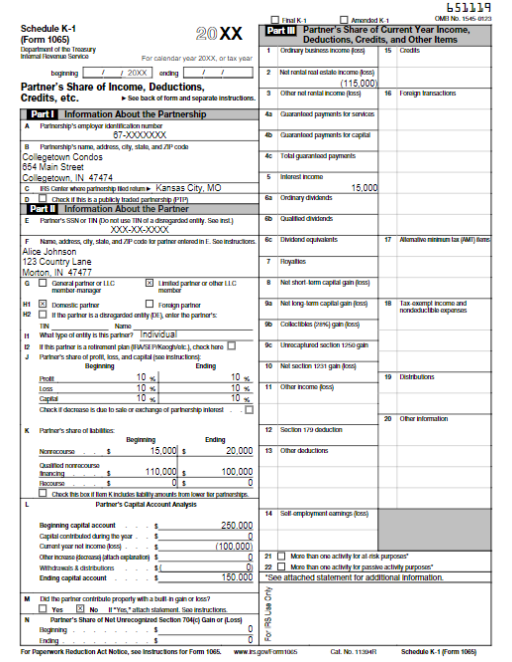

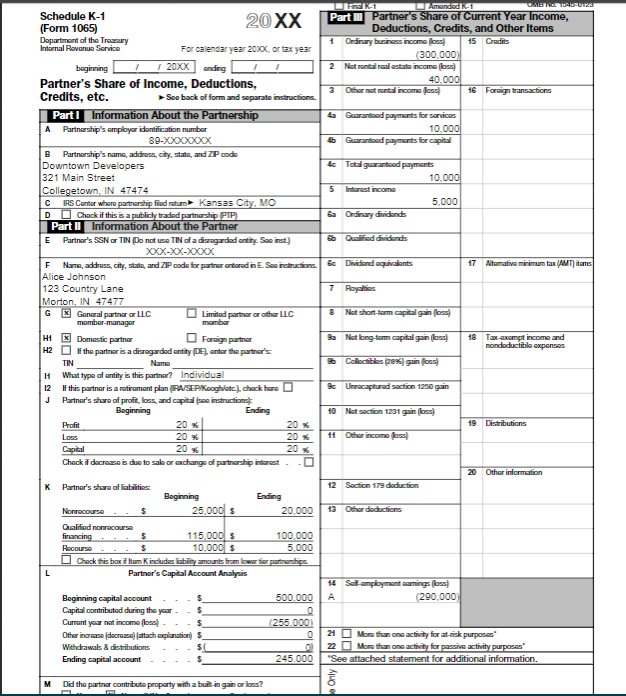

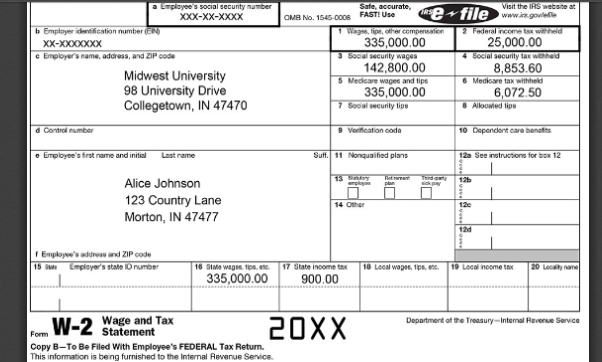

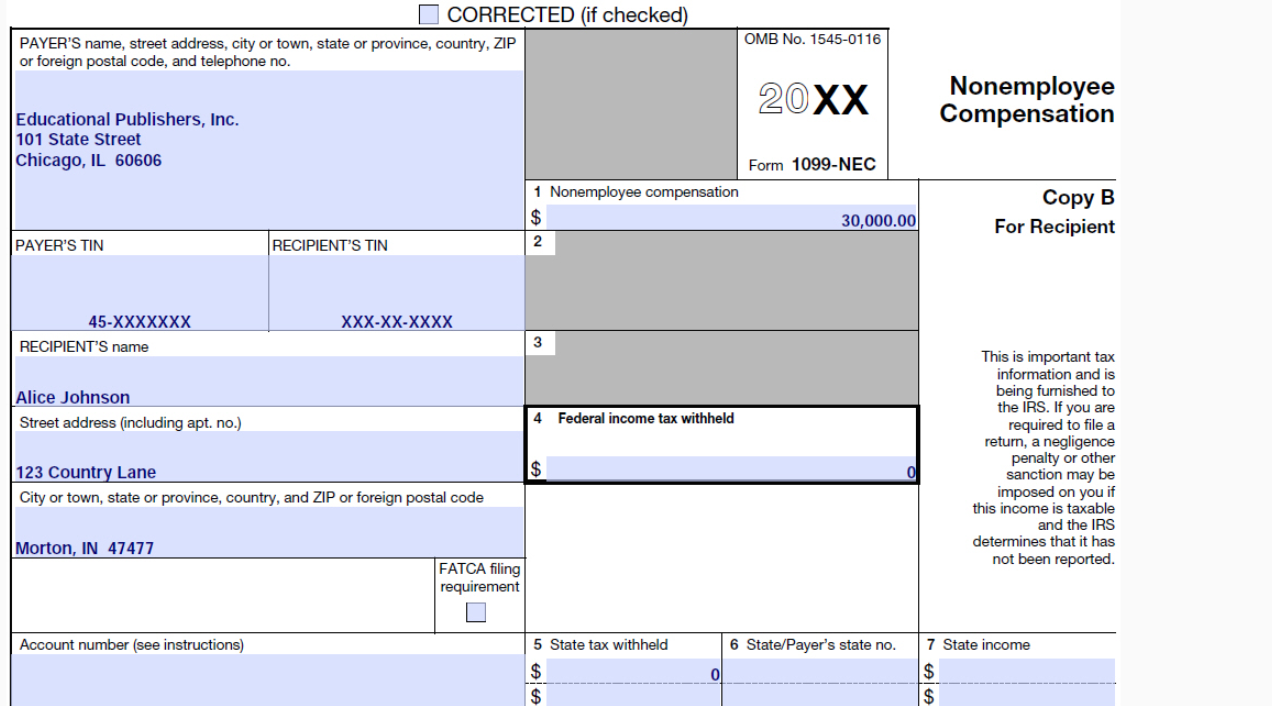

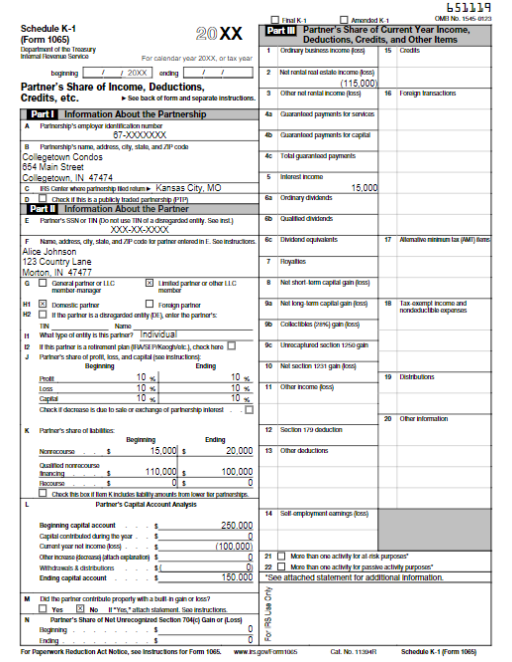

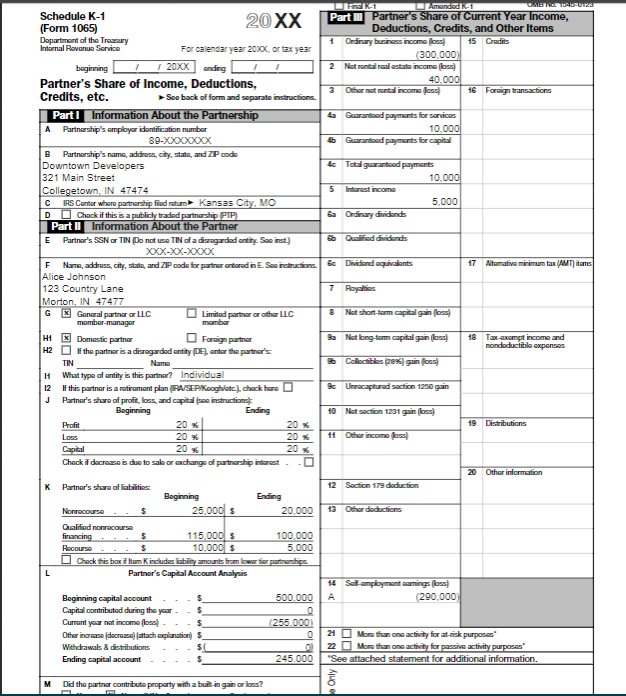

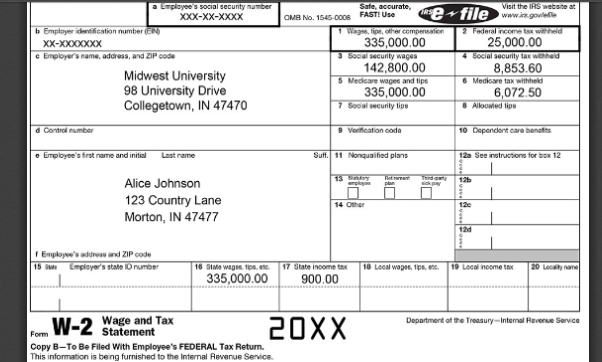

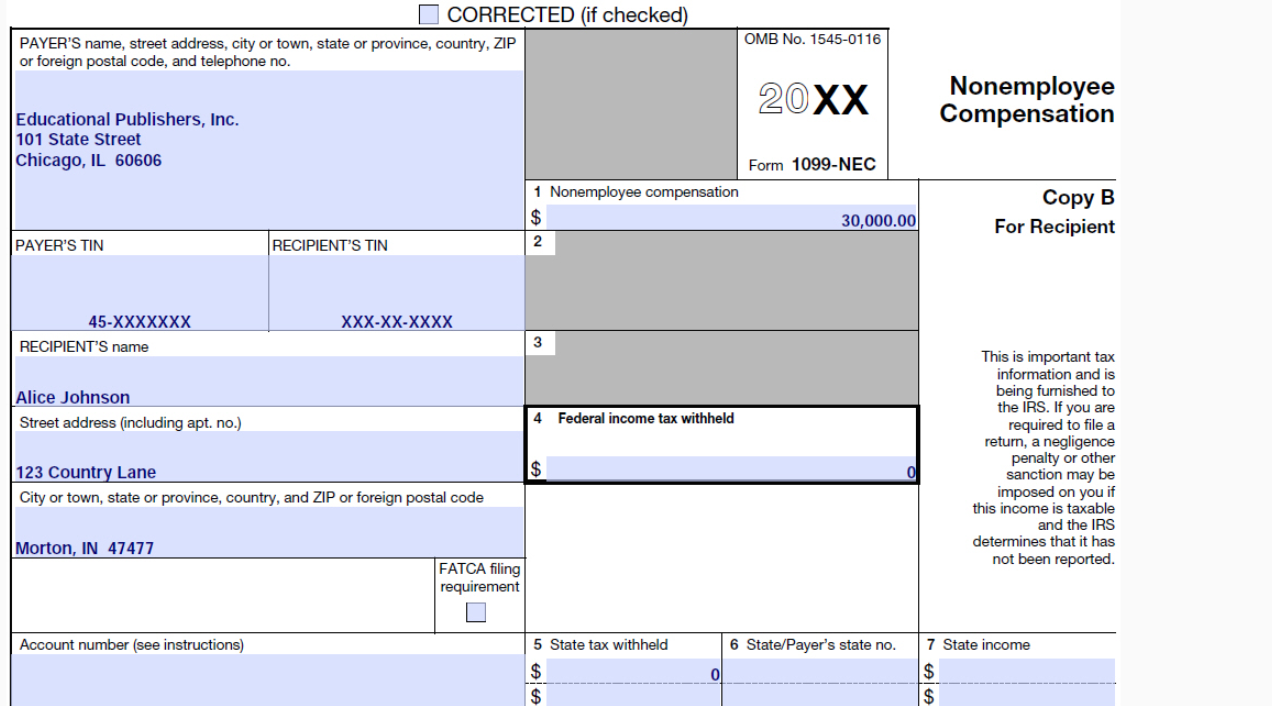

Alice Johnson, a single taxpayer, is a full-time employee at Midwest University. Alice also does editorial work for a publisher as an independent contractor. She does not deduct any expenses related to her editorial work. Alice is also a 20 percent owner in Downtown Developers LLC, in which she materially participates and receives a guaranteed payment each year. Alice is also a 10 percent limited partner in Collegetown Condos LP. Alice does not participate in Collegetown Condos' business activities. Alice has sufficient tax basis and at-risk basis to flow through any losses from her LLC and partnership interests, and does not take any distributions. Alice has provided documentation for her 20XX gross income in the exhibits above. In the table below, calculate the amount of Alice's 20XX taxable gross income. In column B, select from the option list provided whether the income (loss) item is active, passive, or portfolio for purposes of calculating any passive activity loss (PAL) limitation. In column C, select from the option list provided whether the income (loss) item is business or nonbusiness for purposes of calculating any excess business loss deduction limitation. In column D, enter the appropriate amount for each income (loss) item for calculating Alice's 20XX taxable gross income, taking into account the effect, if any, of other items of income and expense included in this problem. Enter income and gains as positive whole numbers and losses as negative whole numbers. If a value is zero, enter a zero (0).

| | A | B | C | D |

| 1 | 20XX Sources of Income (Loss) | Active, Passive, or Portfolio | Business or Nonbusiness | Taxable Gross Income (Loss) |

