Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alea lacta Company (AI Co), a company specializing in high-tech technology, considers investing in a new project that requires an investment cost of 100m.

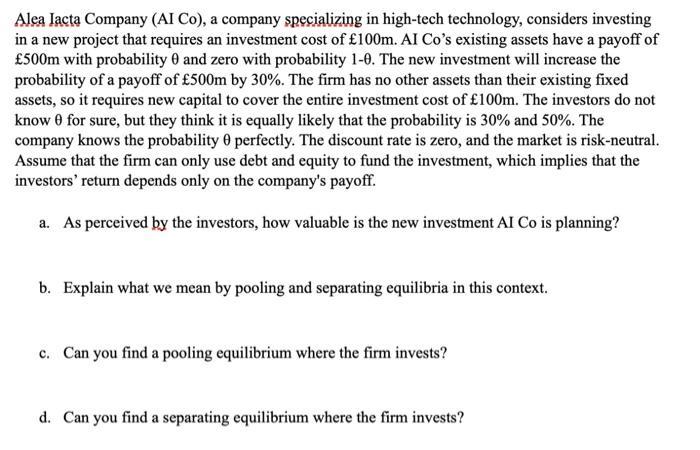

Alea lacta Company (AI Co), a company specializing in high-tech technology, considers investing in a new project that requires an investment cost of 100m. AI Co's existing assets have a payoff of 500m with probability 0 and zero with probability 1-0. The new investment will increase the probability of a payoff of 500m by 30%. The firm has no other assets than their existing fixed assets, so it requires new capital to cover the entire investment cost of 100m. The investors do not know for sure, but they think it is equally likely that the probability is 30% and 50%. The company knows the probability 0 perfectly. The discount rate is zero, and the market is risk-neutral. Assume that the firm can only use debt and equity to fund the investment, which implies that the investors' return depends only on the company's payoff. a. As perceived by the investors, how valuable is the new investment AI Co is planning? b. Explain what we mean by pooling and separating equilibria in this context. c. Can you find a pooling equilibrium where the firm invests? d. Can you find a separating equilibrium where the firm invests?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the value of the new investment as perceived by the investors we need to calculate the expected payoff of the investment Case 1 Probabi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started