Answered step by step

Verified Expert Solution

Question

1 Approved Answer

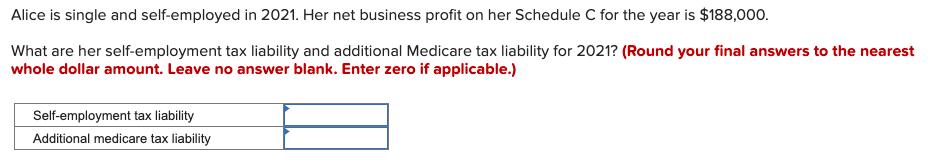

Alice is single and self-employed in 2021. Her net business profit on her Schedule C for the year is $188,000. What are her self-employment

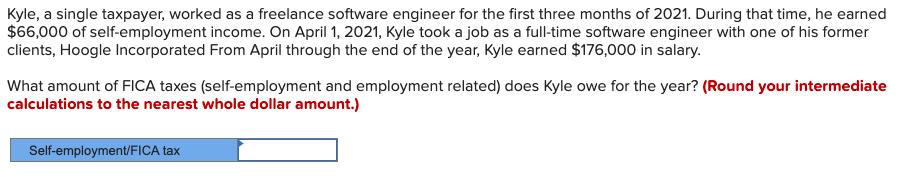

Alice is single and self-employed in 2021. Her net business profit on her Schedule C for the year is $188,000. What are her self-employment tax liability and additional Medicare tax liability for 2021? (Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) Self-employment tax liability Additional medicare tax liability Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2021. During that time, he earned $6,000 of self-employment income. On April 1, 2021, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $176,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? (Round your intermediate calculations to the nearest whole dollar amount.) Self-employment/FICA tax

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Requirement 1 Per IRS a taxpayers tax base for comput...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started