Answered step by step

Verified Expert Solution

Question

1 Approved Answer

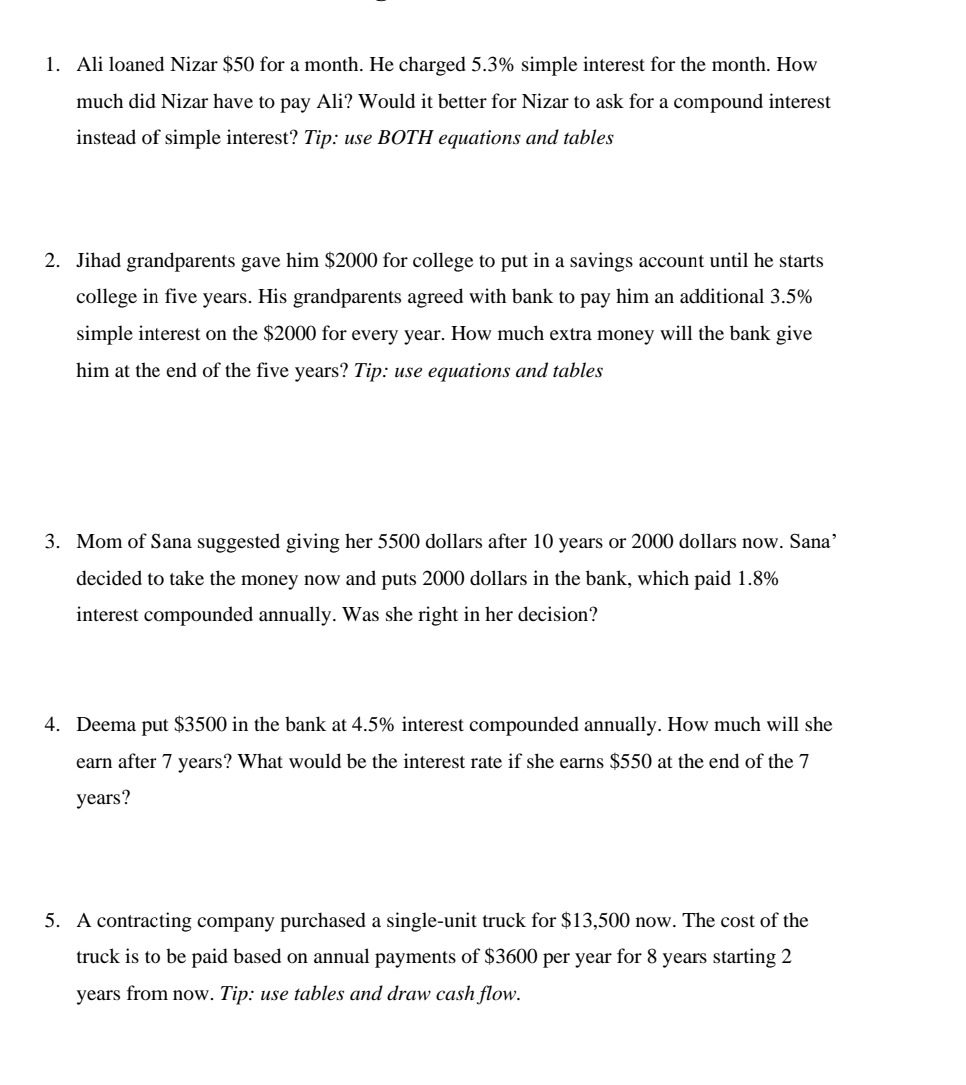

Ali loaned Nizar $ 5 0 for a month. He charged 5 . 3 % simple interest for the month. How much did Nizar have

Ali loaned Nizar $ for a month. He charged simple interest for the month. How much did Nizar have to pay Ali? Would it better for Nizar to ask for a compound interest instead of simple interest? Tip: use BOTH equations and tables

Jihad grandparents gave him $ for college to put in a savings account until he starts college in five years. His grandparents agreed with bank to pay him an additional simple interest on the $ for every year. How much extra money will the bank give him at the end of the five years? Tip: use equations and tables

Mom of Sana suggested giving her dollars after years or dollars now. Sana' decided to take the money now and puts dollars in the bank, which paid interest compounded annually. Was she right in her decision?

Deema put $ in the bank at interest compounded annually. How much will she earn after years? What would be the interest rate if she earns $ at the end of the years?

A contracting company purchased a singleunit truck for $ now. The cost of the truck is to be paid based on annual payments of $ per year for years starting years from now. Tip: use tables and draw cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started