| 2 | Salary | | | |

| 3 | Interest income | | | |

| 4 | Independent contractor income | | | |

| 5 | Collegetown Condos LP net rental real estate income (loss) | | | |

| 6 | Downtown Developers LLC net rental real estate income (loss) | | | |

| 7 | Downtown Developers LLC guaranteed payment | | | |

| 8 | Downtown Developers LLC ordinary business income (loss) | | | |

| |

651119 Final K-1 Amended 1 CMB No. 156-0023 Schedule K-1 [Form 1065) 20 XX Parti Partner's Share of Current Year Income, Deductions, Credits, and Other Items Department of the Try 1 Ordinary benes Income 15 Credits For calendar year 20XX, or a year being 2000X ning 2 Net rental al estate income (115.000 Partner's Share of Income, Deductions, 9 Other refrontal 16 Form Credits, etc. See back of form and separate instruction Partl Information About the Partnership to Guanand payments or services AP'amplayeridianumba 87-000000x Grand payments for capital Partnership's name, address, city, state, and AP code Collegetown Condos 4 Total garanteed payments 654 Main Street Collegetown IN 47474 5 Horncome Cs Carlier where partnershiperton Kansas City, MO 15.000 D Check this baby rated parent PIN Ga Ordinary diands Part Information About the Partner Quod dividende E Partners SSNO IN Do not use Ndaragarded city. So XXX-XX-XOOOX 17 &c Didend quals F meditedly, sale, and code to partner andered in E Seductions Alam na Alice Johnson 123 Country Lane 1 Royal Morton, IN 47477 Q General partner or LC mod partner or other LLC Nail Short Somalilan memberg member 1 Despre O parte Nongomapulan 18 Tax campincome and He the partner dergide yener the partners TIN Name Crecisa Wut type of ently is its partner Individual This partner is a retirement pas Page, check here kecapluding Puther's share al profil, loss, and capital cine Beginning Ending 10 Nisan 1931 ano 10 19 Distribution 10 10 11 Other G 10 10 Check decise dan toleranchange of partnership is 20 Other information KPurse of babies 12 Section 179 Gaduction Beginning Ending 15.000 20,000 13 Other deductions Quador renchg 110.000 05 0 Check this box im Kinders from lower the past L Partner's Capital Account Analysis 14 Selfcmployment coming Beginning capital court 250.000 Capital contributed aing the years Cumanym (100.000 Cherche 0 21Mere than one activity for a purposes Windows distribution 2 More than one activity to passive activity purposes Ending capital account 1-01000 See attached statement for additional Information 10 100.000 Med the partner contribute property with a bulingor? Yes N Partner's Share or Not Unrecognized Section 7044) Gain or Loss For RSU Only OO Ending For Paperwork Reduction Act Notice, se instructions for Form 1065 www.goufamos Cat No. 115 Schedule K-1 Form 1065 LIRIK Amended KST OMERCISSUS Part I Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 Ordinary business income 15 Credits (300.000 2 Not rontal state income loss) 40.000 3 Other not rental income los 16 Foreign transactions ta Guaranteed payments for services 10.000 4 Garanfood payments for capital 4c Total guaranteed payments 10.000 5 Interest income 5.000 & Ordinary dividends Schedule K-1 20 XX (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 20xx, or tax year beginning 1 20XX ending Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions Partl Information About the Partnership A Partnership's employer identification number 89-xxxxxxx B Partnership's name, address, city, state, and ZP code Downtown Developers 321 Main Street Collegetown. IN 47474 CIR Canter where partnership filed ratum