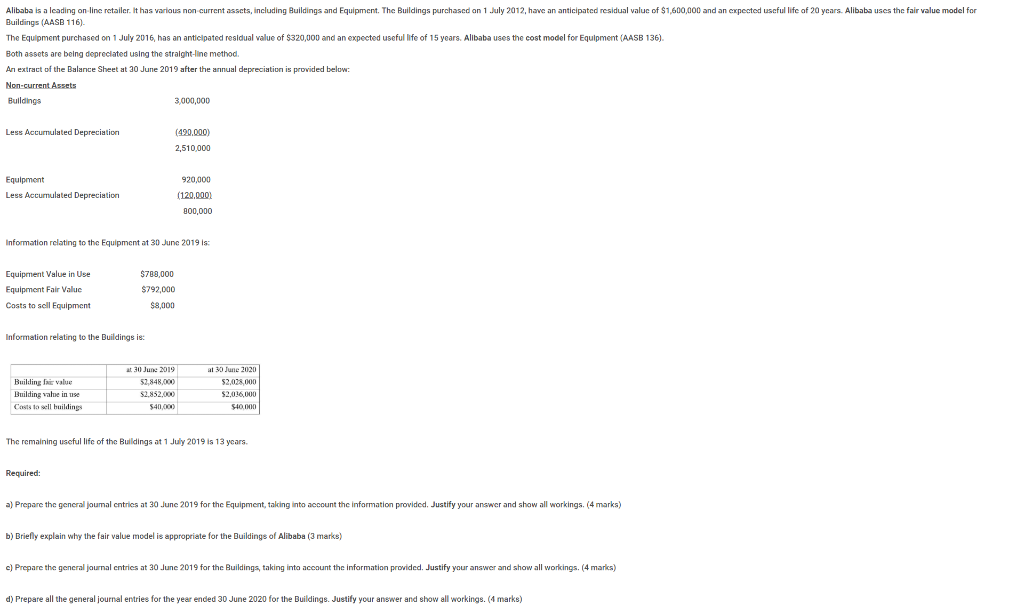

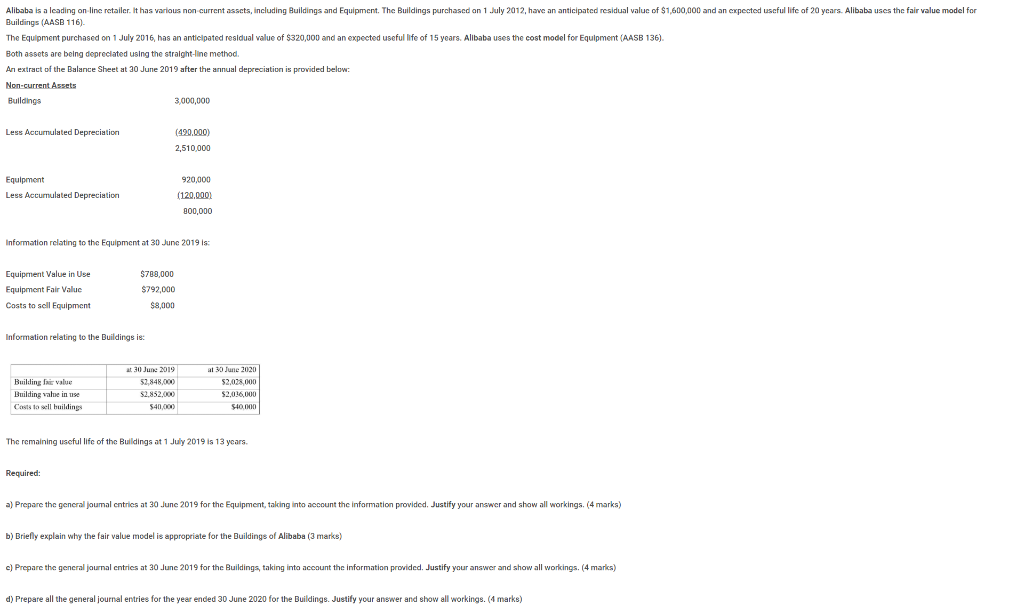

Alibaba is a leading online retailer. It has various non current assets, including Buildings and Equipment. The Buildings purchased on 1 July 2012, have an anticipated residual value of $1,600,000 and an expected useful life of 20 years. Alibaba uses the fair value model for Buildings (AASB 116) The Equipment purchased on 1 July 2016, has an anticipated residual value of $320,000 and an expected useful life of 15 years. Alibaba uses the cost model for Equipment (AASB 136). Both assets are being depreciated using the straight-line method. An extract of the Balance Sheet at 20 June 2019 after the annual depreciation is provided below: Non-current Assets Buildings 3,000,000 Less Accumulated Depreciation (490.000) 2,510,000 Equipment Less Accumulated Depreciation 920,000 (120,000) 800,000 Information relating to the Equipment at 30 June 2019 is: Equipment Value in Use Equipment Fair Value Costs to sell Equipment $788,000 $792,000 $8,000 Information relating to the Buildings is: Building In value Building value in se Cost to sell buildings at 30 June 2019 52,848,000 $2.852.000 $40,000 al 30 June 2020 52,098000 $2,036,000 $40.000 The remaining useful life of the Buildings at 1 July 2019 is 13 years Required: a) Prepare the general joumal entries at 30 June 2019 for the Equipment, taking into account the information provided. Justify your answer and show all workings. (4 marks) b) Brielly explain why the fair value model is appropriate for the Buildings of Alibaba (3 marks) c) Prepare the gencral journal entries at 30 June 2019 for the Buildings, taking into account the information provided. Justify your answer and show all worcings. (4 marks) d) Prepare all the general journal entries for the year ended 30 June 2020 for the Buildings. Justify your answer and show all workings. (4 marks) Alibaba is a leading online retailer. It has various non current assets, including Buildings and Equipment. The Buildings purchased on 1 July 2012, have an anticipated residual value of $1,600,000 and an expected useful life of 20 years. Alibaba uses the fair value model for Buildings (AASB 116) The Equipment purchased on 1 July 2016, has an anticipated residual value of $320,000 and an expected useful life of 15 years. Alibaba uses the cost model for Equipment (AASB 136). Both assets are being depreciated using the straight-line method. An extract of the Balance Sheet at 20 June 2019 after the annual depreciation is provided below: Non-current Assets Buildings 3,000,000 Less Accumulated Depreciation (490.000) 2,510,000 Equipment Less Accumulated Depreciation 920,000 (120,000) 800,000 Information relating to the Equipment at 30 June 2019 is: Equipment Value in Use Equipment Fair Value Costs to sell Equipment $788,000 $792,000 $8,000 Information relating to the Buildings is: Building In value Building value in se Cost to sell buildings at 30 June 2019 52,848,000 $2.852.000 $40,000 al 30 June 2020 52,098000 $2,036,000 $40.000 The remaining useful life of the Buildings at 1 July 2019 is 13 years Required: a) Prepare the general joumal entries at 30 June 2019 for the Equipment, taking into account the information provided. Justify your answer and show all workings. (4 marks) b) Brielly explain why the fair value model is appropriate for the Buildings of Alibaba (3 marks) c) Prepare the gencral journal entries at 30 June 2019 for the Buildings, taking into account the information provided. Justify your answer and show all worcings. (4 marks) d) Prepare all the general journal entries for the year ended 30 June 2020 for the Buildings. Justify your answer and show all workings. (4 marks)