Alex runs a small farm shop which she set up 2 years ago. She is finding that the shop gets very crowded at times

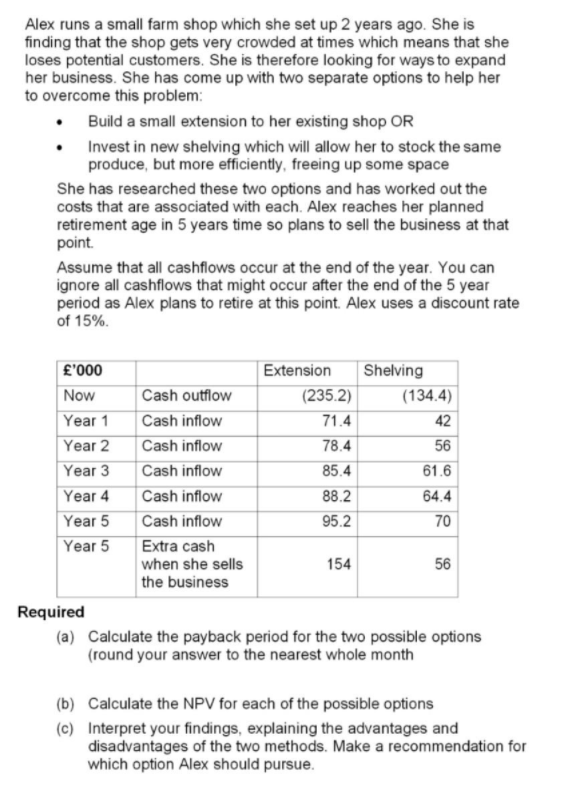

Alex runs a small farm shop which she set up 2 years ago. She is finding that the shop gets very crowded at times which means that she loses potential customers. She is therefore looking for ways to expand her business. She has come up with two separate options to help her to overcome this problem: Build a small extension to her existing shop OR Invest in new shelving which will allow her to stock the same produce, but more efficiently, freeing up some space She has researched these two options and has worked out the costs that are associated with each. Alex reaches her planned retirement age in 5 years time so plans to sell the business at that point. Assume that all cashflows occur at the end of the year. You can ignore all cashflows that might occur after the end of the 5 year period as Alex plans to retire at this point. Alex uses a discount rate of 15%. '000 Now Year 1 Year 2 Year 3 Year 4 Year 5 Year 5 (b) (c) Cash outflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Extra cash when she sells the business Extension (235.2) 71.4 78.4 85.4 88.2 95.2 154 Shelving (134.4) 42 56 61.6 64.4 70 56 Required (a) Calculate the payback period for the two possible options (round your answer to the nearest whole month Calculate the NPV for each of the possible options Interpret your findings, explaining the advantages and disadvantages of the two methods. Make a recommendation for which option Alex should pursue.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payback period for the two options and the net present value NPV for each option we need to analyze the cash inflows and outflows ass...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started