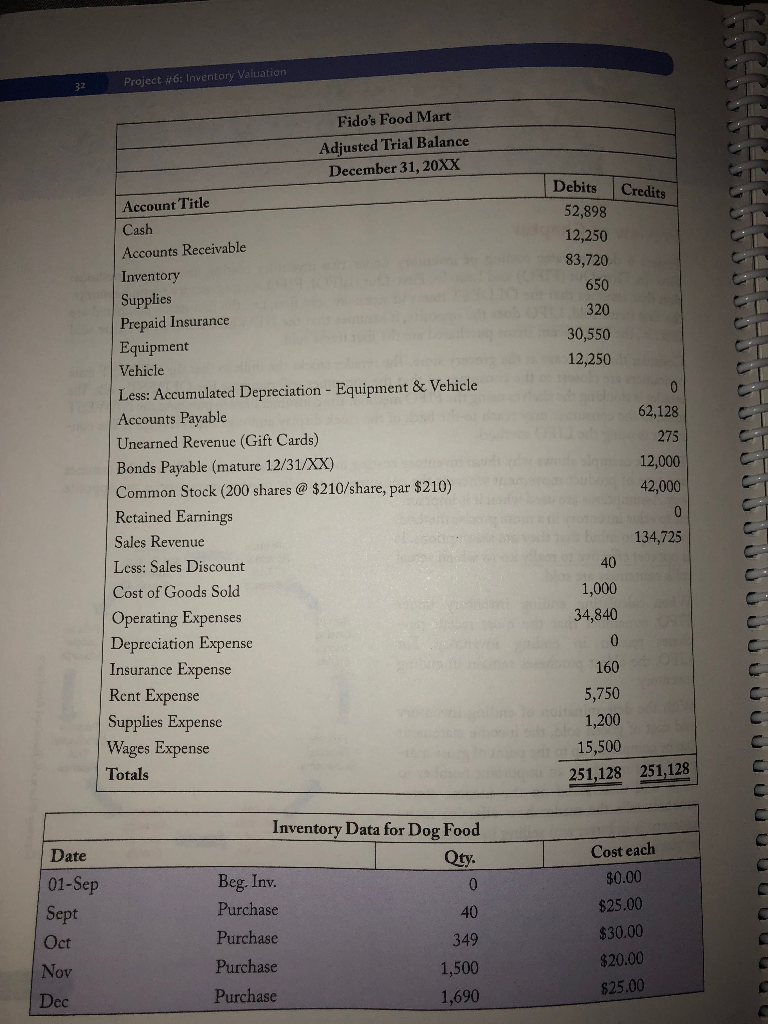

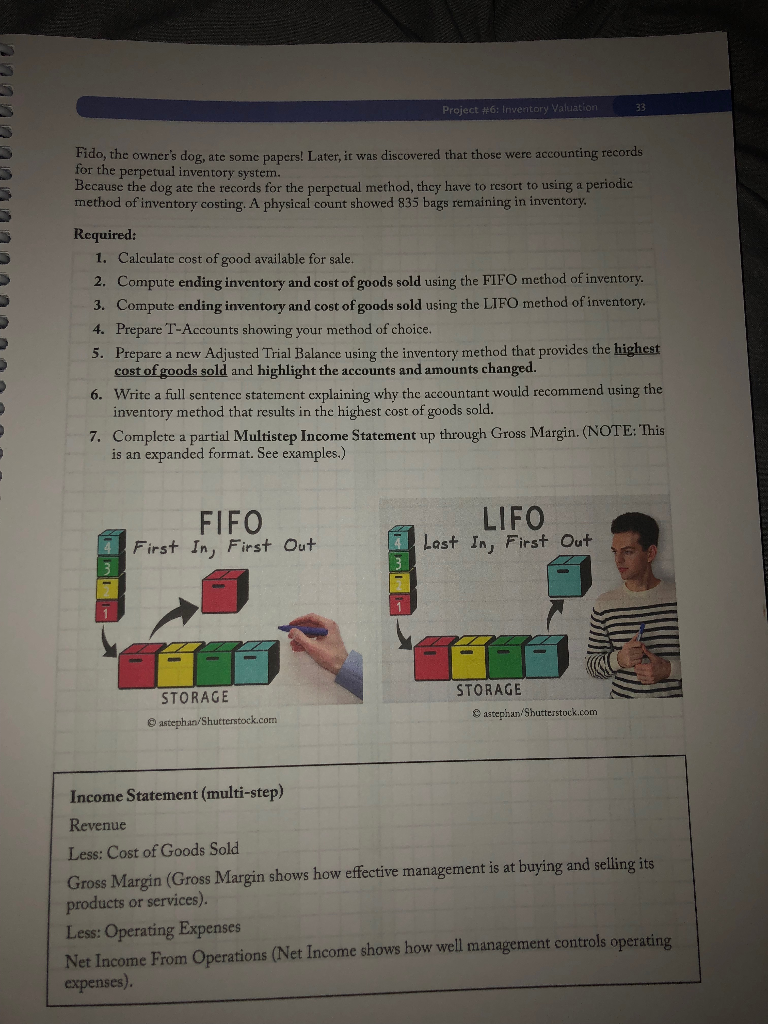

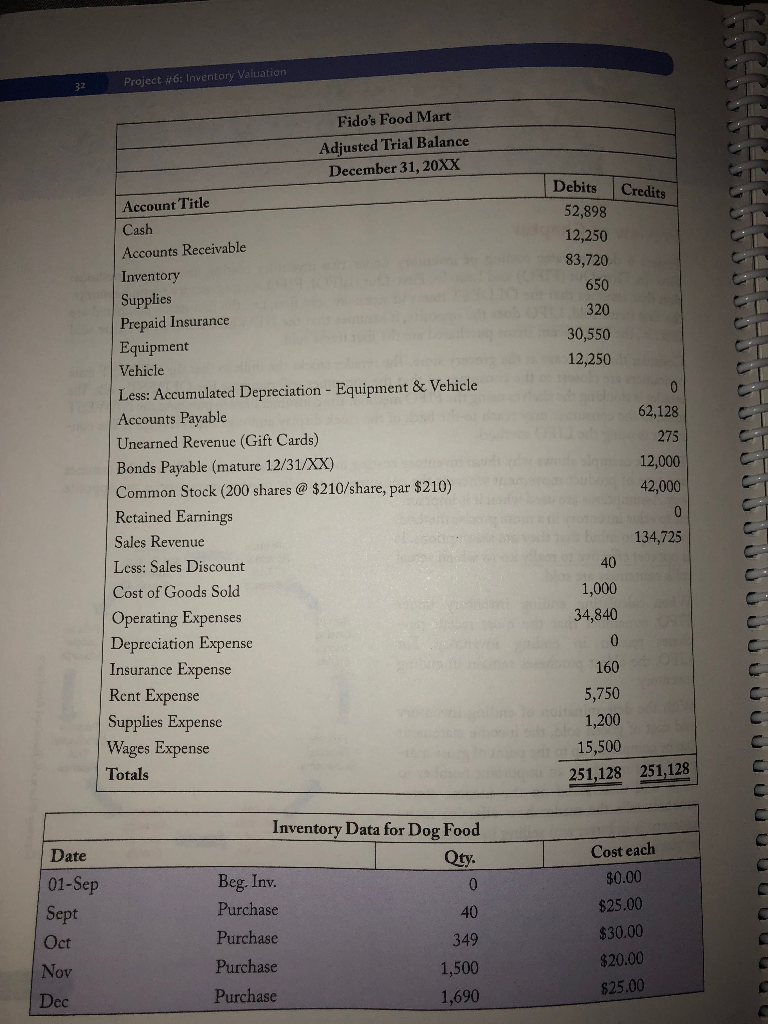

A-L+E 770 9 768 62 778 85 Project #6 782 66 Inventory Valuation ST Preview of Chapter Project 6 demonstrates costing of inventory under two inventory costing assumption methods: First-In, First-Out (FIFO) and Last-In, First-Out (LIFO). FIFO is an inventory costing assump- tion that assumes that the OLDEST items in stock are sold first, i.e., the first items purchased are the first items sold. LIFO does the opposite, it assumes that the NEWEST items in stock are sold first i.e., the most recent items purchased are the first items sold. ** Consider the dairy case at the grocery store. The retailer stocks the milk so that the OLDEST milk containers are closest to the consumer so that the consumer will purchase the OLDEST milk. The retailer is stocking the shelves using the FIFO method. The consumer likes to purchase the NEWEST milk, so the consumer may reach to the back of the stock display and take the NEWEST. The con- sumer is using the LIFO method. The milk example shows why these inventory costing methods are assumption. The retailer assumes one type of product movement whereas the consumer is actually moving inventory in the opposite way. Assumptions are used when it is impracti- cal to value inventory in a more precise method. Just keep in mind that they are assumptions. It is not cost effective to really know which actual milk containers are sold. Prepare Postclosing Analyze and Record Balance