Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALC Corp. has assets in place that's worth $ 8 0 0 million. It also has intangible assets worth $ 2 0 0 million, making

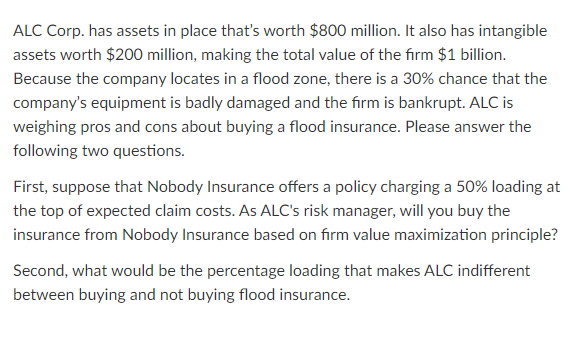

ALC Corp. has assets in place that's worth $ million. It also has intangible

assets worth $ million, making the total value of the firm $ billion.

Because the company locates in a flood zone, there is a chance that the

company's equipment is badly damaged and the firm is bankrupt. ALC is

weighing pros and cons about buying a flood insurance. Please answer the

following two questions.

First, suppose that Nobody Insurance offers a policy charging a loading at

the top of expected claim costs. As ALC's risk manager, will you buy the insurance from Nobody Insurance based on firm value maximization principle? Second, what would be the percentage loading that makes ALC indifferent

between buying and not buying flood insurance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started