Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alice goes to her local Town Savings Bank and takes out a mortgage loan for $ 2 0 0 , 0 0 0 to purchase

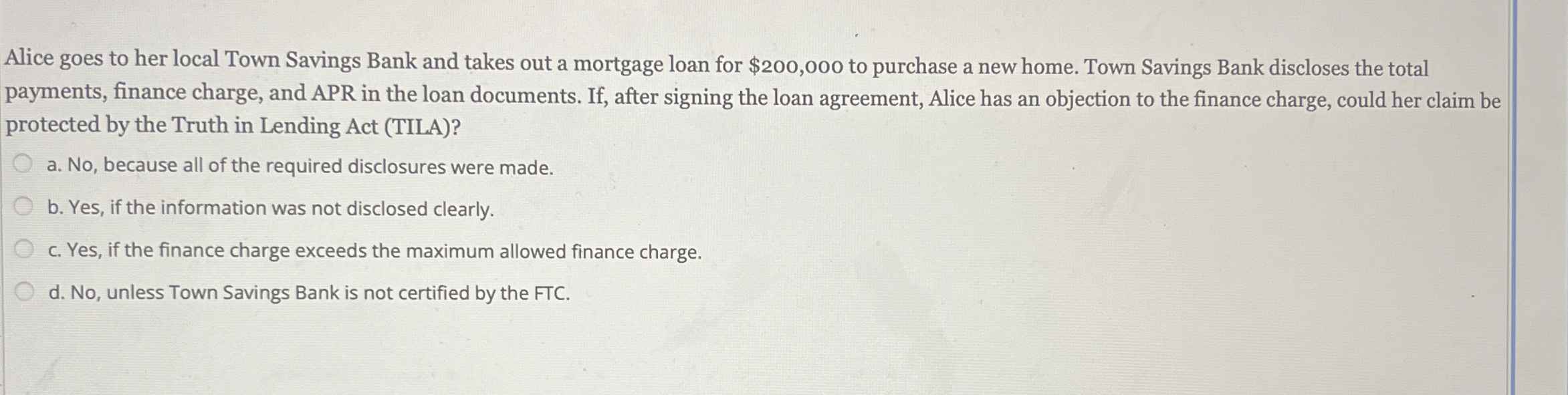

Alice goes to her local Town Savings Bank and takes out a mortgage loan for $ to purchase a new home. Town Savings Bank discloses the total payments, finance charge, and APR in the loan documents. If after signing the loan agreement, Alice has an objection to the finance charge, could her claim be protected by the Truth in Lending Act TILA

a No because all of the required disclosures were made.

b Yes, if the information was not disclosed clearly.

c Yes, if the finance charge exceeds the maximum allowed finance charge.

d No unless Town Savings Bank is not certified by the FTC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started