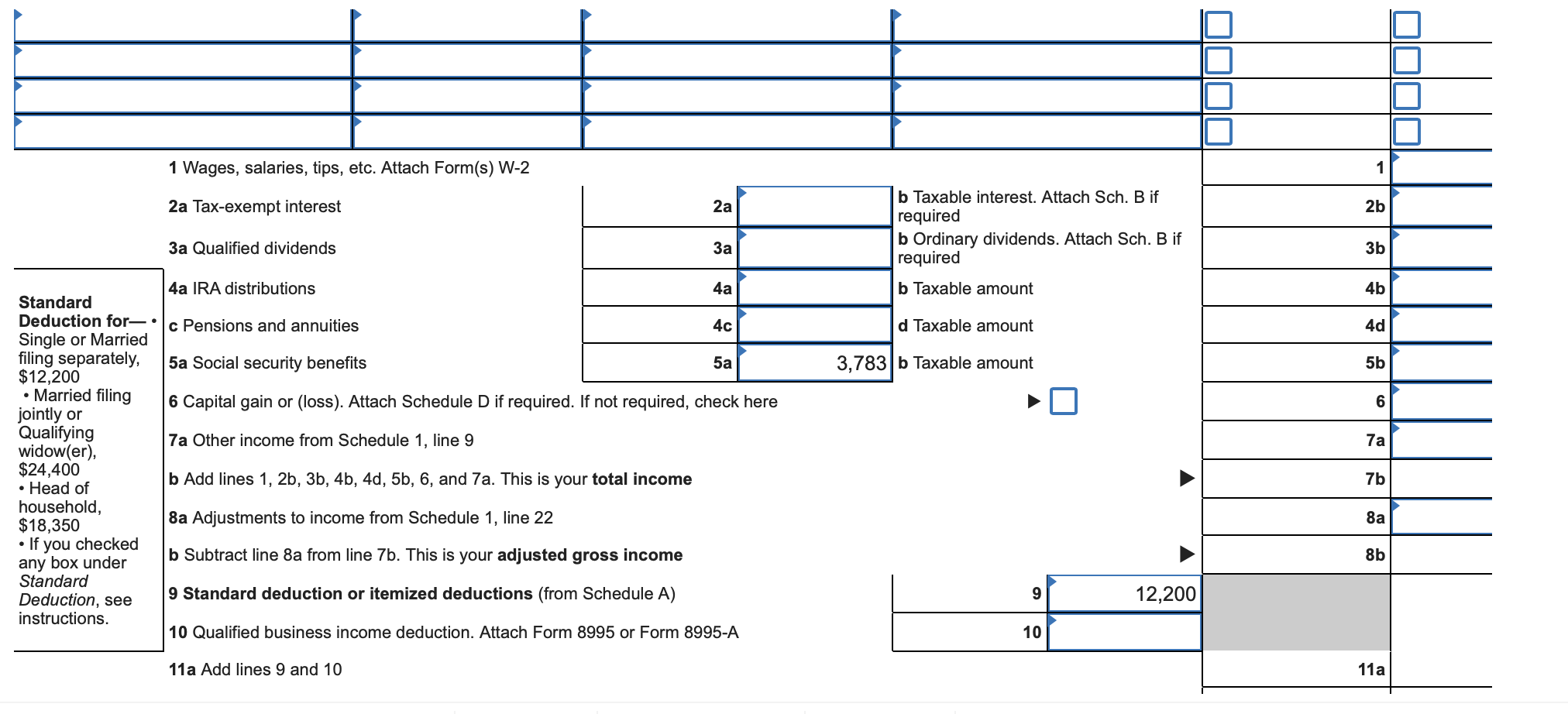

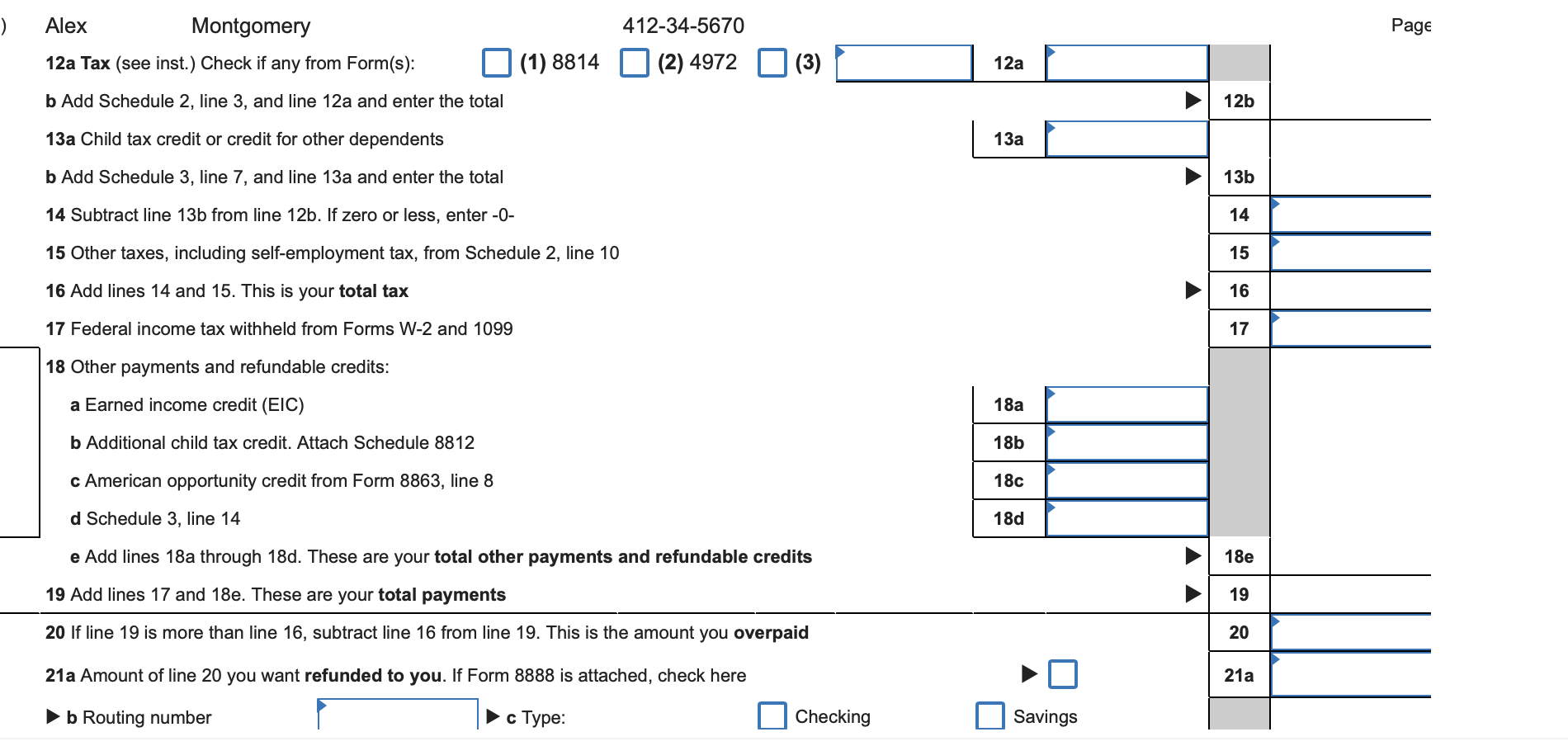

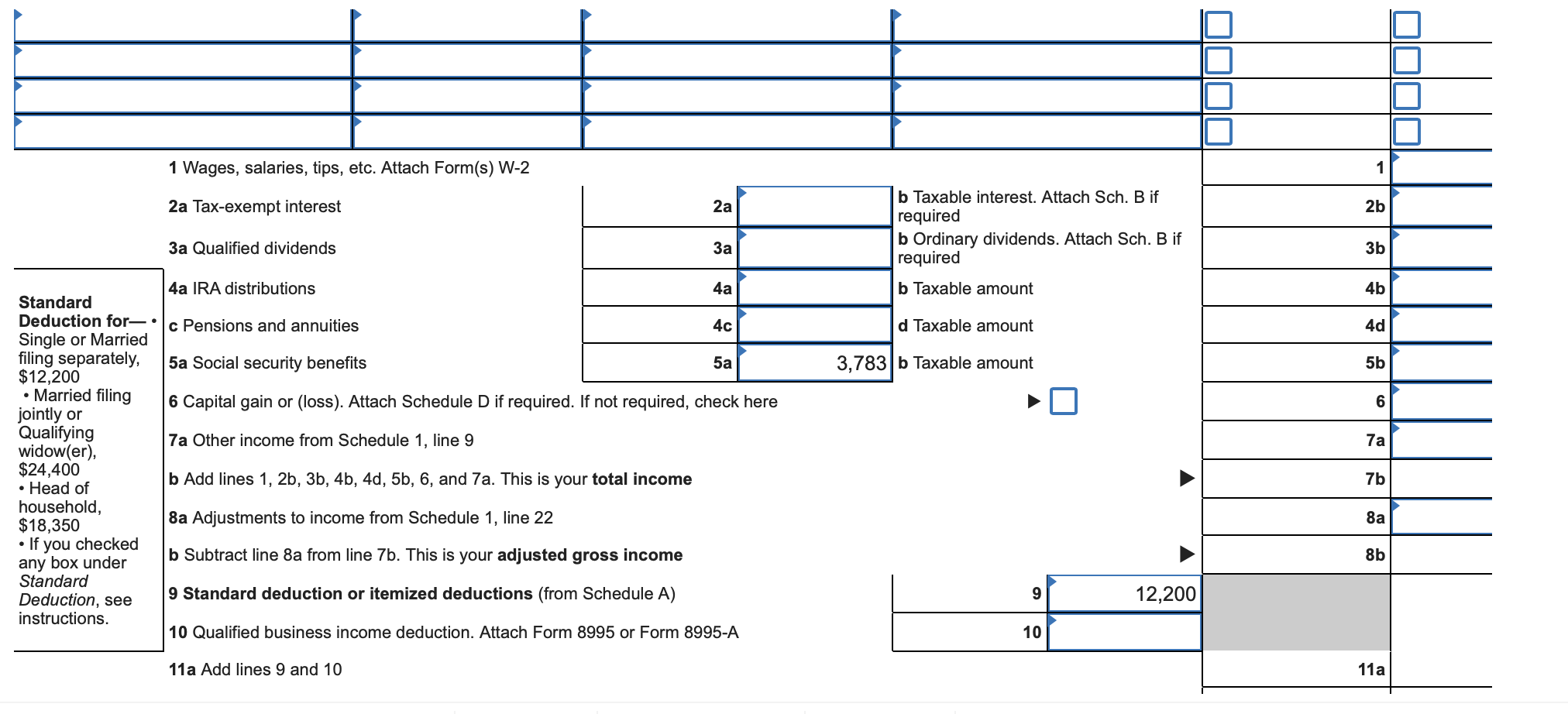

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the following information. Wages (box 1) = $ 61,011.30 Federal W/H (box 2) = $ 6,866.10 Social security wages (box 3) = $ 61,011.30 Social security W/H (box 4) = $ 3,782.70 Medicare wages (box 5) = $ 61,011.30 Medicare W/H (box 6) = $ 884.66 Required: Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040 for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.)

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the following information. Wages (box 1) = $ 61,011.30 Federal W/H (box 2) = $ 6,866.10 Social security wages (box 3) = $ 61,011.30 Social security W/H (box 4) = $ 3,782.70 Medicare wages (box 5) = $ 61,011.30 Medicare W/H (box 6) = $ 884.66 Required: Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040 for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.)

