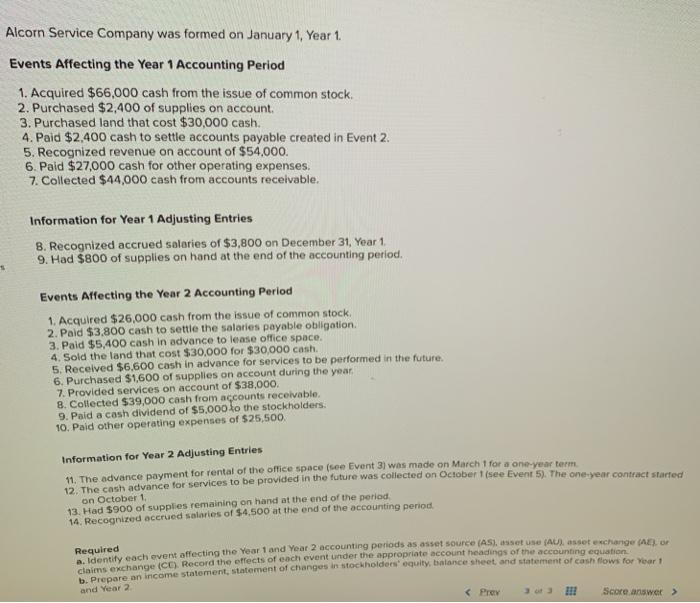

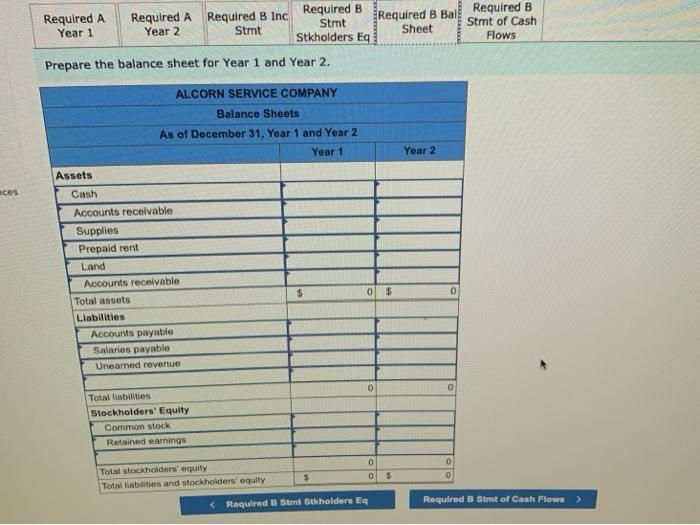

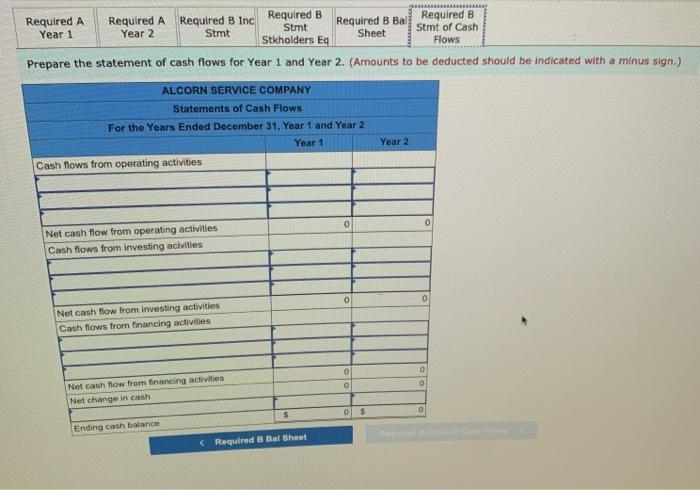

Alcorn Service Company was formed on January 1, Year 1 Events Affecting the Year 1 Accounting Period 1. Acquired $66,000 cash from the issue of common stock. 2. Purchased $2,400 of supplies on account 3. Purchased land that cost $30,000 cash. 4. Paid $2,400 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $54,000. 6. Paid $27,000 cash for other operating expenses. 7. Collected $44,000 cash from accounts receivable. Information for Year 1 Adjusting Entries 8. Recognized accrued salaries of $3,800 on December 31, Year 1 9. Had $800 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Period 1. Acquired $26,000 cash from the issue of common stock. 2. Paid $3,800 cash to settle the salaries payable obligation 3. Paid $5,400 cash in advance to lease office space. 4. Sold the land that cost $30,000 for $30,000 cash 5. Received $6,600 cash in advance for services to be performed in the future. 6. Purchased $1,600 of supplies on account during the year 7. Provided services on account of $38,000. 8. Collected $39,000 cash from accounts receivable 9. Pald a cash dividend of $5,000 to the stockholders. 10. Paid other operating expenses of $25,500. Information for Year 2 Adjusting Entries 11. The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year contract started on October 1 13. Had $900 of supplies remaining on hand at the end of the period 14. Recognized accrued salaries of $4.500 at the end of the accounting period. Required a. Identify each event affecting the Year 1 and Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (or Claimsexchange (CO). Record the effects of each event under the appropriate account headings of the accounting equation b. Prepare an income statement, statement of changes in stockholders equity, balance sheet and statement of cash flows for Year and Year 2