Question

Alex Clayton Ltd., an IFRS reporter, is in the process of assessing the valuation of its intangible assets. At the end of the current year,

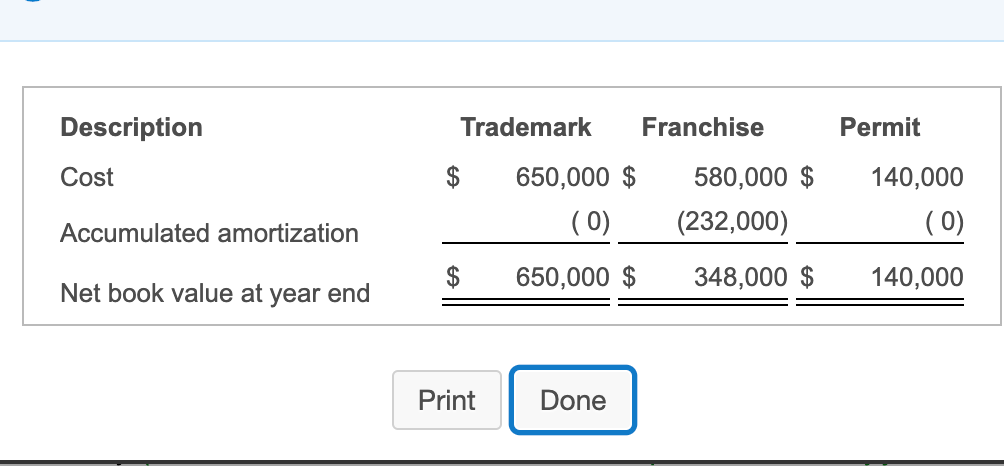

Alex Clayton Ltd., an IFRS reporter, is in the process of assessing the valuation of its intangible assets. At the end of the current year, management reported the following intangible assets:

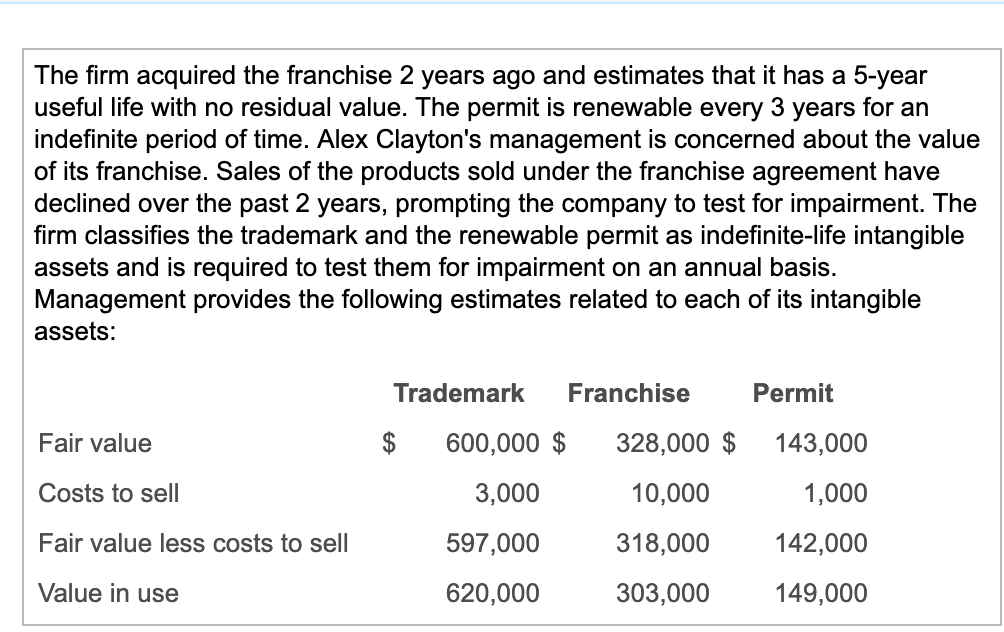

Additional information regarding the intangible assets follows:

Requirement a. Conduct an impairment test for Alex Clayton's intangible assets. Start with Part 1. (Complete all answer boxes.)

| Part 1: | Trademark | Franchise | Permit |

|

|

|

|

|

|

|

|

|

|

| Recoverable amount |

|

|

|

Now complete Part 2. For each asset group, complete the analysis and calculate the amount of the impairment, if any. (If there is no impairment loss, leave the impairment loss cell blank for that asset.)

| Part 2: | Trademark | Franchise | Permit |

|

|

|

|

|

|

|

|

|

|

| Impairment loss |

|

|

|

Requirement b. Prepare the journal entries required to record the impairment loss, if any. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.)

Begin by preparing the journal entry required to record impairment loss, if any, on the trademark.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepare the journal entry required to record impairment loss, if any, on the franchise.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepare the journal entry required to record impairment loss, if any, on the permit.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Requirement c. Compute the amount of the annual amortization for the franchise for years subsequent to the impairment test. (Round your answer to the nearest whole dollar.)

| The amount of the amortization for the franchise for years subsequent to the impairment test is $ |

| annually. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started