Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ali is thinking of buying a vehicle, priced at KD22 000 and would like to keep it in his business for 6 years. The

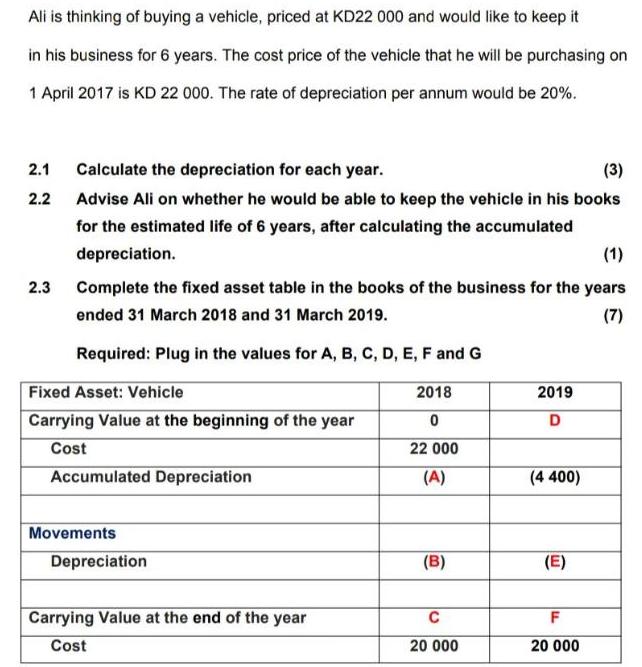

Ali is thinking of buying a vehicle, priced at KD22 000 and would like to keep it in his business for 6 years. The cost price of the vehicle that he will be purchasing on 1 April 2017 is KD 22 000. The rate of depreciation per annum would be 20%. 2.1 Calculate the depreciation for each year. (3) 2.2 Advise Ali on whether he would be able to keep the vehicle in his books for the estimated life of 6 years, after calculating the accumulated depreciation. (1) 2.3 Complete the fixed asset table in the books of the business for the years ended 31 March 2018 and 31 March 2019. (7) Required: Plug in the values for A, B, C, D, E, F and G Fixed Asset: Vehicle Carrying Value at the beginning of the year 2018 2019 D Cost 22 000 Accumulated Depreciation (A) (4 400) Movements Depreciation (B) (E) Carrying Value at the end of the year F Cost 20 000 20 000

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution 21 Calculation fo Depreciofien for each year Using Staight lige methad Amount of depuciafie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started