Answered step by step

Verified Expert Solution

Question

1 Approved Answer

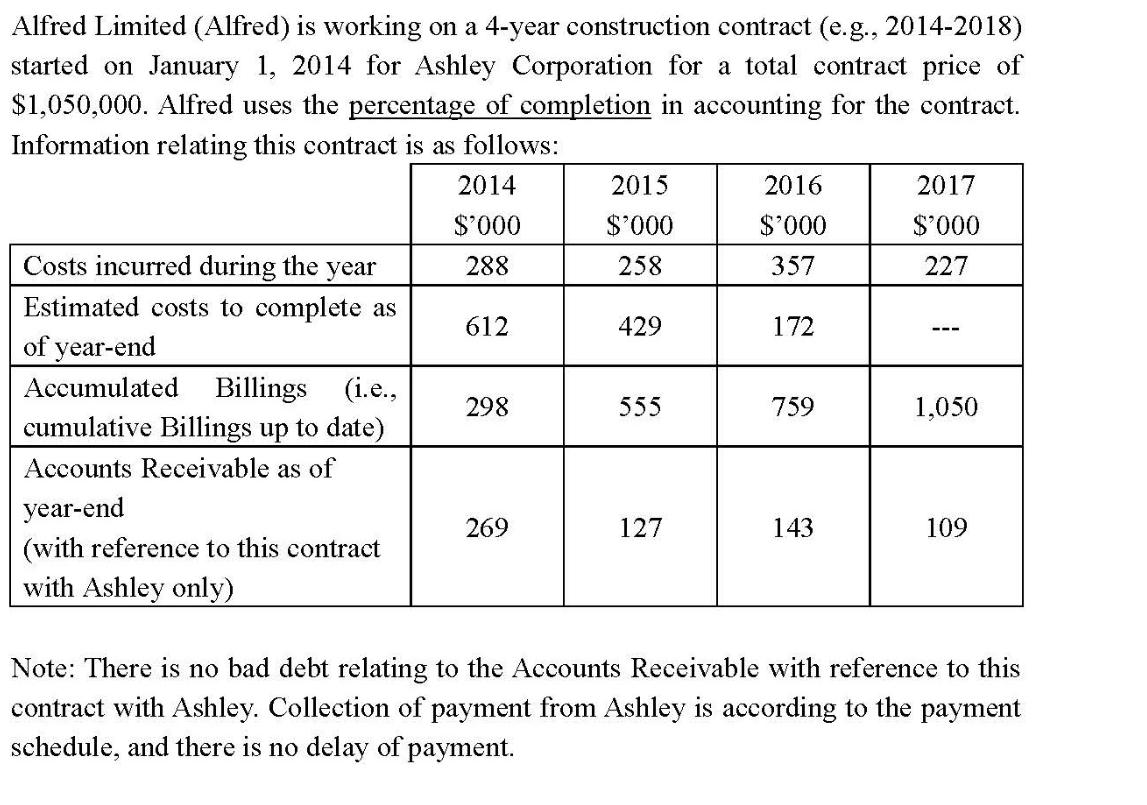

Alfred Limited (Alfred) is working on a 4-year construction contract (e.g., 2014-2018) started on January 1, 2014 for Ashley Corporation for a total contract

