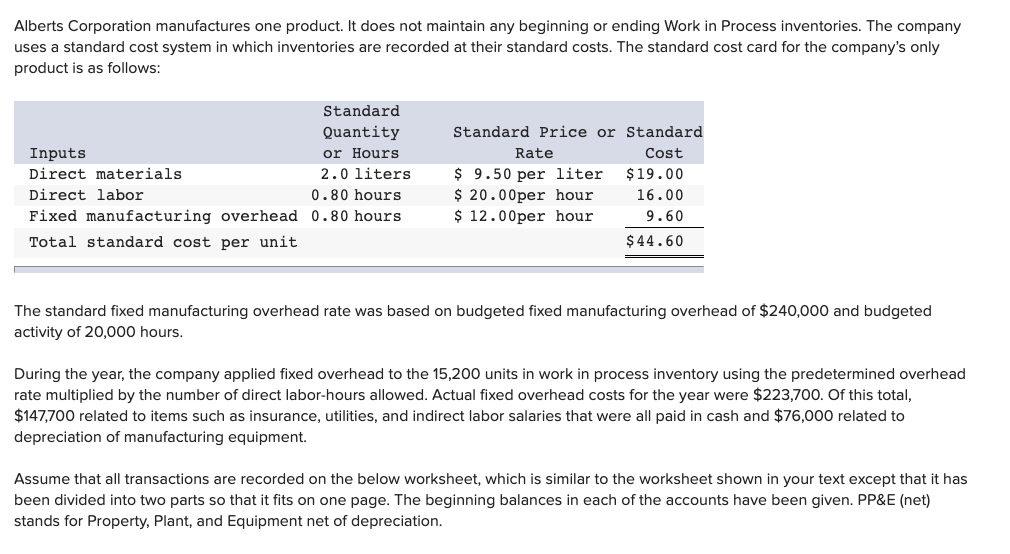

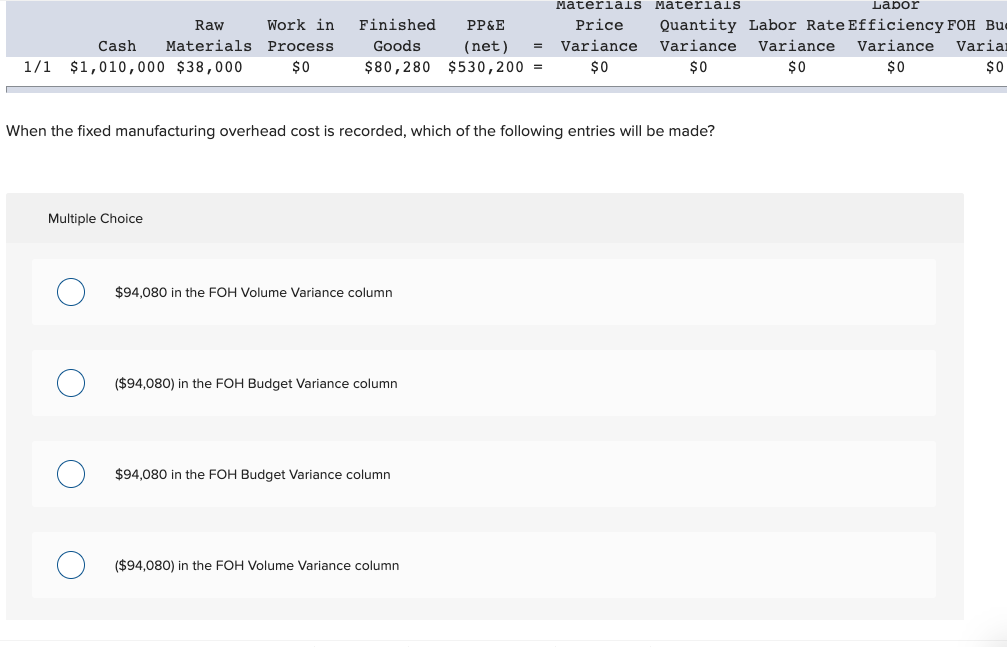

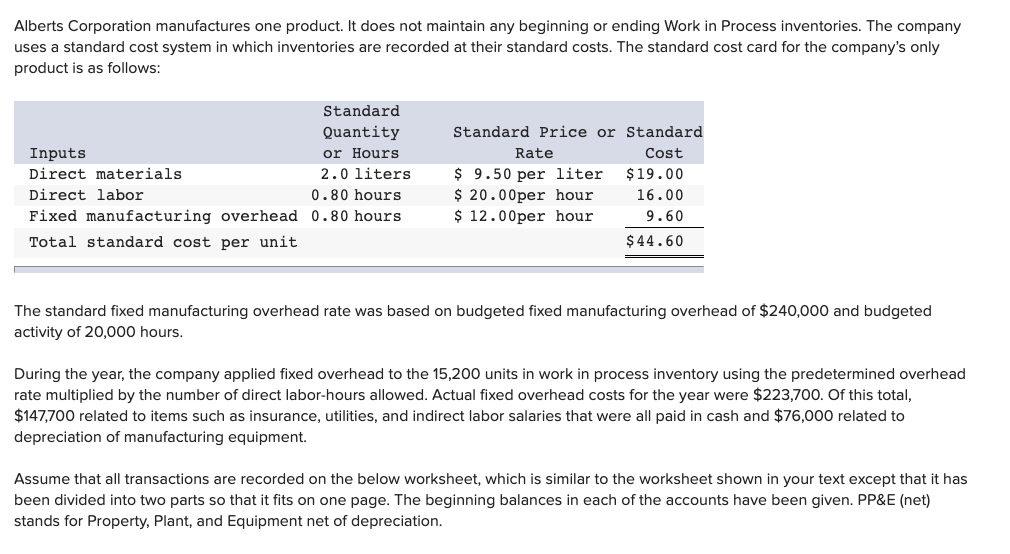

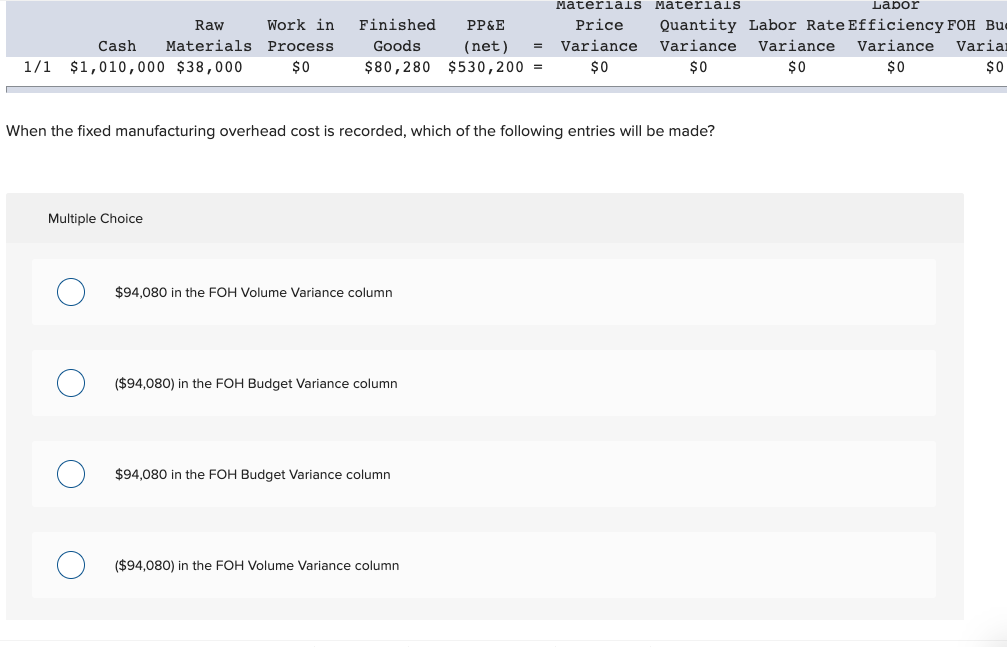

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows: Standard Quantity Standard Price or Standard Inputs Rate Cost or Hours $ 9.50 per liter $ 20.00per hour $ 12.00per hour Direct materials 2.0 liters $19.00 16.00 Direct labor 0.80 hours Fixed manufacturing overhead 0.80 hours 9.60 Total standard cost per unit $44.60 The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment. Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. Labor teriais Materials Quantity Labor Rate Efficiency FOH Bu Varia Finished Price Raw Work in PP&E Variance Variance Cash Materials Goods Variance Variance Process (net) 1/1 $1,010,000 $38,000 $0 $80,280 $530,200 = $0 $0 $0 $0 When the fixed manufacturing overhead cost is recorded, which of the following entries will be made? Multiple Choice $94,080 in the FOH Volume Variance column ($94,080) in the FOH Budget Variance column $94,080 in the FOH Budget Variance column ($94,080) in the FOH Volume Variance column Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows: Standard Quantity Standard Price or Standard Inputs Rate Cost or Hours $ 9.50 per liter $ 20.00per hour $ 12.00per hour Direct materials 2.0 liters $19.00 16.00 Direct labor 0.80 hours Fixed manufacturing overhead 0.80 hours 9.60 Total standard cost per unit $44.60 The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment. Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. Labor teriais Materials Quantity Labor Rate Efficiency FOH Bu Varia Finished Price Raw Work in PP&E Variance Variance Cash Materials Goods Variance Variance Process (net) 1/1 $1,010,000 $38,000 $0 $80,280 $530,200 = $0 $0 $0 $0 When the fixed manufacturing overhead cost is recorded, which of the following entries will be made? Multiple Choice $94,080 in the FOH Volume Variance column ($94,080) in the FOH Budget Variance column $94,080 in the FOH Budget Variance column ($94,080) in the FOH Volume Variance column