Answered step by step

Verified Expert Solution

Question

1 Approved Answer

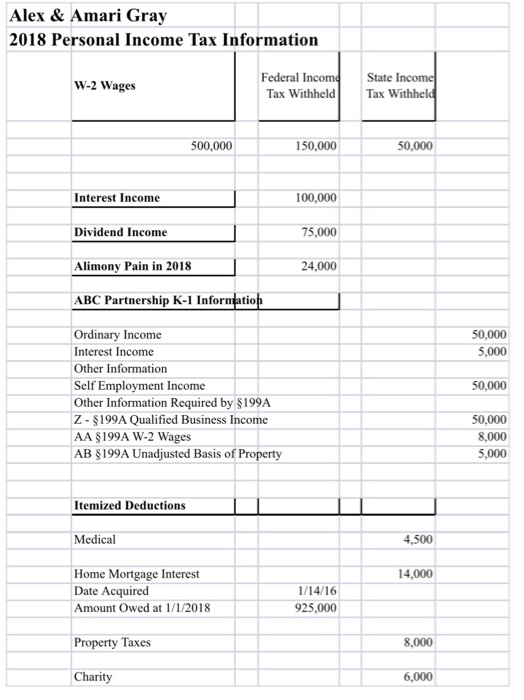

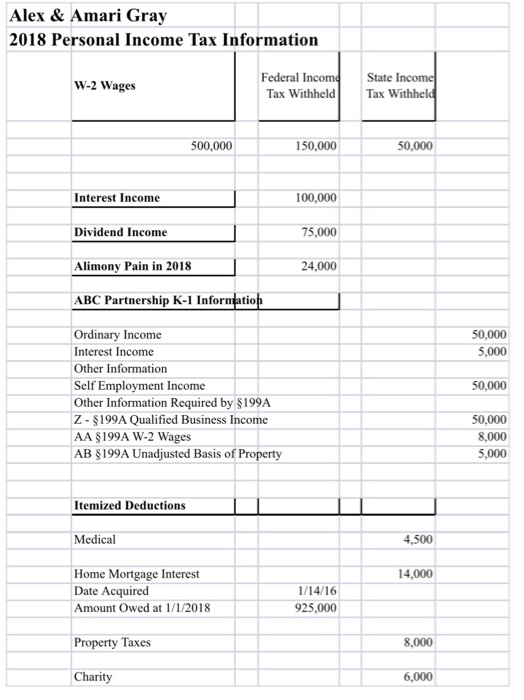

Alex and Amari Gray want to pay their tax as soon as possible to minimize interest and penalties for filing a late tax return. They

Alex and Amari Gray want to pay their tax as soon as possible to minimize interest and penalties for filing a late tax return. They are each 36 years old it want to file a married filing joint tax return and have no children. their income and deductions are attached in an Excel spreadsheet.

What will be there incomes taxes due or refunded in 2018?

in California. United States

Alex & Amari Gray 2018 Personal Income Tax Information Federal I State I Tax Wit W-2 Wages Tax Withheld 500,000 150,000 50,000 Interest Income 100,000 75,000 Dividend Incom Alimony Pain in 2018 ABC Partnership K-1 Informatio 24,000 Ordinary Income Interest Income Other Information Self Employment I Other Information Required by S199A Z- $199A Qualified Business Income AA S199A W-2 Wages AB S199A Unadjusted Basis of Property 50,000 5,000 50,000 50,000 8,000 5,000 Itemized Deductions Medical 4,500 Home Mortgage Interest Date Acquired Amount Owed at 1/1/2018 14,000 1/14/16 925,000 Property Taxes 8,000 Charity 6,000 Alex & Amari Gray 2018 Personal Income Tax Information Federal I State I Tax Wit W-2 Wages Tax Withheld 500,000 150,000 50,000 Interest Income 100,000 75,000 Dividend Incom Alimony Pain in 2018 ABC Partnership K-1 Informatio 24,000 Ordinary Income Interest Income Other Information Self Employment I Other Information Required by S199A Z- $199A Qualified Business Income AA S199A W-2 Wages AB S199A Unadjusted Basis of Property 50,000 5,000 50,000 50,000 8,000 5,000 Itemized Deductions Medical 4,500 Home Mortgage Interest Date Acquired Amount Owed at 1/1/2018 14,000 1/14/16 925,000 Property Taxes 8,000 Charity 6,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started