Entries When calculating ending inventory under FIFO, remember that the most recent pur- chases remain in ending inventory. For LIFO, the oldest purchases remain in ending inventory Record Post to Closing Ledger Accounts Journal Entries With the determination of ending inventory and cost of goods sold, the income statement can be completed up to the point of gross mar- gin. Gross margin is an important number to know and understand on the income state- ment. It tells the reader how effective man- Prepare Unadjusted Trial Balance Prepare Financial Statements Prepare Adiusted Trial Record Adjusting Journal agement is in buyer and selling its products or services. Balance Entries . Courtesy of Laura K. Bantz and Ann Esarco Project #6: Inventory Vaiuation 32 Fido's Food Mart Adjusted Trial Balance December 31, 20XX Debits Credits Account Title 52,898 Cash 12,250 Accounts Receivable 83,720 Inventory 650 Supplies 320 Prepaid Insurance 30,550 Equipment 12,250 Vehicle Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable Unearned Revenue (Gift Cards 62,128 275 12,000 Bonds Payable (mature 12/31/XX) Common Stock (200 shares@$210/share, par $210) 42,000 0 Retained Earnings 134,725 Sales Revenue 40 Less: Sales Discount 1,000 Cost of Goods Sold 34,840 Operating Expenses Depreciation Expense Insurance Expense Rent Expense 160 5,750 1,200 Supplies Expense 15,500 Wages Expense 251,128 Totals 251,128 Inventory Data for Dog Food Cost each Date Qty. $0.00 Beg. Inv. 01-Sep Sept $25.00 Purchase 40 $30.00 Purchase 349 Oct $20.00 