Kansas City, MO D Check if this is a publicly traded partnership PIP Part II Information About the Partner E Partner's SSN OTIN (Do not use TIN of a disregarded entity. So ist) XXX-XX-XXXX F Name, address, city, stato, and ZIP code for partner eterodine Sainctions Alice Johnson 123 Country Lane Morton, IN 47477 G X General partner or LLC Limited partner or other LLC member-manager mambai H1 Domestic partner Foreign partner H2 the partner is a disregarded antity Danter the partner's TIN Name 11 What type of antity is this partner? Individual 12 F this partner is a rotiramant plan (PASEP Keoghoc). check here J Partner's share of profit, loss, and capital instructions Beginning Ending Profit 20 % 20 % Loss 20 20 % Capital 20 Check it decrease is due to sale or exchange of partnership interest Bb Qualified dividends Bc Dividend equivalent 17 Altomative minimum lax (AMT) ilms 7 Royalties 8 Net short-term capital gains sa Netlong tom capital gain foss 18 Tax-xempt income and mondeducible expenses Sb Collectibles (2996) sains &c Unrecaptured section 1250 gain 10 Net section 1231 gainos) 19 Distributions 11 Other income 20 20 Other information K Partner's share of abilities: 12 Section 179 deduction Beginning 25,000 $ Ending 20.000 Nonrecourse $ 13 Other dieductions Qualified no recourse financing $ 115,000 $ 100.000 Recourse $ 10.000 $ 5.000 Check this box iliam K includes liability amounts from lower fer partnerships Partner's Capital Account Analysis L 14 Selemployment amingslos A (290.000 500.000 Beginning capital account $ Capital contributed during the year $ Current your not income foss) $ Other increase (docrozza) (attach explanations Withdrawals & distributions SC Ending capital account (255.000) 0 21 More than one activity for at-risk purposes 22 More than one activity for passive activity purposes "See attached statement for additional information. 245.000 M Did the partner contribute property with a built-in gain or loss? a Employee's social security number XXX-XX-XXXX b Employer identification number (EN XX-XXXXXXX c Employer's name, address, and ZIP code Midwest University 98 University Drive Collegetown, IN 47470 Sate, accurate, Visit the IRS website at e-file www.ir gortel OMB No 1545-00D FAST! Use Wagstips, other compensation 2 Federal income tak wield 335,000.00 25,000.00 3 Social security wages 4 Social security to withheld 142,800.00 8,853.60 S Medicare wages and Tips 6 Mediave tax withheld 335,000.00 6,072,50 7 Solecurity tips & Allocated lipo d Control number 9 Verification code 10 Dependent care benetes e Employee's first name and initial Lastrame Suft. 11 Nonqualified plans 12a See instructions for box 12 13 12b Alice Johnson 123 Country Lane Morton, IN 47477 14 Other 12e 12d 1 Employees addio and ZIP code 15 Employer's state ID number 10 Local Wapes, pse 19 Local income tax 20 Lt 18 Sime tot 117 state income tax 335,000.00 900.00 Department of the Treasury - Internal Revenue Service Wage and Tax Form Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service W-2 20XX CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. OMB No. 1545-0116 20XX Nonemployee Compensation Educational Publishers, Inc. 101 State Street Chicago, IL 60606 Form 1099-NEC 1 Nonemployee compensation $ 2 30,000.00 Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN XXX-XX-XXXX 45-XXXXXXX RECIPIENT'S name 3 Alice Johnson Street address (including apt. no.) 4 Federal income tax withheld This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. $ 123 Country Lane City or town, state or