Question

Alice, a single woman, buys her home for $200,000 on January 1, 2016. She proceeds to use that home as her principal residence for

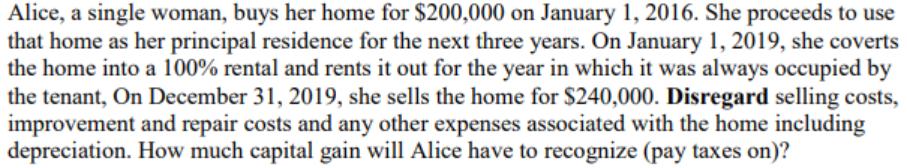

Alice, a single woman, buys her home for $200,000 on January 1, 2016. She proceeds to use that home as her principal residence for the next three years. On January 1, 2019, she coverts the home into a 100% rental and rents it out for the year in which it was always occupied by the tenant, On December 31, 2019, she sells the home for $240,000. Disregard selling costs, improvement and repair costs and any other expenses associated with the home including depreciation. How much capital gain will Alice have to recognize (pay taxes on)?

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the capital gain that Alice must recognize we need to establish the cost basis of the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial statements

Authors: Stephen Barrad

5th Edition

978-007802531, 9780324186383, 032418638X

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App