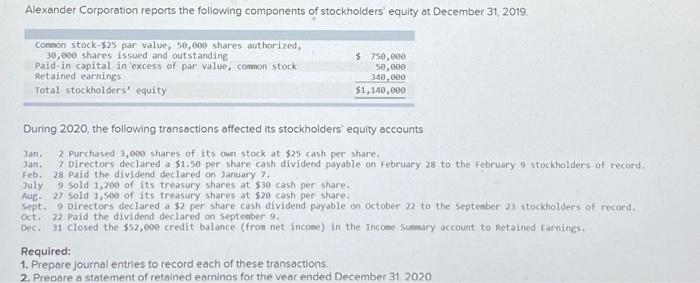

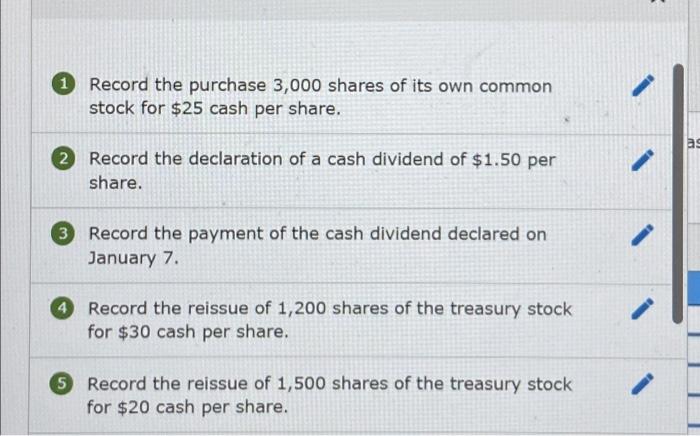

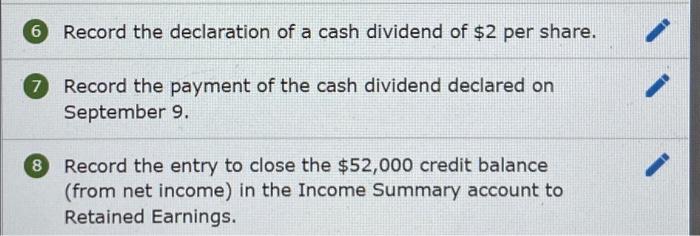

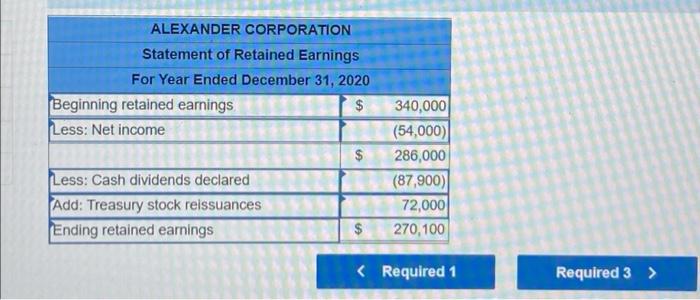

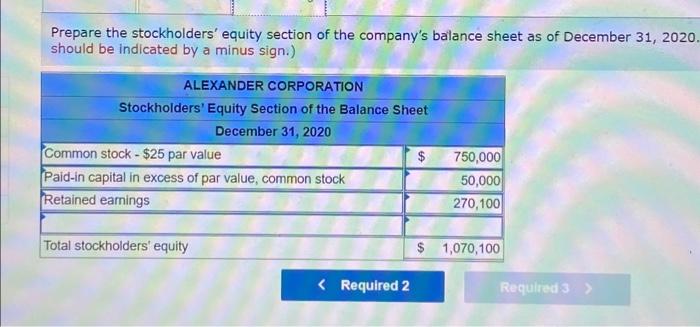

Alexander Corporation reports the following components of stockholders equity at December 31, 2019. Common stock-$25 par value 50,000 shares authorized 30,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity 750,000 50,000 340.000 $1,140,000 During 2020, the following transactions affected its stockholders' equity accounts Jan. 2 Purchased 3,000 shares of its own stock at $25 cash per share. Jan. Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record. Feb. 28 Paid the dividend declared on January 7. July 9 Sold 1,200 of its treasury shares at $30 cash per share. Aug. 27 Sold 1,500 of its treasury shares at $20 cash per share. Sept. 9 Directors declared a $2 per share cash dividend payable on October 22 to the September 27 stockholders of record. oct. 22 Paid the dividend declared on September 9, Dec 31 closed the $52,000 credit balance (from net income) in the Income Somsary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions, 2. Prepare a statement of retained earninas for the vear ended December 31 2020 1 Record the purchase 3,000 shares of its own common stock for $25 cash per share. ag 2 Record the declaration of a cash dividend of $1.50 per share. 3 Record the payment of the cash dividend declared on January 7. ~ Record the reissue of 1,200 shares of the treasury stock for $30 cash per share. 5 Record the reissue of 1,500 shares of the treasury stock for $20 cash per share. 6 Record the declaration of a cash dividend of $2 per share. 7 Record the payment of the cash dividend declared on September 9. 8 Record the entry to close the $52,000 credit balance (from net income) in the Income Summary account to Retained Earnings. ALEXANDER CORPORATION Statement of Retained Earnings For Year Ended December 31, 2020 Beginning retained earnings $ Less: Net income $ 340,000 (54,000) 286,000 (87,900) 72,000 270,100 Less: Cash dividends declared 'Add: Treasury stock reissuances Ending retained earnings Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2020. should be indicated by a minus sign.) ALEXANDER CORPORATION Stockholders' Equity Section of the Balance Sheet December 31, 2020 Common stock - $25 par value 750,000 Paid-in capital in excess of par value, common stock 50,000 Retained earnings 270,100 Total stockholders' equity $ 1,070,100