province, country, and ZIP or foreign postal code Morton, IN 47477 FATCA filing requirement O Account number (see instructions) 5 State tax withheld 6 State/Payer's state no. 7 State income SAA 0 $ $ 651119 Final K-1 Amended 1 CMB No. 156-0023 Schedule K-1 [Form 1065) 20 XX Parti Partner's Share of Current Year Income, Deductions, Credits, and Other Items Department of the Try 1 Ordinary benes Income 15 Credits For calendar year 20XX, or a year being 2000X ning 2 Net rental al estate income (115.000 Partner's Share of Income, Deductions, 9 Other refrontal 16 Form Credits, etc. See back of form and separate instruction Partl Information About the Partnership to Guanand payments or services AP'amplayeridianumba 87-000000x Grand payments for capital Partnership's name, address, city, state, and AP code Collegetown Condos 4 Total garanteed payments 654 Main Street Collegetown IN 47474 5 Horncome Cs Carlier where partnershiperton Kansas City, MO 15.000 D Check this baby rated parent PIN Ga Ordinary diands Part Information About the Partner Quod dividende E Partners SSNO IN Do not use Ndaragarded city. So XXX-XX-XOOOX 17 &c Didend quals F meditedly, sale, and code to partner andered in E Seductions Alam na Alice Johnson 123 Country Lane 1 Royal Morton, IN 47477 Q General partner or LC mod partner or other LLC Nail Short Somalilan memberg member 1 Despre O parte Nongomapulan 18 Tax campincome and He the partner dergide yener the partners TIN Name Crecisa Wut type of ently is its partner Individual This partner is a retirement pas Page, check here kecapluding Puther's share al profil, loss, and capital cine Beginning Ending 10 Nisan 1931 ano 10 19 Distribution 10 10 11 Other G 10 10 Check decise dan toleranchange of partnership is 20 Other information KPurse of babies 12 Section 179 Gaduction Beginning Ending 15.000 20,000 13 Other deductions Quador renchg 110.000 05 0 Check this box im Kinders from lower the past L Partner's Capital Account Analysis 14 Selfcmployment coming Beginning capital court 250.000 Capital contributed aing the years Cumanym (100.000 Cherche 0 21Mere than one activity for a purposes Windows distribution 2 More than one activity to passive activity purposes Ending capital account 1-01000 See attached statement for additional Information 10 100.000 Med the partner contribute property with a bulingor? Yes N Partner's Share or Not Unrecognized Section 7044) Gain or Loss For RSU Only OO Ending For Paperwork Reduction Act Notice, se instructions for Form 1065 www.goufamos Cat No. 115 Schedule K-1 Form 1065 LIRIK Amended KST OMERCISSUS Part I Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 Ordinary business income 15 Credits (300.000 2 Not rontal state income loss) 40.000 3 Other not rental income los 16 Foreign transactions ta Guaranteed payments for services 10.000 4 Garanfood payments for capital 4c Total guaranteed payments 10.000 5 Interest income 5.000 & Ordinary dividends Schedule K-1 20 XX (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 20xx, or tax year beginning 1 20XX ending Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions Partl Information About the Partnership A Partnership's employer identification number 89-xxxxxxx B Partnership's name, address, city, state, and ZP code Downtown Developers 321 Main Street Collegetown. IN 47474 CIR Canter where partnership filed ratum Kansas City, MO D Check if this is a publicly traded partnership PIP Part II Information About the Partner E Partner's SSN OTIN (Do not use TIN of a disregarded entity. So ist) XXX-XX-XXXX