Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total

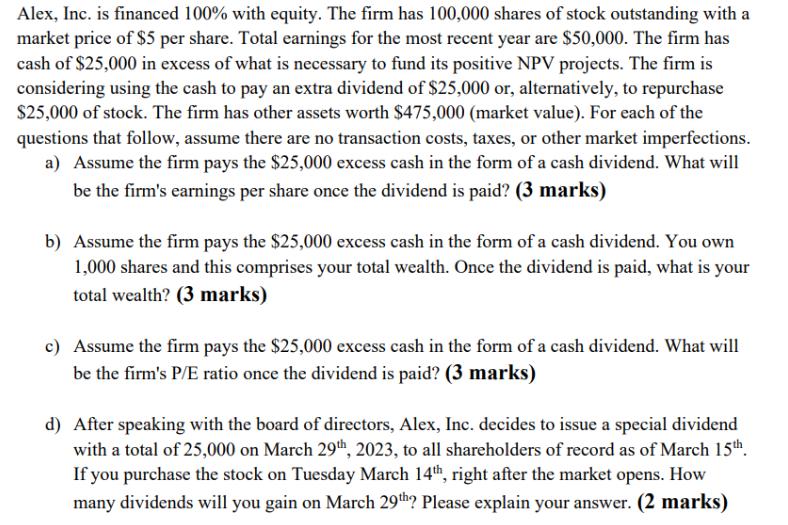

Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has cash of $25,000 in excess of what is necessary to fund its positive NPV projects. The firm is considering using the cash to pay an extra dividend of $25,000 or, alternatively, to repurchase $25,000 of stock. The firm has other assets worth $475,000 (market value). For each of the questions that follow, assume there are no transaction costs, taxes, or other market imperfections. a) Assume the firm pays the $25,000 excess cash in the form of a cash dividend. What will be the firm's earnings per share once the dividend is paid? (3 marks) b) Assume the firm pays the $25,000 excess cash in the form of a cash dividend. You own 1,000 shares and this comprises your total wealth. Once the dividend is paid, what is your total wealth? (3 marks) c) Assume the firm pays the $25,000 excess cash in the form of a cash dividend. What will be the firm's P/E ratio once the dividend is paid? (3 marks) d) After speaking with the board of directors, Alex, Inc. decides to issue a special dividend with a total of 25,000 on March 29th, 2023, to all shareholders of record as of March 15th. If you purchase the stock on Tuesday March 14th, right after the market opens. How many dividends will you gain on March 29th? Please explain your answer. (2 marks)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a If the firm pays a 25000 cash dividend its total earnings will be reduced by 25000 to 25000 The ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started