Question

Ali Company and Bill Company entered into a semi-annual pay plain vanilla interest rate swap with a nominal value of $8,000,000. Bill offered to pay

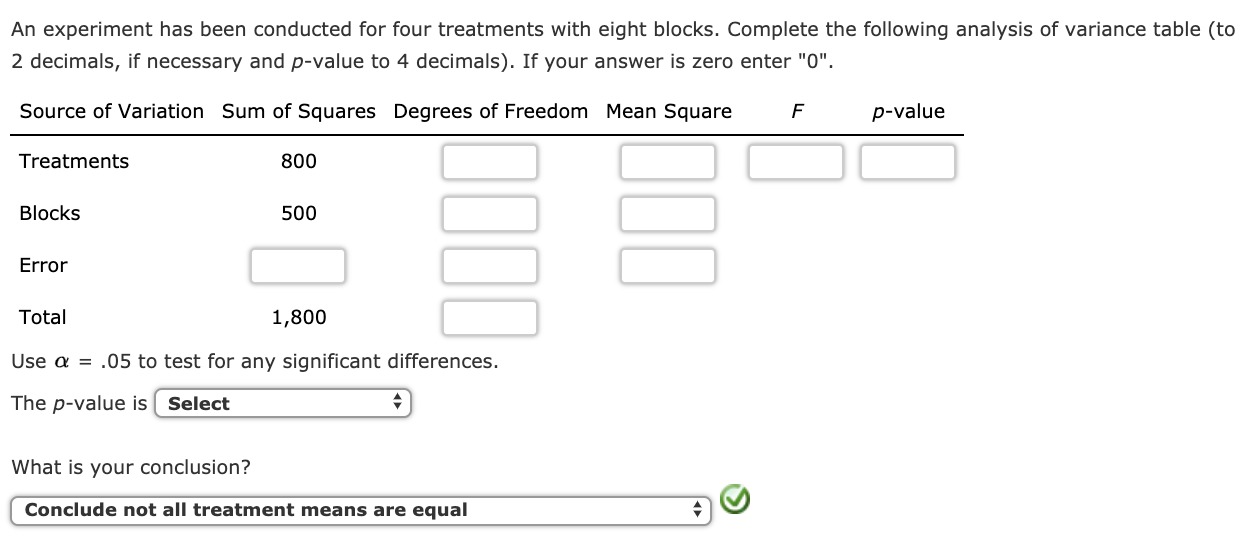

Ali Company and Bill Company entered into a semi-annual pay plain vanilla interest rate swap with a nominal value of $8,000,000. Bill offered to pay Ali a fixed annual rate of 2.75% (with semi-annual compounding). The remaining life of the swap is nine months. Assume the six-month LIBOR rate observed three months ago was 2.6% with semi-annual compounding. Today's three and nine month LIBOR rates are 2.526% and 2.846% (with continuous compounding). The implied forward rate is 3.0287% with semi-annual compounding. What is the value of the swap to Bill Company using the FRA methodology? Do not round intermediate calculations.

A.$4,950

B.$2,009

C.-$1,407

D.$5,613

Ali Company and Bill Company entered into a semi-annual pay plain vanilla interest rate swap with a nominal value of $8,000,000. Bill offered to pay Ali a fixed annual rate of 2.75% (with semi-annual compounding). The remaining life of the swap is nine months. Assume the six-month LIBOR rate observed three months ago was 2.6% with semi-annual compounding. Today's three and nine month LIBOR rates are 2.526% and 2.846% (with continuous compounding). The implied forward rate is 3.0287% with semi-annual compounding. What is the present value of the net cash flow (or payoff) at nine months point to Bill Company?

A.$4,556

B.$4,913

C.$8,904

D.$10,913

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started