F Name, address, city, stato, and ZIP code for partner eterodine Sainctions Alice Johnson 123 Country Lane Morton, IN 47477 G X General partner or LLC Limited partner or other LLC member-manager mambai H1 Domestic partner Foreign partner H2 the partner is a disregarded antity Danter the partner's TIN Name 11 What type of antity is this partner? Individual 12 F this partner is a rotiramant plan (PASEP Keoghoc). check here J Partner's share of profit, loss, and capital instructions Beginning Ending Profit 20 % 20 % Loss 20 20 % Capital 20 Check it decrease is due to sale or exchange of partnership interest Bb Qualified dividends Bc Dividend equivalent 17 Altomative minimum lax (AMT) ilms 7 Royalties 8 Net short-term capital gains sa Netlong tom capital gain foss 18 Tax-xempt income and mondeducible expenses Sb Collectibles (2996) sains &c Unrecaptured section 1250 gain 10 Net section 1231 gainos) 19 Distributions 11 Other income 20 20 Other information K Partner's share of abilities: 12 Section 179 deduction Beginning 25,000 $ Ending 20.000 Nonrecourse $ 13 Other dieductions Qualified no recourse financing $ 115,000 $ 100.000 Recourse $ 10.000 $ 5.000 Check this box iliam K includes liability amounts from lower fer partnerships Partner's Capital Account Analysis L 14 Selemployment amingslos A (290.000 500.000 Beginning capital account $ Capital contributed during the year $ Current your not income foss) $ Other increase (docrozza) (attach explanations Withdrawals & distributions SC Ending capital account (255.000) 0 21 More than one activity for at-risk purposes 22 More than one activity for passive activity purposes "See attached statement for additional information. 245.000 M Did the partner contribute property with a built-in gain or loss? a Employee's social security number XXX-XX-XXXX b Employer identification number (EN XX-XXXXXXX c Employer's name, address, and ZIP code Midwest University 98 University Drive Collegetown, IN 47470 Sate, accurate, Visit the IRS website at e-file www.ir gortel OMB No 1545-00D FAST! Use Wagstips, other compensation 2 Federal income tak wield 335,000.00 25,000.00 3 Social security wages 4 Social security to withheld 142,800.00 8,853.60 S Medicare wages and Tips 6 Mediave tax withheld 335,000.00 6,072,50 7 Solecurity tips & Allocated lipo d Control number 9 Verification code 10 Dependent care benetes e Employee's first name and initial Lastrame Suft. 11 Nonqualified plans 12a See instructions for box 12 13 12b Alice Johnson 123 Country Lane Morton, IN 47477 14 Other 12e 12d 1 Employees addio and ZIP code 15 Employer's state ID number 10 Local Wapes, pse 19 Local income tax 20 Lt 18 Sime tot 117 state income tax 335,000.00 900.00 Department of the Treasury - Internal Revenue Service Wage and Tax Form Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service W-2 20XX CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. OMB No. 1545-0116 20XX Nonemployee Compensation Educational Publishers, Inc. 101 State Street Chicago, IL 60606 Form 1099-NEC 1 Nonemployee compensation $ 2 30,000.00 Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN XXX-XX-XXXX 45-XXXXXXX RECIPIENT'S name 3 Alice Johnson Street address (including apt. no.) 4 Federal income tax withheld This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. $ 123 Country Lane City or town, state or province, country, and ZIP or foreign postal code Morton, IN 47477 FATCA filing requirement O Account number (see instructions) 5 State tax withheld 6 State/Payer's state no. 7 State income SAA 0 $ $