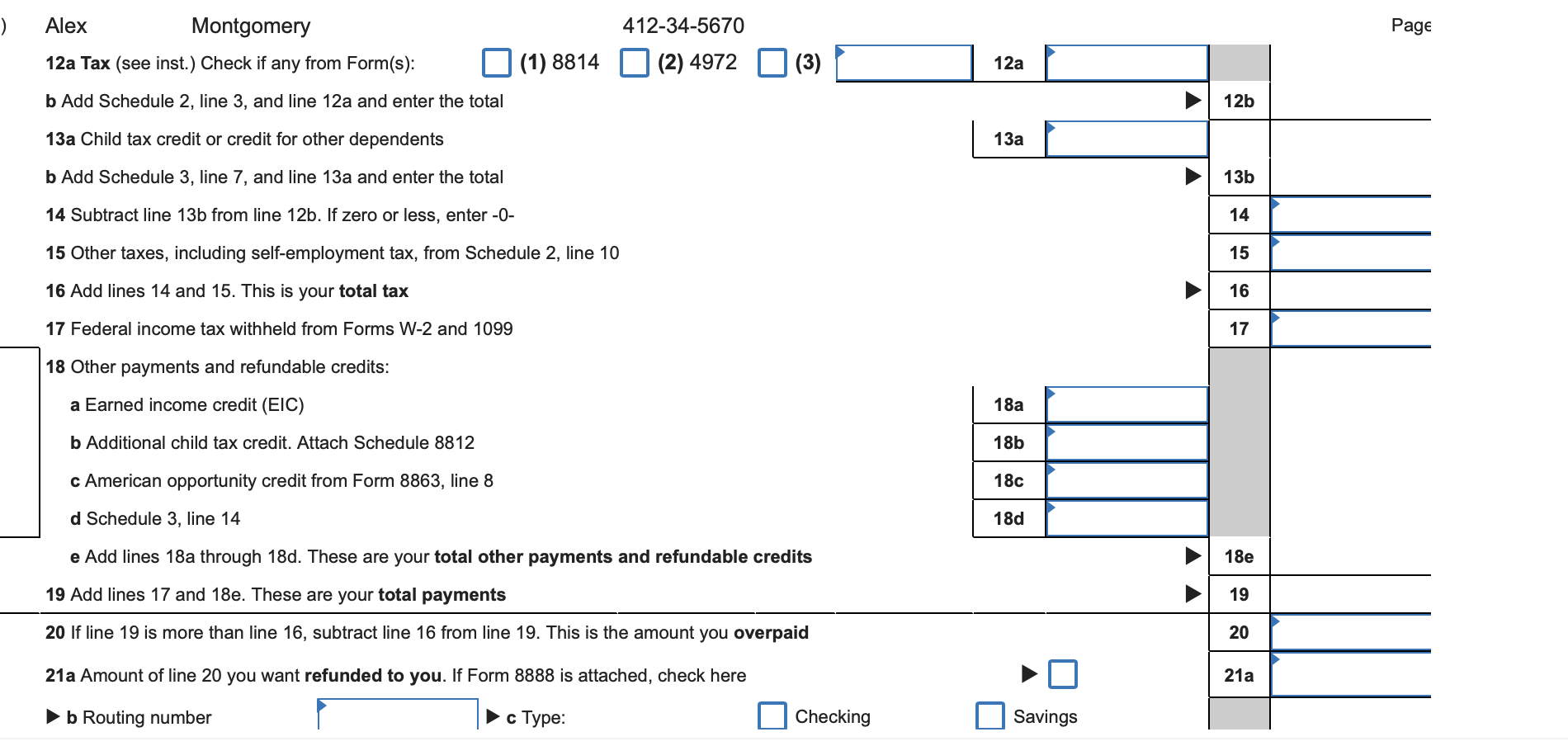

1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 2a Tax-exempt interest 2a 2b b Taxable interest. Attach Sch. B if required b Ordinary dividends. Attach Sch. B if required 3a Qualified dividends 3b b Taxable amount 4b d Taxable amount 4d 3,783 b Taxable amount 5b 6 7a 4a IRA distributions 4a Standard Deduction for- . c Pensions and annuities 4c Single or Married filing separately, 5a Social security benefits 5a $12,200 Married filing 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here jointly or Qualifying 7a Other income from Schedule 1, line 9 widow(er), $24,400 Head of b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income household, $18,350 8a Adjustments to income from Schedule 1, line 22 If you checked b Subtract line 8a from line 7b. This is your adjusted gross income any box under Standard Deduction, see 9 Standard deduction or itemized deductions (from Schedule A) instructions. 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 7b 8 8b 9 12,200 10 11a Add lines 9 and 10 11a ) 412-34-5670 Page Alex Montgomery 12a Tax (see inst.) Check if any from Form(s): (1) 8814 (2) 4972 (3) 12a b Add Schedule 2, line 3, and line 12a and enter the total 12b 13a 13a Child tax credit or credit for other dependents b Add Schedule 3, line 7, and line 13a and enter the total 13b 14 Subtract line 13b from line 12b. If zero or less, enter -O- 14 15 Other taxes, including self-employment tax, from Schedule 2, line 10 15 16 Add lines 14 and 15. This is your total tax 16 17 Federal income tax withheld from Forms W-2 and 1099 17 18 Other payments and refundable credits: a Earned income credit (EIC) 18a b Additional child tax credit. Attach Schedule 8812 18b c American opportunity credit from Form 8863, line 8 18C d Schedule 3, line 14 18d e Add lines 18a through 18d. These are your total other payments and refundable credits 18e 19 Add lines 17 and 18e. These are your total payments 19 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 20 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here 21a b Routing number c Type: Checking Savings 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 2a Tax-exempt interest 2a 2b b Taxable interest. Attach Sch. B if required b Ordinary dividends. Attach Sch. B if required 3a Qualified dividends 3b b Taxable amount 4b d Taxable amount 4d 3,783 b Taxable amount 5b 6 7a 4a IRA distributions 4a Standard Deduction for- . c Pensions and annuities 4c Single or Married filing separately, 5a Social