Purchase 1,500 Nov $25.00 Purchase 1,690 Dec UUUUUU0U U U UUU 33 Project #6: Inventory Valuation Fido, the owner's dog, ate some papers! Later, it was discovered that those were accounting records for the perpetual inventory system. Because the dog ate the records for the perpctual method, they have to resort to using a periodic method of inventory costing. A physical count showed 835 bags remaining in inventory. Required: 1. Calculate cost of good available for sale. 2. Compute ending inventory and cost of goods sold using the FIFO method of inventory. Compute ending inventory and cost of goods sold using the LIFO method of inventory. Prepare T-Accounts showing your method of choice. 3. 4. 5. Prepare a new Adjusted Trial Balance using the inventory method that provides the highest cost of goods sold and highlight the accounts and amounts changed. 6. Write a full sentence statement explaining why the accountant would recommend using the inventory method that results in the highest cost of goods sold. 7. Complete a partial Multistep Income Statement up through Gross Margin. (NOTE: This is an expanded format. See examples.) LIFO Last In, First Out FIFO First In, First Out 1 STORAGE STORAGE astephan Shutterstock.com astephan/Shutterstock.com Income Statement (multi-step) Revenue Less: Cost of Goods Sold how effective management is at buying and selling its Gross Margin (Gross Margin sho products or services). Less: Operating Expenses Net Income From Operations (Net Income shows how well management controls operating expenses)