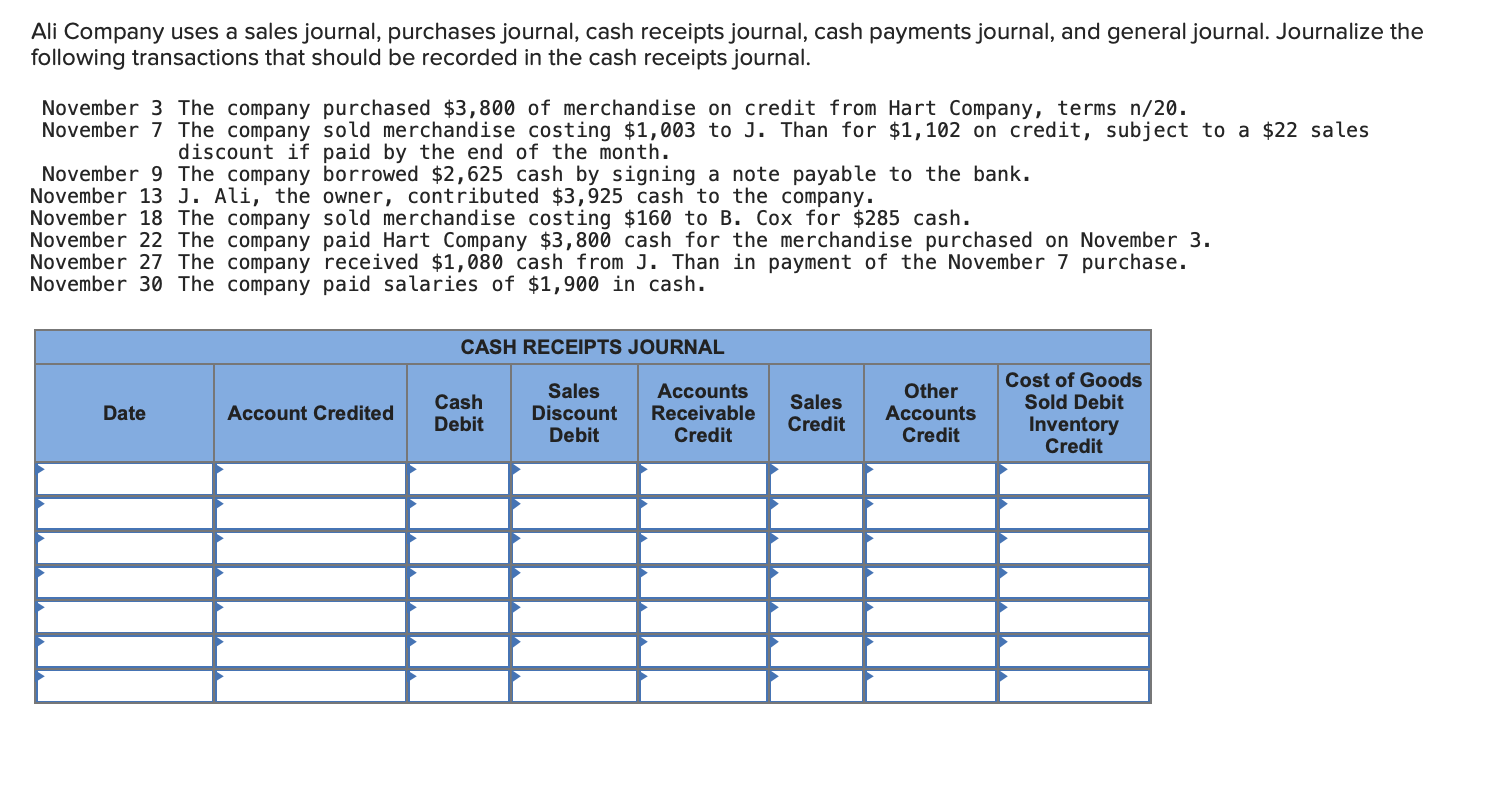

Ali Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the cash receipts journal. November 3 The company purchased $3,800 of merchandise on credit from Hart Company, terms n/20. November 7 The company sold merchandise costing $1,003 to J. Than for $1,102 on credit, subject to a $22 sales discount if paid by the end of the month. November 9 The company borrowed $2,625 cash by signing a note payable to the bank. November 13 J. Ali, the owner, contributed $3,925 cash to the company. November 18 The company sold merchandise costing $160 to B. Cox for $285 cash. November 22 The company paid Hart Company $3,800 cash for the merchandise purchased on November 3. November 27 The company received $1,080 cash from J. Than in payment of the November 7 purchase. November 30 The company paid salaries of $1,900 in cash. CASH RECEIPTS JOURNAL Date Account Credited Cash Debit Sales Discount Debit Accounts Receivable Credit Sales Credit Other Accounts Credit Cost of Goods Sold Debit Inventory Credit Ali Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the cash receipts journal. November 3 The company purchased $3,800 of merchandise on credit from Hart Company, terms n/20. November 7 The company sold merchandise costing $1,003 to J. Than for $1,102 on credit, subject to a $22 sales discount if paid by the end of the month. November 9 The company borrowed $2,625 cash by signing a note payable to the bank. November 13 J. Ali, the owner, contributed $3,925 cash to the company. November 18 The company sold merchandise costing $160 to B. Cox for $285 cash. November 22 The company paid Hart Company $3,800 cash for the merchandise purchased on November 3. November 27 The company received $1,080 cash from J. Than in payment of the November 7 purchase. November 30 The company paid salaries of $1,900 in cash. CASH RECEIPTS JOURNAL Date Account Credited Cash Debit Sales Discount Debit Accounts Receivable Credit Sales Credit Other Accounts Credit Cost of Goods Sold Debit Inventory Credit