND INC Common.Size Comparative Income Statement Year ended March 31, 2020 and March 2010 2020 2010 2 Revens Cost of us and seting general and admitive condamnation pense Operating pri Interest on loomdott Omere 3 10 Romas Costanding and writive Depreciation and mortation expert Opening Inson og om Other expenses Prebere comes Income taxes Pro 2. Calculate the 2020 ratios for Alberta Playground Inc Including a comparison against the industry averages. (Round the final answers to 2 decimal places) Ratio Favourable or Unfavourable Current ratio Totessero Industry Average 161 23 times Tunes 10 point 2. Calculate the 2020 ratios for Alberta Playground Inc. Including a comparison against the Industry averages (Round the final 2 Rab Favours Unfavourable 1 Industry Avenge 181 23mes 35 Content ratio Toti se bo Debitrabo Equity Tunes med Profit margin Return on total Earnings per share 651 50 m us 10 2014 5 170 Me Pm 35 13 Nard