Answered step by step

Verified Expert Solution

Question

1 Approved Answer

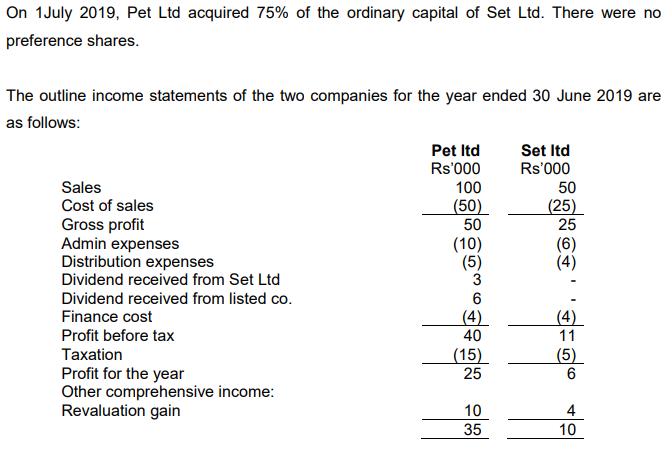

On 1July 2019, Pet Ltd acquired 75% of the ordinary capital of Set Ltd. There were no preference shares. The outline income statements of

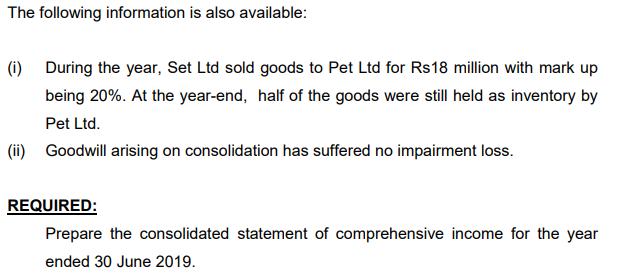

On 1July 2019, Pet Ltd acquired 75% of the ordinary capital of Set Ltd. There were no preference shares. The outline income statements of the two companies for the year ended 30 June 2019 are as follows: Pet Itd Rs'000 100 Set Itd Rs'000 Sales Cost of sales 50 (50) 50 (25) 25 Gross profit Admin expenses Distribution expenses Dividend received from Set Ltd (10) (5) 3 (6) (4) Dividend received from listed co. Finance cost (4) 40 (4) 11 Profit before tax Taxation (15) 25 (5) 6 Profit for the year Other comprehensive income: Revaluation gain 10 4 35 10 The following information is also available: (i) During the year, Set Ltd sold goods to Pet Ltd for Rs18 million with mark up being 20%. At the year-end, half of the goods were still held as inventory by Pet Ltd. (ii) Goodwill arising on consolidation has suffered no impairment loss. REQUIRED: Prepare the consolidated statement of comprehensive income for the year ended 30 June 2019.

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Comprehensive Income for the year e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started