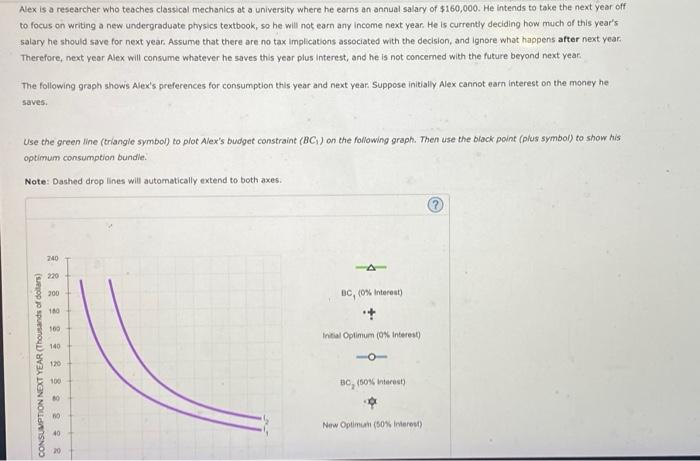

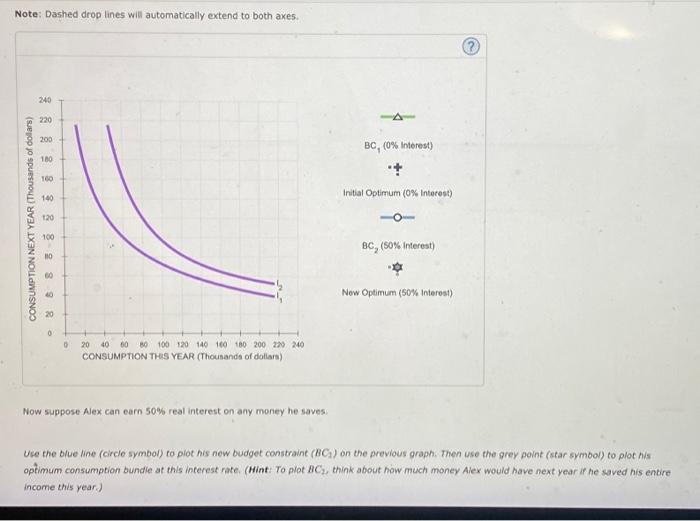

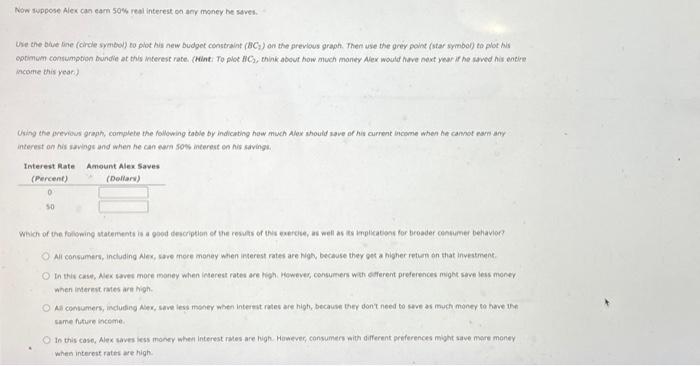

Alex is a researcher who teaches classical mechanics at a university where he earns an annual salary of $160,000. He intends to take the next year off to focus on writing a new undergraduate physics textbook, so he will not earn any income next year. He is currently deciding how much af this year's salary he should save for next year. Assume that there are no tax implications associated with the decision, and ignore what happens after next year. Therefore, next year Alex will consume whatever he saves this year plus interest, and he is not concemed with the future beyond next year. The following graph shows Alex's preferences for consumption this year and next year Suppose initially Alex cannot earn interest on the money he saves: Use the green line (triangle symbol) to plot Alex's budget constraint ( BC1 ) on the following graph. Then use the black point (plus symbol) to show his optimum consumption bundie. Note: Dashed drop lines will automatically extend to both axes. Note: Dashed drop lines will automatically extend to both axes. Now suppose Alex can earn 50% real interest on any money he saves. Use the blue line (circle symbol) to plot his new budget constraint (BC 4 ) on the previous graph. Then use the grey point (star symbol) to plot his optimum consumption bundle at this interest rate. (Hint. To plot BC. think about how much money Alex would have next year if he saved his enbre income this year.) Now suppose Alex can eam 50% reai interest oo any money he saven. Ohe che bive line (corcle sveteol) to phot his new budget constraint (BC) ) on the grevlous graph. Then use the grev point (star symbol) to plot his income bis y(a+) Using the grevious graph, complete the following table by indicithy how much Alex should ave of his current income when be camot earn any interest on his savings and when he can cwh sow meerest on his savingk. Which of the folswing atacements is a gogd descriptian of the remags of this exercive, as wel as is tapicabons for broader consumer behavioc? Al cansumers, including Aex, sare more money when imserest rates are Nign, beceuse ther get a higher retum on that inyestment. In this case, Alex wwet more maney when icherest pates are hoh. Howeve, consumens wh stferent proferences might sive less moner when imereve rates are high. Mil consumers, induding Aex, save less moner mben interat rates are high, because ther dont need to wore as much moner lo heve ite same huture inceme. In this cose, Alex wavesiess money when interest rmes are high. However, consumen with different preferences might save mare moner when interest rates are high