security benefits 5a $12,200 Married filing 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here jointly or Qualifying 7a Other income from Schedule 1, line 9 widow(er), $24,400 Head of b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income household, $18,350 8a Adjustments to income from Schedule 1, line 22 If you checked b Subtract line 8a from line 7b. This is your adjusted gross income any box under Standard Deduction, see 9 Standard deduction or itemized deductions (from Schedule A) instructions. 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 7b 8 8b 9 12,200 10 11a Add lines 9 and 10 11a ) 412-34-5670 Page Alex Montgomery 12a Tax (see inst.) Check if any from Form(s): (1) 8814 (2) 4972 (3) 12a b Add Schedule 2, line 3, and line 12a and enter the total 12b 13a 13a Child tax credit or credit for other dependents b Add Schedule 3, line 7, and line 13a and enter the total 13b 14 Subtract line 13b from line 12b. If zero or less, enter -O- 14 15 Other taxes, including self-employment tax, from Schedule 2, line 10 15 16 Add lines 14 and 15. This is your total tax 16 17 Federal income tax withheld from Forms W-2 and 1099 17 18 Other payments and refundable credits: a Earned income credit (EIC) 18a b Additional child tax credit. Attach Schedule 8812 18b c American opportunity credit from Form 8863, line 8 18C d Schedule 3, line 14 18d e Add lines 18a through 18d. These are your total other payments and refundable credits 18e 19 Add lines 17 and 18e. These are your total payments 19 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 20 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here 21a b Routing number c Type: Checking Savings

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the following information. Wages (box 1) = $ 61,011.30 Federal W/H (box 2) = $ 6,866.10 Social security wages (box 3) = $ 61,011.30 Social security W/H (box 4) = $ 3,782.70 Medicare wages (box 5) = $ 61,011.30 Medicare W/H (box 6) = $ 884.66 Required: Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040 for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.)

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the following information. Wages (box 1) = $ 61,011.30 Federal W/H (box 2) = $ 6,866.10 Social security wages (box 3) = $ 61,011.30 Social security W/H (box 4) = $ 3,782.70 Medicare wages (box 5) = $ 61,011.30 Medicare W/H (box 6) = $ 884.66 Required: Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040 for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.)