Question

Alexa had recently taken over her aunts business selling pots and ceramic wares after she graduated from JP University with a Bachelor of Business in

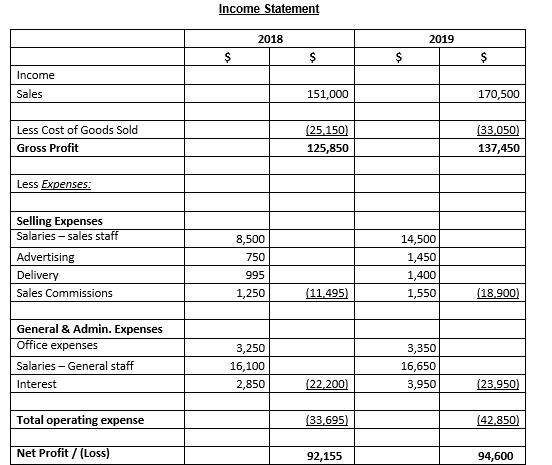

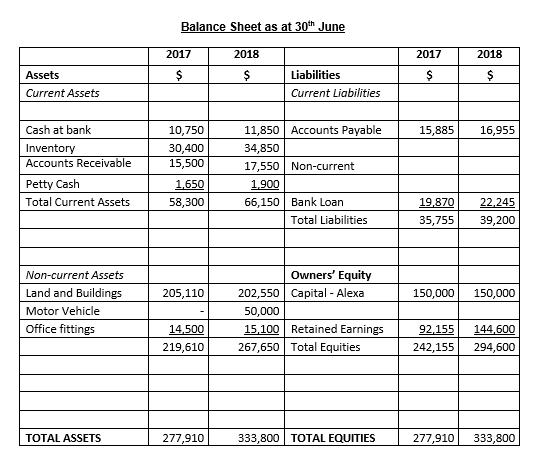

Alexa had recently taken over her aunt’s business selling pots and ceramic wares after she graduated from JP University with a Bachelor of Business in 2019. Now she wants you to do some financial analysis for the business. Alexa has provided you with the following financial statements for 2017/2018 and 2018/2019 fiscal years. Please ignore any taxation-related matters in this question.

following forecasts for her business in 2021.

Quarters | Sales Revenue | Purchases |

Q3 2020 (Actual) | 50,000 | 9,750 |

Q4 2020 (Actual) | 55,000 | 10,000 |

Q1 2021 | 75,000 | 12,500 |

Q2 2021 | 60,000 | 10,500 |

Q3 2021 | 65,000 | 11,000 |

Q4 2021 | 60,000 | 10,000 |

Cash collections 70% of Alexa’s quarterly sales are cash sales and the remaining 30% are credit sales. Cash collections from credit customers are:

80% of credit sales are collected in the quarter following the sale.

20% of credit sales are collected in the second quarter following the sale.80% of all purchases are paid for in the quarter they are purchased, with the remaining 20% paid for in the following quarter. The business also plans to take out a small business loan of $50,000 at the end of Quarter 1 2021 and will be repaying it back in Quarter 1 of 2022. Equipment costing $70,000 is expected to be bought in Q2 2020 following the receipt of the business loan.

The selling expenses are $15,000 each quarter. Administrative expenses are $12,000 per quarter, excluding depreciation expenses. Expenses are paid in the quarter they are incurred. Alexa also predicts cash at hand amounting to $16,300 as at 30th June 2020.

Required:

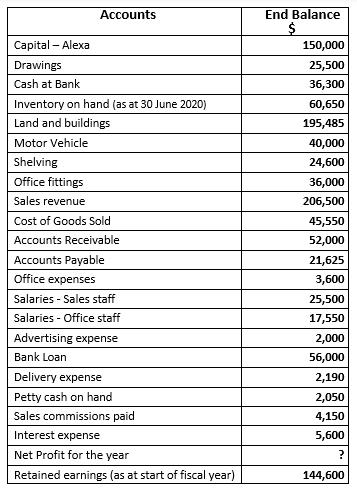

From the information above, prepare a properly classified Income Statement for the 2019/2020 fiscal year. From the information above, prepare Balance Sheet as at the fiscal end of 2020. Prepare a schedule of cash collections, a schedule of purchase payments, and a cash budget for all four quarters in 2021,business as at the fiscal end of 2023.

Income Sales Less Cost of Goods Sold Gross Profit Less Expenses: Selling Expenses Salaries-sales staff Advertising Delivery Sales Commissions General & Admin. Expenses Office expenses Salaries - General staff Interest Total operating expense Net Profit/ (Loss) Income Statement $ 2018 8,500 750 995 1,250 3,250 16,100 2,850 $ 151,000 (25,150) 125,850 (11,495) (22,200) (33,695) 92,155 $ 2019 14,500 1,450 1,400 1,550 3,350 16,650 3,950 $ 170,500 (33,050) 137,450 (18,900) (23,950) (42,850) 94,600

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1 STE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started