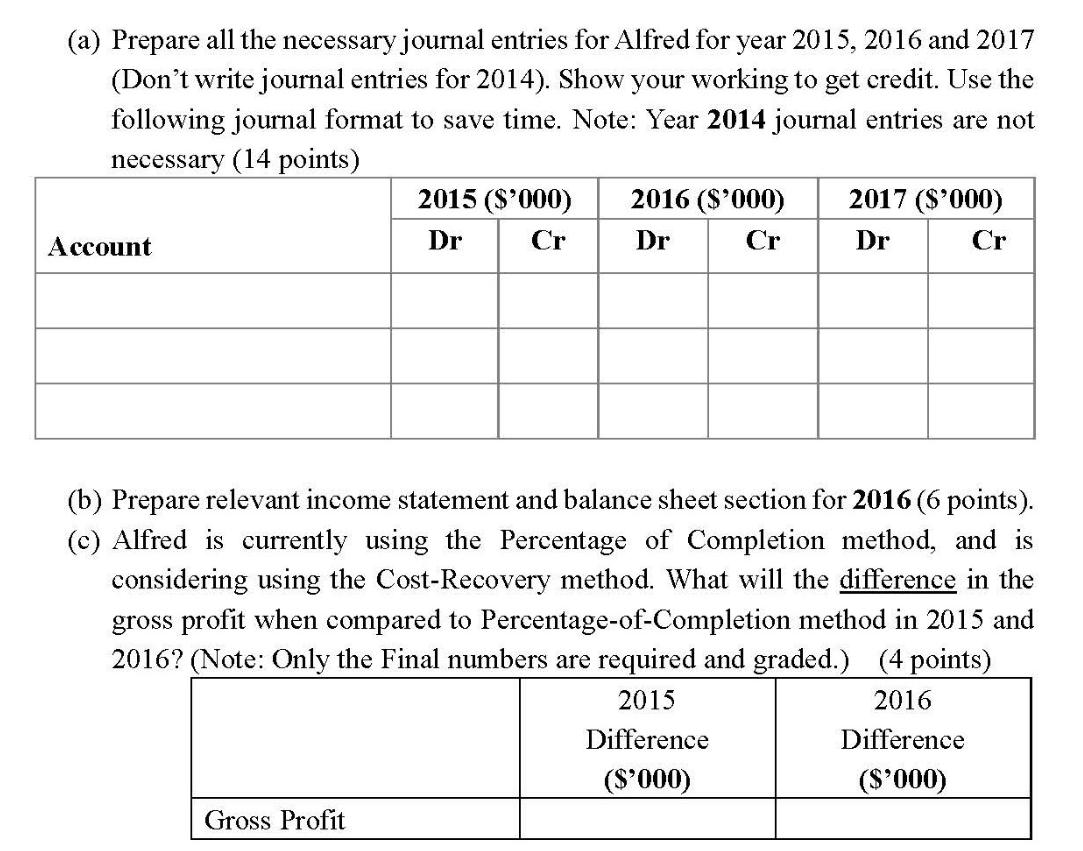

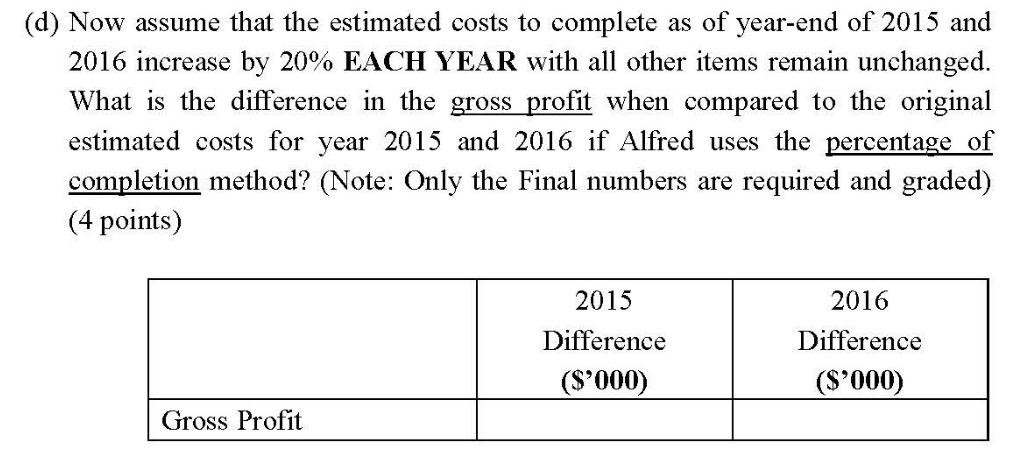

Alfred Limited (Alfred) is working on a 4-year construction contract (e.g., 2014-2018) started on January 1, 2014 for Ashley Corporation for a total contract price of $1,050,000. Alfred uses the percentage of completion in accounting for the contract. Information relating this contract is as follows: Costs incurred during the year Estimated costs to complete as of year-end Accumulated Billings (i.e., cumulative Billings up to date) Accounts Receivable as of year-end (with reference to this contract with Ashley only) 2014 $'000 288 612 298 269 2015 $'000 258 429 555 127 2016 $'000 357 172 759 143 2017 $'000 227 1,050 109 Note: There is no bad debt relating to the Accounts Receivable with reference to this contract with Ashley. Collection of payment from Ashley is according to the payment schedule, and there is no delay of payment. (a) Prepare all the necessary journal entries for Alfred for year 2015, 2016 and 2017 (Don't write journal entries for 2014). Show your working to get credit. Use the following journal format to save time. Note: Year 2014 journal entries are not necessary (14 points) Account 2015 ($'000) Dr Cr Gross Profit 2016 ($'000) Dr Cr 2017 ($'000) Cr Dr (b) Prepare relevant income statement and balance sheet section for 2016 (6 points). (c) Alfred is currently using the Percentage of Completion method, and is considering using the Cost-Recovery method. What will the difference in the gross profit when compared to Percentage-of-Completion method in 2015 and 2016? (Note: Only the Final numbers are required and graded.) (4 points) 2015 2016 Difference Difference ($'000) ($'000) (d) Now assume that the estimated costs to complete as of year-end of 2015 and 2016 increase by 20% EACH YEAR with all other items remain unchanged. What is the difference in the gross profit when compared to the original estimated costs for year 2015 and 2016 if Alfred uses the percentage of completion method? (Note: Only the Final numbers are required and graded) (4 points) Gross Profit 2015 Difference ($'000) 2016 Difference ($'000)

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Part A Part B Part C Part D as Parta 10 Account To rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started