Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alby Benedict ( a single resident taxpayer aged 4 5 ) owns a restaurant called Benoit . He has not previously been elected to be

Alby Benedict a single resident taxpayer aged owns a restaurant called Benoit He has not previously been elected to be treated under the SBE provisions; however, he would like to minimize his tax obligation. William has provided you with the following information regarding the financial year. The figures provided exclude GST Question

Alby Benedict a single resident taxpayer aged

owns a restaurant called "Benoit". He has not

previously been elected to be treated under the

SBE provisions; however, he would like to

minimize his tax obligation. William has provided

you with the following information regarding the

financial year. The figures provided

exclude GST

Receipts

Receipts of Cash Debtors

Cash Sales

Drawings by Alby

Add

Receipts

Receipts of Cash Debtors

Cash Sales

Proceeds From Loan

Insurance Recovery on Damaged stock

Fully Franked Dividends from MITEK Pty Ltd Small Business entity

Payments

Payments to creditors trading stock

Employee wages

PAYG tax withheld from employees wages

Drawings by Alby

Purchase of Microwave Oven effective life years

Purchase of coffee machine effective life years

Purchase of Heavyduty Pasta Maker effective life years

Rent

Purchase of a ceiling fan

Other deductible expenses

Other Balances June June

Debtors $ $

Trading Stock $ $

Creditors $ $

Rent prepayment $ $

Additional information:

Decline in value for all other assets held amounted to $ The adjustable value of these assets as at was $

Stock taken home by Alby amounted to $

REQUIRED:

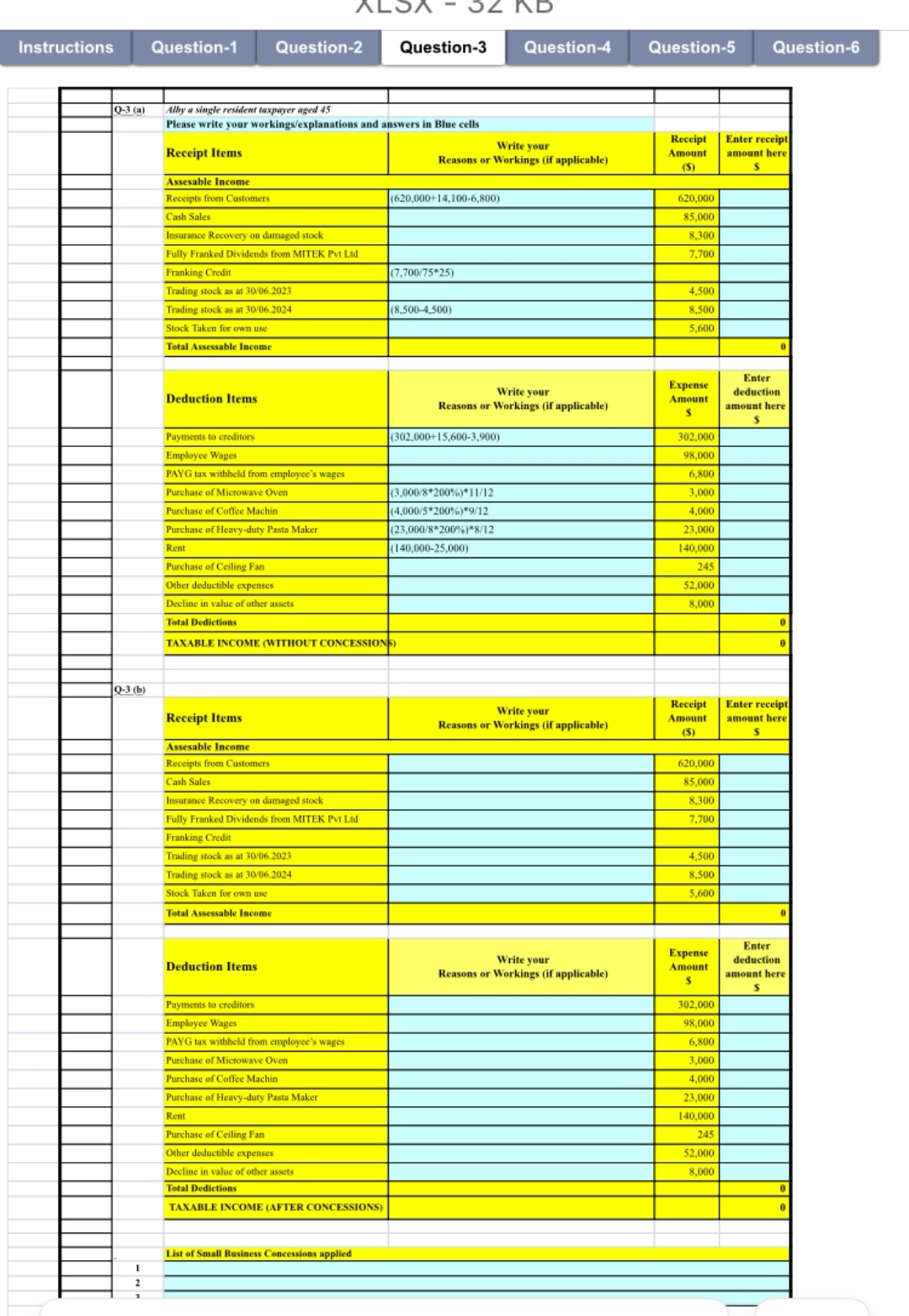

a Using the Excel template provided, calculate Albys taxable income for the tax year if he chooses to not apply any of the small business concessions.

b Using the Excel template provided, calculate Albys taxable income for the tax year if he chooses to apply the small business concessions and make a list of the small business concessions applied.

c Complete the Individual Tax Return Please use the provided Tax Return of FY Attach a copy of the tax return to an email to Alby requesting he sign and return the form for lodgment with the ATO and explaining the impact of the SBE concessions used. All concessions use should be clearly explainedInstructions

Question

Alby Benedict a single resident taxpayer aged owns a restaurant called Benoit He has not previously been elected to be treated under the SBE provisions; however, he would like to minimize his tax obligation. William has provided you with the following information regarding the financial year. The figures provided exclude GST

Receipts

Receipts of Cash Debtors

Cash Sales

Proceeds From Loan

Insurance Recovery on Damaged stock

Fully Franked Dividends from MITEK Pty Ltd Small Business entity

Payments

Payments to creditors trading stock

Employee wages

PAYG tax withheld from employees wages

Drawings by Alby

Purchase of Microwave Oven effective life years

Purchase of coffee machine effective life years

Purchase of Heavyduty Pasta Maker effective life years

Rent

Purchase of a ceiling fan

Other deductible expenses

Other Balances June June

Debtors $ $

Trading Stock $ $

Creditors $ $

Rent prepayment $ $

Additional information:

Decline in value for all other assets held amounted to $ The adjustable value of these assets as at was $

Stock taken home by Alby amounted to $

REQUIRED:

a Using the Excel template provided, calculate Albys taxable income for the tax year if he chooses to not apply any of the small business concessions.

b Using the Excel template provided, calculate Albys taxable income for the tax year if he chooses to apply the small business concessions and make a list of the small business concessions applied.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started