Question

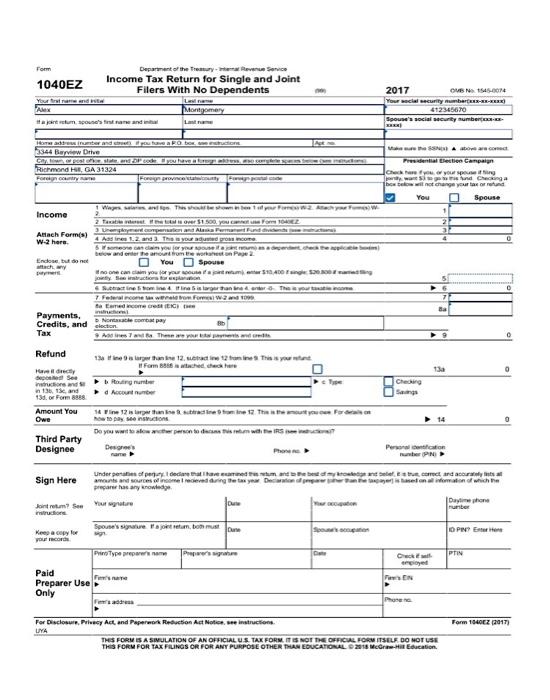

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College

Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the following information.

Wages (box 1) = $ 61,011.30

Federal W/H (box 2) = $ 8,528.10

Social security wages (box 3) = $ 61,011.30

Social security W/H (box 4) = $ 3,782.70

Medicare wages (box 5) = $ 61,011.30

Medicare W/H (box 6) = $ 884.66

Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040EZ for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.)

Department of the Treaury-ntenat Revenue Senice Income Tax Return for Single and Joint Filers With No Dependents Fom 1040EZ 2017 OMB N 1545-0074 Your trat nae end kitw Your secial security mumberti--) 412345670 Montgomery ta jart retum spoune's fist name and inta Lat nae Spouse's social security number a om ad innter and routave aRO bor udione 3344 Bayview Drive Cay, tiepost slae and DP cod you haveaanr akbus, ao se Richmond H, GA 31324 Foreign cntry a Ma he SN a ato ar comect Predential letien Campaign Check hae fy or yo spoeng nd Checinga tchange your la or refund Forgnprovnceta y For e box telow You Spouse ! Wages seles ad This sho ownentdy F 2 A Income 2 Taat et et over S1500. you canne Fom 10E 3 Unempoyment.comperin and Alaka PmattFund dvden 1 Ass ines 1.2 and 3 Thea your adued gron income Ssomeone can daim you jor youroneita umnadn heepleim Attach Form(s) w-2 here. Ienter the anouatume workaet Endose but do net tach y pymer You O Spouse r your pounefajt um eter S10 40O Einge S a ng anon Scact ine hom ine4 ina sis largartan aenter a Theyourtaatieo 7 Feleralcone weneeom Fomei wand O ta Eamed ncome rest ECI e in DNontasate combat pay Ba Payments, Credits, and clecto 3 Aa ies 7an a Thene we yar a aes and nd Refund 13 ine larger an e 12. eat ie 1 ton ine This is yourtant Fom 8 tched chec here 13a Ha decty depone See tructione and Checking Sangs in 136. 1, and punu fary a 13d. or Form 888 a Account number Amount You Owe 14 Fine 12 is large than e raeone ow to pay see nsctions ount you o For on > 14 Do you wat te akow acter person to dacana is tm with e IRS e Third Party Designee Desigres Personal dentication nunter PN Phone ne Under peraties of perey t dediare atihae esamned tem and e best dyrotedeant belef. Etu coect and accuraly nts at annts and sources o iome l redeved daring he tas year Deciaatd p ane taeraned on al ematon of which he preparr has any knowtedge. Sign Here Jont retum Sen vur gnatre tructione Due ton Dayline phone runber Spouse's signae Pa etun, bo must De Sp cten O PIN Ester itene Keep a cpy for you cor Prino Type preparer name Preparers gae Cete PTIN Checkt empioyet Paid Fes name FesEN Preparer Use Only Phote For Disclosure, Privecy Act, and Paperwork Reduction Act Notice. see instructions Form 1040EZ (2017) UYA THIS FORMIS A SIMULATION OF AN OFFICIAL US TAX FORM. ITIS NOT TE OFFICIAL FORM ITSELF DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANT PURPOSE OTHER THAN EDUCATIONALOS MeGra-H Education.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started